Ether’s price could rise as Bitcoin remains rangebound below $100K, driving increased investment in the world’s second-largest cryptocurrency.

The demand from investors for trading instruments based on leveraged Ethereum is soaring, indicating growing momentum that may push the second-largest cryptocurrency in the world over the psychological $4,000 threshold.

Leveraged ETH$3,620.11 positions that enable short-term cash borrowing to expand a trader’s position are becoming increasingly popular among investors.

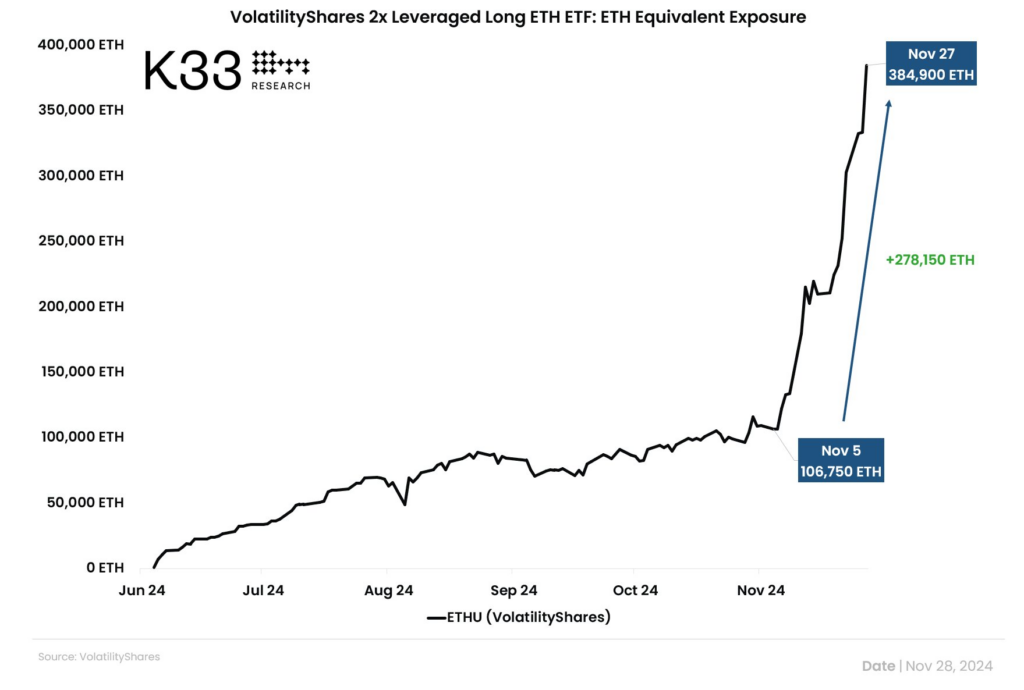

In a November 28 X post, Vetle Lunde, head of research at K33 Research, stated that demand for leveraged VolatilityShares 2x Ether exchange-traded fund (ETF) has increased by more than 160% since November 5.

“Since November 5,ETH the equivalent exposure in the VolatilityShares 2x leveraged long ETH ETF has increased by 278,150 (+160%!). VolatilityShares now hold more than half of CME’s ETH [open interest] (50.1%!!).”

In the three weeks following Donald Trump’s victory in the 2024 presidential election on November 5, the demand for leverage increased by 160%, increasing investor interest in riskier assets like cryptocurrencies.

Although the ETH price has trailed behind that of Bitcoin (BTC), market players anticipate this will change with the recent decline in ETH’s value. At the peak of the 2025 bull cycle, some analysts predict that Ether will hit $20,000 based on new technical chart patterns.

According to analysts, the ETH surge to $4,000 will be fueled by ETF inflows and spot purchases.

Even while ETH ETF flows improved, spot buying pressure might also be to blame for ETH’s recent price increases.

Ryan Lee, chief analyst of Bitget Research, said that this indicates Ether is poised for additional upward momentum in the coming weeks:

“The implied volatility of 1-day options has remained stable, indicating that the recent breakout above $3,600 was driven by spot accumulation rather than speculative activity. This trend suggests ETH may continue to rise, and the ETH/BTC exchange rate, which shows signs of bottoming and rebounding, is worth monitoring.”

