Lawmakers want Bitcoin options trading in the United States to be approved by the SEC.

In a recent letter to the commission’s chief, Gary Gensler, Axios reports that Representatives Mike Flood and Wiley Nickel urged the SEC to discontinue discriminating against cryptocurrency funds.

The bipartisan letter states, “We urge you to approve spot Bitcoin ETP options immediately or to explain the Commission’s differential treatment of options for Bitcoin futures ETFs, which are currently trading, and options for spot Bitcoin ETPs.”

Financial instruments referred to as options confer the buyer the right, without imposing any duty, to buy or sell a particular asset—Bitcoin in this case—at a prearranged price by a designated date.

Typical uses for this instrument include:

- Hedging against price fluctuations.

- Limiting potential losses.

- Facilitating the generation of additional income by investors through strategic approaches.

Flood and Nickel argue that the approval is crucial for protecting investors, which is the SEC’s primary objective.

January applications submitted by the New York Stock Exchange, Nasdaq, and Cboe Global Markets have been subject to postponed agency decisions.

As opposed to iShares Bitcoin Trust by BlackRock, which Nasdaq has registered to list and trade options, Cboe intends to provide options trading on various BTC funds. Similarly, the NYSE plans to trade options for Grayscale Bitcoin Trusts, Bitwise Bitcoin ETF, and any other Bitcoin-holding trusts.

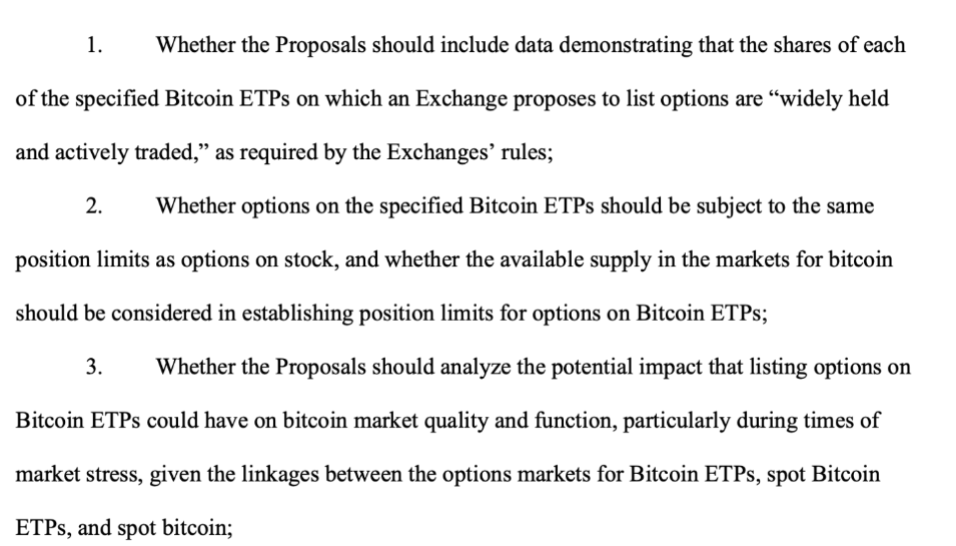

The commission has initiated a new phase of consultations concerning the rule change proposal that would permit the trading of options on Bitcoin funds.

In a filing dated April 24, the SEC declared its intention to examine the potential impact of Bitcoin options on market stability, particularly during times of volatility.

Further, the agency is investigating the adequacy of existing enforcement and market surveillance protocols in handling the intricacies associated with Bitcoin options effectively. Participants must submit preliminary remarks by May 15, followed by rebuttal comments by May 29.