Large outflows from Ether funds are in stark contrast to the movements observed in Bitcoin and other cryptocurrencies.

The final week of June was characterized by a turbulent market for Ethereum exchange-traded products, which experienced the largest outflow since August 2022.

According to CoinShares’ weekly analysis, investors withdrew $61 million from Ether investment products between June 24-29, resulting in a total discharge of $119 million over the past two weeks and a total balance of $37 million in funds withdrawn for June.

Ether funds have been the asset that has underperformed year-to-date in terms of net flows due to the decline, with a total withdrawal of $25 million.

Despite the United States Securities and Exchange Commission (SEC)’s approval of Ether exchange-traded funds (ETFs) in May, the cryptocurrency experienced a price decline of over 8.7% in June.

According to analysts, the eight funds that have been approved are anticipated to make their debut in the upcoming weeks.

The SEC has recently requested that prospective issuers resubmit their S-1 forms by July 8, which will delay the launch of the ETFs until mid-July or later, according to Bloomberg ETF analysts Eric Balchunas and James Seyffart. By 2025, Bitwise anticipated that the funds would garner $25 billion.

Change in Sentiment

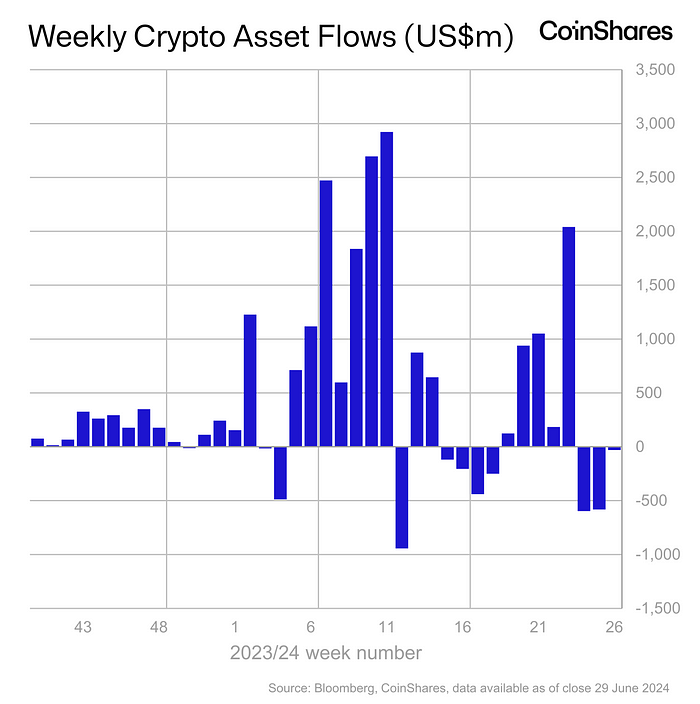

Over the past week, the performance of digital asset investment products was negatively impacted by the outflows of ether, which amounted to $30 million. Nevertheless, CoinShares reported that most Bitcoin ETF providers experienced modest inflows, starkly contrasting with the previous weeks.

Grayscale’s Bitcoin fund experienced outflows of $153 million during the week, which counterbalanced an aggregate inflow of $10 million from other issuers.

“The inflows were primarily driven by Bitcoin ETPs and multi-asset ETPs, with US$18m and US$10m, respectively.” Last week, there was also a rise in outflows totaling US$4.2m in short-bitcoin, which indicates that sentiment may be shifting, according to the report.

According to CoinShares, trading volumes increased by 43% week-on-week to $6.2 billion as of June 29, but they remained “significantly lower” than the $14.2 billion weekly average for the year thus far. Litecoin attracted $1.4 million, while Solana funds saw inflows of $1.6 million during the period.

This year, blockchain equities have been withdrawn for $545 million, which accounts for 19% of the market capitalization.