Mantra (OM), a blockchain network that focuses on tokenizing real-world assets, hit its all-time high again on October 10 and jumped 9.2% to $1.46

The altcoin’s market value exceeded $1.2 billion, and about $56 million worth of trades happened daily, mainly on Binance and XT.COM.

The price of Mantra has gone up 42% in the last 30 days, beating out other important RWA tokens like Ondo and Pendle. It had increased over 2400% since the beginning of 2024 when this was written.

OM’s price movement has matched a rise in its futures open interest, reaching a high of $40.06 million, the highest level in several months. The big surge in open interest shows that investors want the asset.

One of the major reasons for OM’s rise is the upcoming launch of Mantra’s mainnet later this month, which has made more people interested in the project. Developers think that the mainnet will make Mantra even more important as a tool for developers in the RWA tokenization space, which is growing quickly.

A new plan by Mantra DAO to update its tokenomics has added to the pace. The plan includes changes to how tokens are distributed, how long team members and early investors have to wait to get their tokens, the rate of inflation, and the staking rewards. It also has community-driven incentives like the “GenDrop” airdrop and better rewards for staking, which have all been well accepted as the launch of the mainnet draws near.

The OM price has increased along with a broader rise in interest in Real World Assets. According to figures from DeFi Llama, these assets now make up 4% of all the value locked in the DeFi sector, up from 1.77% last year.

Also, 50 million OM tokens will be given away soon as an airdrop to ATOM holders on the Mantra node, people who competed in the Mantra Zone competition, and some NFT users. This will make people even more excited about the project. Read on.

What will OM do next?

As one trader put it, OM was moving upward, supported by steady bullish momentum and higher lows. If the current trend continues, the currency could run for the 1.7532 USDT mark.

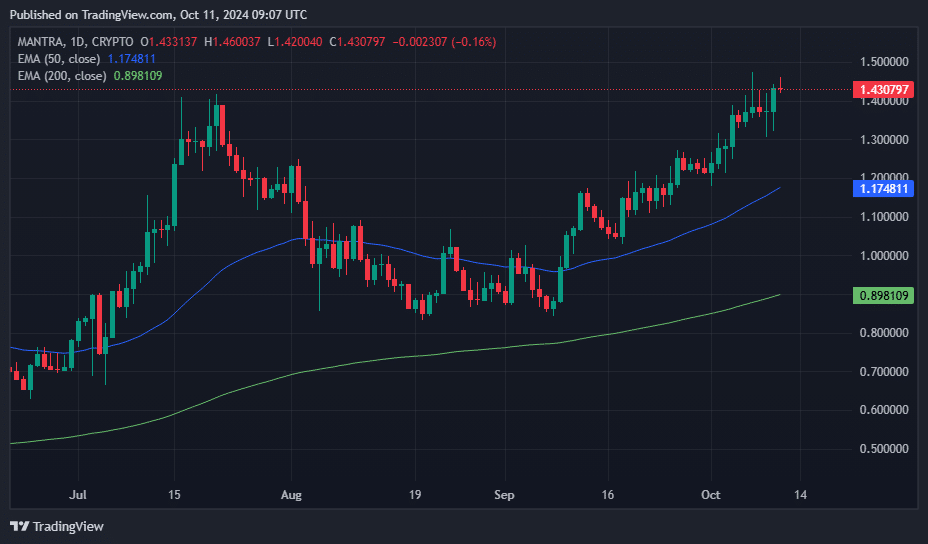

There are technical signs that point to the altcoin going up. The 50-day EMA (blue) has crossed over the 100-day EMA (green) on the daily chart, a common sign that prices are increasing. The short-term EMA is also starting to increase, making it more likely that more gains will happen.

Since October 4, the Relative Strength Index has stayed above the overbought level of 70. At the same time, the Average Directional Index, which measures the strength of a trend, has risen to 41, showing a strong upward trend.

On the other hand, a big rise in BTC could be good for OM in the short term and help push the price to new highs. When writing, the community’s view of OM was very positive. Of the 1,779 votes on CoinMarketCap, 81% thought the altcoin would increase even more.