Ledn has removed Ethereum support and adopted a full custody model for its Bitcoin loan services, signaling a shift toward more secure crypto lending practices.

Ledn will now keep full custody of Bitcoin instead of lending out customer assets to generate yield.

To strengthen its BTC-focused company and better protect client assets from credit risks, digital asset lender Ledn is switching to completely collateralized Bitcoin lending and terminating support for Ethereum.

Ledn announced on May 23 that it will no longer lend out client assets to earn interest, as it is implementing a complete custody framework for Bitcoin loans amounting to $108,670. Instead, Ledn or one of its approved finance partners will continue to have full custody of Bitcoin collateral.

Adam Reeds, co-founder and CEO of Ledn, stated, “This means assets aren’t rehypothecated, reused, or loaned out to generate yield.”

Reeds says the action returns the business to its roots and aligns with Bitcoin’s original ideas.

Reed stated that the creation of Bitcoin directly reacted to the dangers of fractional reserve banking and the unrestrained exploitation of customer assets to earn income.

“Traditional finance relies on constantly reusing client assets to create leverage and, ultimately, inflation. Bitcoiners instinctively reject that model. That’s why we’ve moved away from this approach entirely.

Since Bitcoin accounts for over 99% of Ledn’s client activity, Reed stated that the company is discontinuing support for Ether (ETH $2,560) as “part of a broader strategic shift.”

“We’re going all in on Bitcoin and simplifying our stack to reflect what our clients value instead of fragmenting the platform to chase marginal volume,” Reed stated.

According to Galaxy Research, Ledn, which was founded in 2018, has become one of the biggest lenders in the digital asset market, with a loan book value of $9.9 billion. The company gives Bitcoin owners access to liquidity by allowing them to borrow against their assets without having to sell their holdings or cause a taxable event.

Wealthy investors frequently utilize this strategy to obtain cash by taking out low-interest loans secured by stocks, real estate, and other assets.

Digital assets are disrupting TradFi.

Following the 2008 global financial crisis, the genesis block of Bitcoin was mined, providing a stable currency substitute for the fiat monetary system, which is prone to inflation.

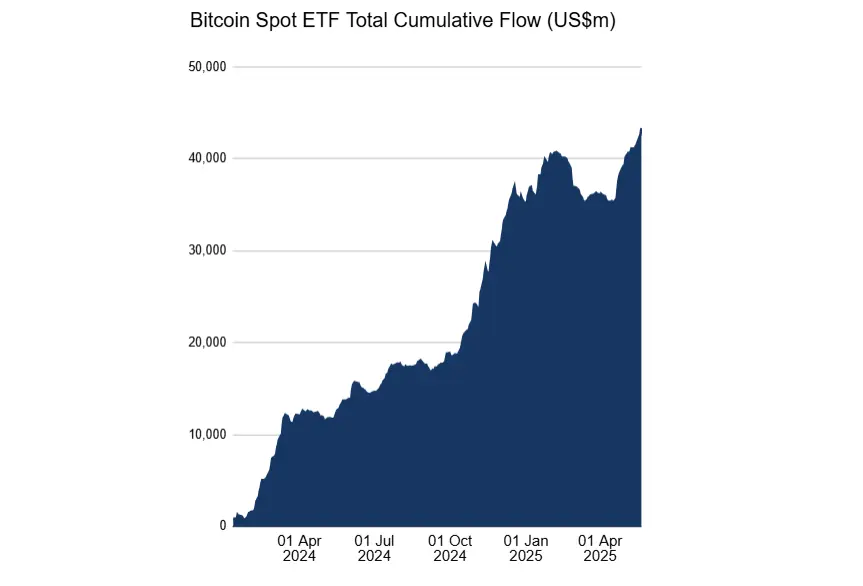

With the successful introduction of spot exchange-traded funds (ETFs) in 2024, Bitcoin is already thriving in traditional finance.

Some bank lobbyists are allegedly worried about other blockchain breakthroughs upending traditional business models, even as financial institutions increasingly embrace Bitcoin.

According to Austin Campbell, a professor at New York University, the banking lobby is specifically “panicking” over yield-bearing stablecoins because they can offer higher interest rates and other financial incentives that traditional banks have completely abandoned.

Campbell referred to banks as a “cartel,” claiming they use fractional reserves to increase profits while providing depositors with low interest rates.