Chainlink’s LINK price rebounds 5% to $23.54 after Bitwise files S-1 for a spot ETF, tracking the CME CF Chainlink-Dollar Reference Rate.

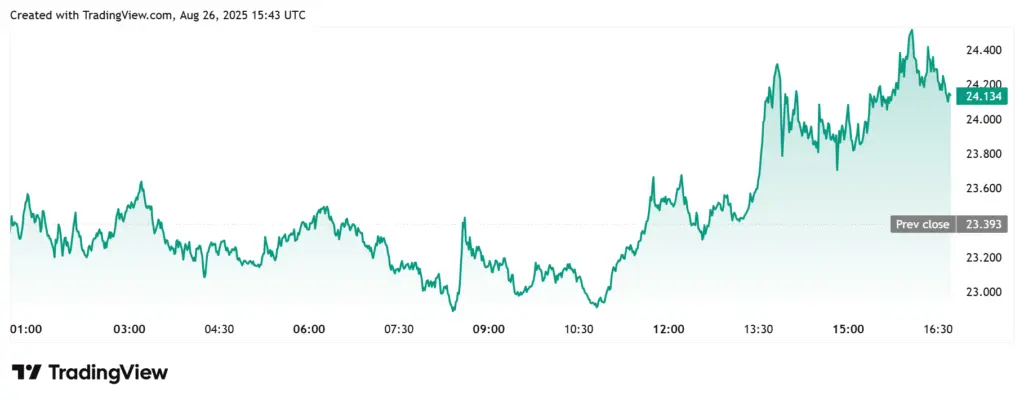

Due to the Chainlink ETF filing, the price of Chainlink (LINK) increased by 5% from its intraday low of $22.94 on Tuesday, August 26. The large-cap altcoin, which has a fully diluted valuation of approximately $23 billion, was trading at roughly $23.96, a 1.9% decrease over the past 24 hours.

Chainlink ETF Application Results in Price Increases for LINK

TradingView data indicates that the LINK price has recovered in response to Bitwise’s Form S-1 filing with the United States Securities and Exchange Commission (SEC) to introduce the Bitwise Chainlink ETF.

The Bitwise LINK ETF will work with Coinbase Custody Trust Company to ensure the security of its acquired tokens, as stated in the S-1 registration statement. Given the potential inflow of capital into the LINK ecosystem via this fund, this is a positive development for the LINK price.

The Bitwise ETF will support cash-based and in-kind creation and redemption if the U.S. Securities and Exchange Commission approves. As the filing expressly specifies provisions for LINK, the fund will refrain from engaging in active trading.

An exchange will require a 19b-4 filing to list and trade shares of this fund and initiate the review procedure for the Chainlink ETF. After that, the U.S. SEC will proceed with its standard procedure, encompassing an initial review, a potential publication comments stage, potential amendments, and a final decision.

A pioneering invention

According to Bloomberg analyst Eric Balchunas in an X post, the Bitwise filing is the first of its kind for Chainlink, at least for a “true blue spot ETF,” as Tuttle filed for a 2x LINK ETF under the 40 Act.

The Tuttle Capital 2X Long Chainlink Daily Target ETF is designed to generate 200% of the daily performance of the LINK index. The Tuttle Capital 2X Long Chainlink Daily Target ETF aims to create greater daily returns by utilizing swap agreements executed through call options and direct LINK investments, as indicated in the SEC filing.

The Implications for Chainlink

The Bitwise Chainlink ETF is important because it validates the organic demand for LINK among institutional investors. Additionally, if the U.S. Securities and Exchange Commission (SEC) approves, the fund will authorize LINK for hedge funds and pension funds. This could increase the price of the altcoin as demand increases.

It is important to note that the Chainlink team also contributes to the demand for the LINK token by establishing a reserve. The Chainlink reserve has recently exceeded 150,770 LINK tokens, as CoinGape reported.

Concurrently, the Bitwise Chainlink ETF application will enhance the Chainlink network’s status as a critical infrastructure for the broader DeFi ecosystem. The Chainlink network has established numerous strategic partnerships within the DeFi ecosystem to offer secure and consistent price oracles.

For example, earlier this week, SBI Group, a prominent financial institution in Japan, disclosed a strategic partnership with Chainlink to facilitate its DeFi initiatives. Due to the partnership, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) will facilitate SBI’s entry into cross-chain tokenized real-world assets (RWA).