MARA Holdings plans $850M convertible senior notes offering to fund Bitcoin buys and debt repurchasing, aiming to boost its 34,794 BTC holdings.

MARA Holdings, the world’s largest public Bitcoin miner, has disclosed its intention to sustain its aggressive accumulation of BTC through substantial funding. The digital energy and infrastructure company disclosed its intention to raise $850 million through a private offering of zero-coupon convertible senior notes due in 2032 earlier today.

MARA Holdings raises $850 million to accumulate Bitcoin

MARA Holdings recently announced its most recent $850 million BTC transaction in a press release, which drew the attention of Bitcoin enthusiasts. The BTC miner plans to raise this substantial sum through a private placement of zero-coupon convertible senior notes.

The offering is exclusively available to qualified institutional buyers, as an SEC filing submitted on Wednesday indicates. Initial purchasers can purchase an additional $150 million in notes, bringing the total financing to $1 billion. A portion of the company’s 2026 convertible notes will be repurchased with $50 million of the proceeds. The remaining funds will be allocated to repurchase debt, the accumulation of Bitcoin, capped call transactions, and general corporate purposes. The organization declared,

MARA also expects to grant to the initial purchasers of the notes an option to purchase, within a 13-day period beginning on, and including, the date on which the notes are first issued, up to an additional $150 million aggregate principal amount of the notes. The offering is subject to market and other conditions, and there can be no assurance as to whether, when or on what terms the offering may be completed.

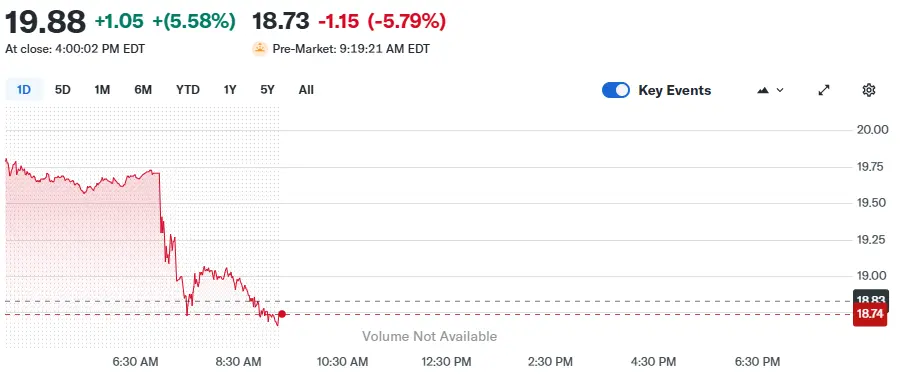

Despite this substantial development, the price of MARA Holdings stock (MARA) experienced a significant decline of 5.79%. Nevertheless, the stock price has experienced substantial increases of 5% and 38% over the past five days and 30 days, with a premarket price of $18.73 and a closing price of $19.88, respectively.

MARA is the leader in the mining and holding of Bitcoin

It is worth noting that MARA Holdings is the world’s largest public Bitcoin miner and possesses the second-largest public BTC hoard, with 50,000 coins valued at $5.9 billion. However, it is only surpassed by Michael Saylor’s MicroStrategy. The BTC portfolio of MARA was increased to 50,000 in May 2025, as previously reported.

In January, the platform announced its ambitious intentions to support Donald Trump’s Bitcoin Reserve Strategy. CEO Fred Thiel stated that the organization’s top priority is to broaden the SBR initiative to encompass all 50 states and the federal government, as previously reported.

MARA Holdings disclosed its Bitcoin mining development updates as of June 30, 2025, in an SEC filing today. Approximately 310,000 energized miners are reportedly present in all of the company’s locations. MARA mined 2,358 BTC during the second quarter of 2025, averaging 25.9 daily coins. This constitutes 5.7% of the rewards that are accessible to miners.

The company’s total Bitcoin holdings, which included those under asset management, collateralization, or loan, were 49,95, as indicated in the filing. MARA generated 4,644 coins during this period by winning 694 bitcoin blocks in the quarter and 1,360 blocks in the first half of 2025.