Bitcoin plunges to $65K on South Korean platforms after martial law disrupts liquidity; prices recover as political tensions ease and markets stabilize.

According to one researcher, there was an abrupt drop in liquidity due to South Korea restricting the market to a few participants.

After President Yoon Suk Yeol imposed martial law, Bitcoin prices on South Korean platforms fell by $30,000 due to a liquidity problem and the withdrawal of important market participants.

In a live televised speech on December 3, President Yoon declared martial law, stating that it was necessary to “eliminate anti-state elements” and deal with “threats posed by North Korea’s communist forces.”

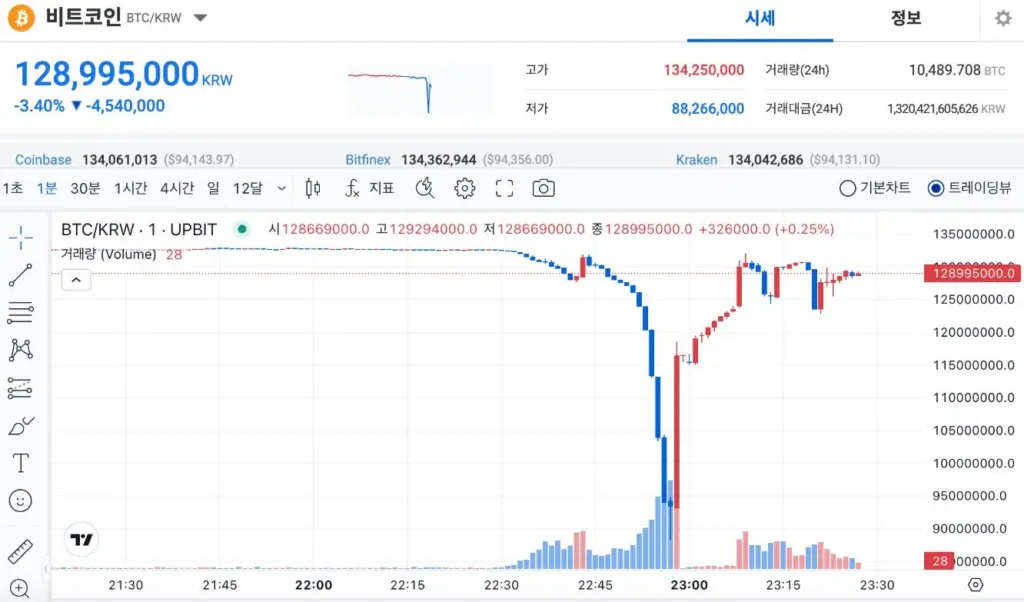

As a result of the announcement, the market was immediately disrupted, and the price of Bitcoin BTC$96,001 on the South Korean exchange Upbit fell as low as 92 million Korean won, or almost $65,000.

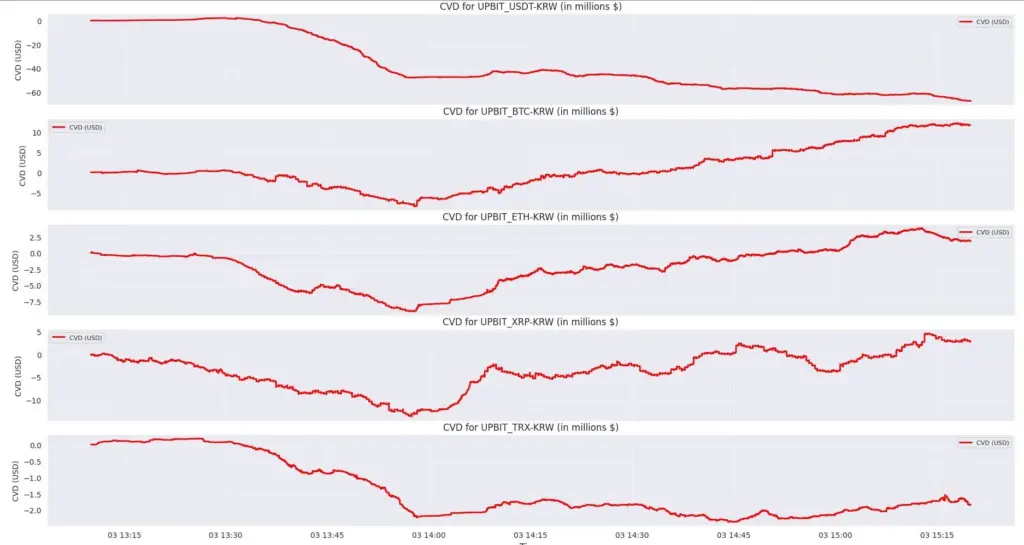

An abrupt loss of liquidity was the reason given by one analyst for the steep drop. The lack of active participants led to an imbalance between bids and offers, which resulted in a 10% spread during the crisis, according to trader Ltrd.

In South Korea, a lack of liquidity drives Bitcoin to $65,000.

Trader Ltrd stated in an X forum that the dip would not be this severe if the liquidity were regular. However, according to the trader, “all the players just disappeared from the market” when martial law was declared. The analyst wrote:

“The reason is simple — it is shockingly hard to enter the Korean market and trade there. This means that only a few players can provide liquidity and arbitrage those discrepancies.”

Ltrd said price volatility might have been reduced with greater market maker participation. South Korean traders paid the price for restricting the market to a few players.

The trader also pointed out intense sell pressure on every instrument, which resulted in a sharp decline. Nevertheless, Ltrd stated that the market overreacted and that the sharp price decline would not have occurred if more liquidity providers had been active in the South Korean market.

Following the reversal of martial law, South Korean markets revived.

One hundred ninety members of the South Korean parliament voted to declare martial law void just hours after it was announced. Tensions were reduced when President Yoon lifted the order after accepting the decision.

Bitcoin values recovered after the reversal, and at the time of writing, they were trading at roughly 135 million KRW, or $95,000.

According to market watchers, the brief crisis emphasizes how susceptible South Korea’s cryptocurrency markets are to liquidity shocks, especially when there is political unrest.