Luxembourg’s 2025 report flags crypto firms as high risk for money laundering despite rising adoption by local financial institutions.

Luxembourg classified virtual asset service providers (VASPs) as high-risk entities for money laundering in its 2025 National Risk Assessment (NRA), underscoring concerns regarding the crypto industry’s susceptibility to financial crime.

Luxembourg report indicates that the inherent risk level of VASPs is “High,” which is determined by various factors, such as the international scope of operations, legal structures, transaction volume, client reach, and distribution channels.

In Luxembourg’s 2020 report, the NRA identified VASPs as an emerging risk following “a comprehensive evaluation of the inherent risks of machine learning emerging from virtual assets.”

This was succeeded by a 2022 NRA report that classified “the risks associated with crypto assets and virtual currencies as very high” due to their internet-based and cross-border nature.

European Union’s Evolving Regulation Of Cryptocurrency

Luxembourg, a founding member of the European Union, has been engaged in the process of regulating the cryptocurrency industry.

The Markets in Crypto-Assets (MiCA) framework is a critical component of this endeavor, as it endeavors to harmonize the regulation of crypto assets across all 27 EU member states.

Crypto asset service providers have begun to acquire licenses to operate legally within the EU since January.

This month, Kraken, a cryptocurrency exchange, has implemented regulated derivatives trading, while Crypto.com, a competitor, has obtained a license that permits it to do the same.

MiCA also establishes a new set of requirements for stablecoins.

Tether, the stablecoin market leader behind USD (USDT), was delisted on the EU platforms of Crypto.com, Coinbase, and the leading crypto exchange Binance due to its refusal to comply with the new regulations.

Cryptocurrency-Based Money Laundering

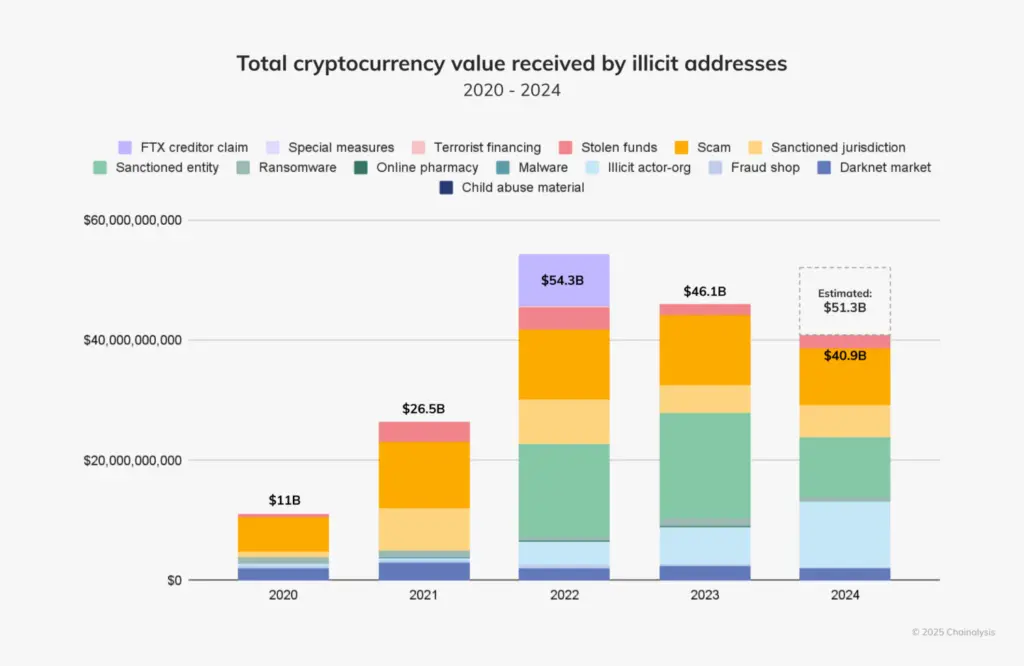

The prevalence of cryptocurrencies for money laundering is rising as their role in the broader financial ecosystem continues to expand.

Twelve individuals were apprehended by the Hong Kong police earlier this month for their involvement in a cross-border money laundering scheme.

The scheme utilized cryptocurrency and over 500 surrogate bank accounts to launder 118 million Hong Kong dollars ($15 million).

This month, European law enforcement apprehended 17 perpetrators of a “mafia crypto bank” for allegedly laundering more than 21 million euros ($23.5 million) in cryptocurrency for criminal organizations based in the Middle East and China, according to reports.

Cash, cryptocurrency, 18 vehicles, four shotguns, and numerous electronic devices were confiscated due to the proceedings, totaling 4.5 million euros ($5 million).