In addition, Maker is renaming the biggest decentralized stablecoin in the world before introducing SKY, its governance token.

To bring decentralized finance (DeFi) to a broader audience, Maker protocol has officially changed its name to Sky and revealed the name of its updated stablecoin and native governance token.

Maker, the oldest DeFi lending platform, has changed the name of Dai DAI$1.00, the most prominent decentralized stablecoin in the world, to USDS as part of its rebranding campaign.

As an improved version of the Maker MKR$2,069 token, the protocol also launched the Sky (SKY) native governance token for the larger Sky ecosystem.

According to Rune Christensen, co-founder of MakerDAO, the rebranding initiative is a step toward introducing the “next evolution of DeFi.”

In a statement, Christensen wrote:

“The protocol has been built with a […] focus on simplicity and ease of use. It allows users to benefit from innovations such as Sky Token Rewards (STRs) and the Sky Savings Rate (SSR), provided they are in an eligible jurisdiction.”

According to Christensen, the Sky Protocol is still decentralized, community-governed, and non-custodial, just like MakerDAO.

Further developments in DeFi protocols may draw more mainstream users away from centralized exchanges (CEXs).

According to Christensen, Sky hopes rebranding will make the protocol more accessible.

“By upgrading MKR to SKY at a rate of 1:24,000, far more people are provided with access to the Sky ecosystem. The larger supply of SKY improves the experience for those who want to purchase more than just a fraction of the token…”

Maker SubDAOs rebrands to Sky Stars

Maker SubDAOs will rebrand as Sky Stars as part of the initiative, continuing to be autonomous, decentralized projects that link the Sky ecosystem with their distinct economic models.

Spark, an open-source, decentralized liquidity protocol, is the first subDAO of this type to go online. It allows users to borrow USDS at a 7% interest rate and deposits DAI tokens at a 6% yield.

According to Christensen, each Sky Star subDAO will have the autonomy to run its community and treasury, issue a governance token, and carry out DAO-specific decisions independently. Christensen said:

“Sky Stars will be able to innovate, experiment and take more risks, while the Sky Protocol itself can remain purely focused on maintaining the value and security of the USDS stablecoin. Core Sky Governance will protect against risks in the tail end, while Stars specialize in doing business in the trenches. “

The second-largest protocol category in DeFi is still lending.

Lending is one of DeFi’s second-biggest protocol categories, and Spark is in it.

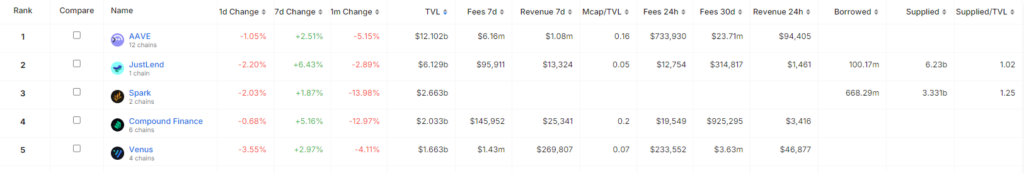

DefiLlama data shows that there are 443 DeFi lending protocols with a combined total value locked (TVL) of over $33.4 billion. Liquid staking is the largest protocol category, valued at over $44.3 billion.

Spark is currently the third-largest lending protocol out of 443, having seen a decline of roughly 14% in its $2.66 billion TVL over the last month.

With over $12.1 billion in TVL, Aave is still the most popular DeFi lending protocol despite a 5% decline in value over the previous month.