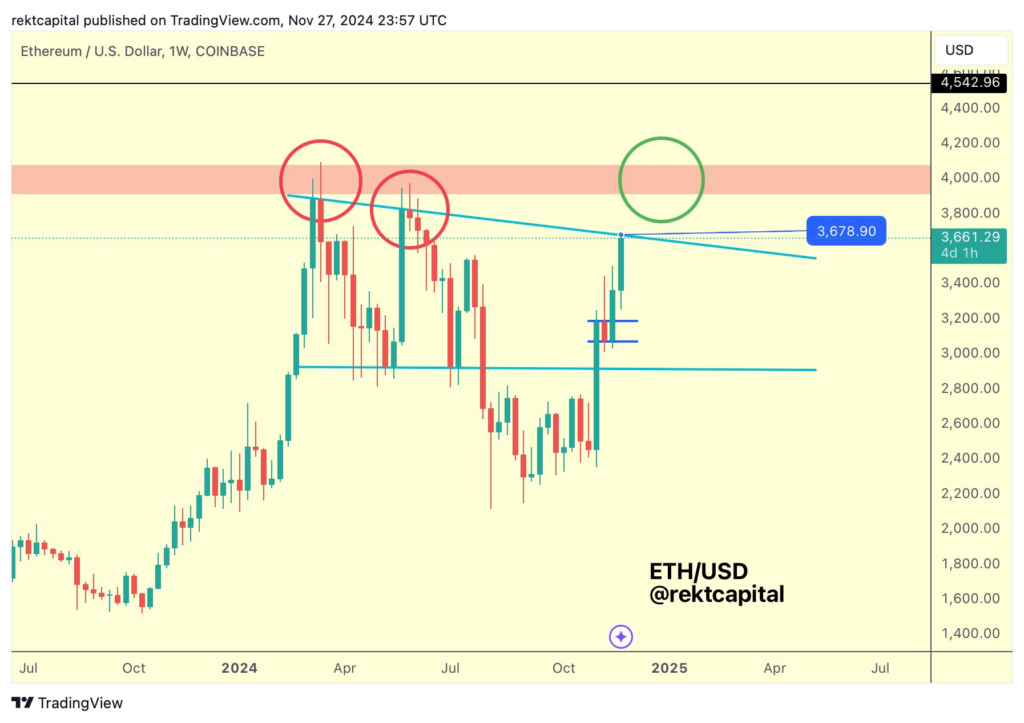

According to technical chart formations revealed by well-known trader Wolf in a November 27 X post, this might position Ether for a rally above the psychological $4,000 mark:

“One way to view it is as a 3-year cup and handle, with major resistance at 4k. Once that’s cleared, a measured move places it north of $15k.”

Lee stated that the record stablecoin inflows to exchanges in November could be a factor in Ether’s price increase.

“Sustained net inflows of stablecoins are providing liquidity to the crypto market […] This inflow trend is unlikely to reverse in the short term, suggesting that the market’s momentum will persist.”

Bitcoin’s decline below $100,000 might act as a stimulus for the price of Ether.

On November 22, the price of Bitcoin reached a new all-time high of $99,800 before seeing a brief decline to above $91,000, which some analysts predict might go as deep as 30% before breaking the six-figure mark.

However, well-known cryptocurrency analyst Rekt Capital stated in a November 28 X post that Bitcoin’s continued rangebound status below $100,000 would be a favorable catalyst for the price of Ether:

“Bitcoin ranging between $91,000 & $100,000 may very well be a recipe for Ethereum to take the lead and enable money flow into smaller Altcoins.”

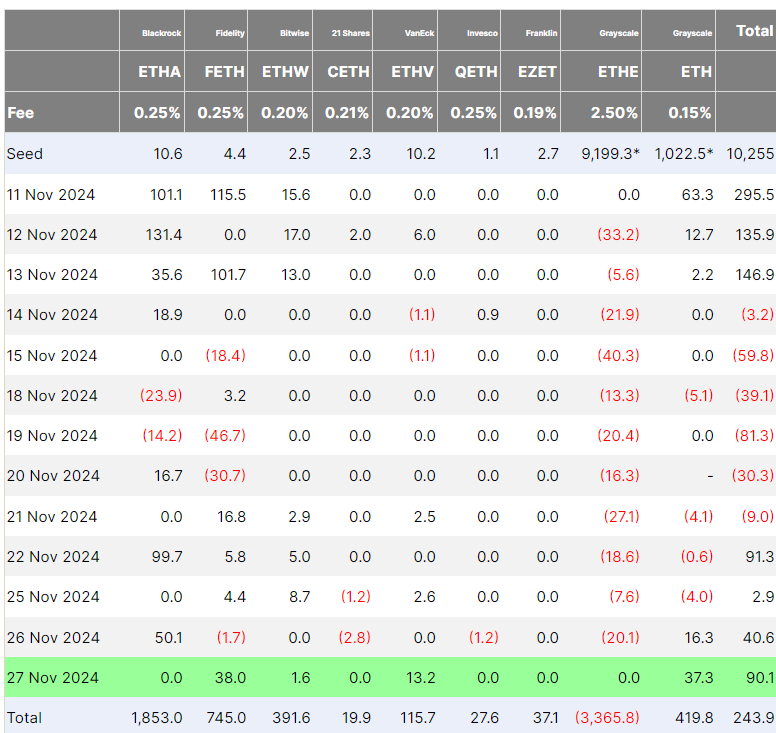

Ether’s price increase may also be influenced by ongoing inflows into Ether ETFs. According to statistics from Farside Investors, the Ether ETFs saw net positive inflows of more than $90 million for the fourth day on November 27.