Wallets linked to Murad Mahmudov show $68M in unrealized memecoin gains, fueling debate over his “memecoin supercycle” theory.

Blockchain data shows that cryptocurrency investor Murad Mahmudov has tens of millions of dollars in unrealized memecoin earnings, which is further fueling the ongoing controversy over his “memecoin supercycle” theory.

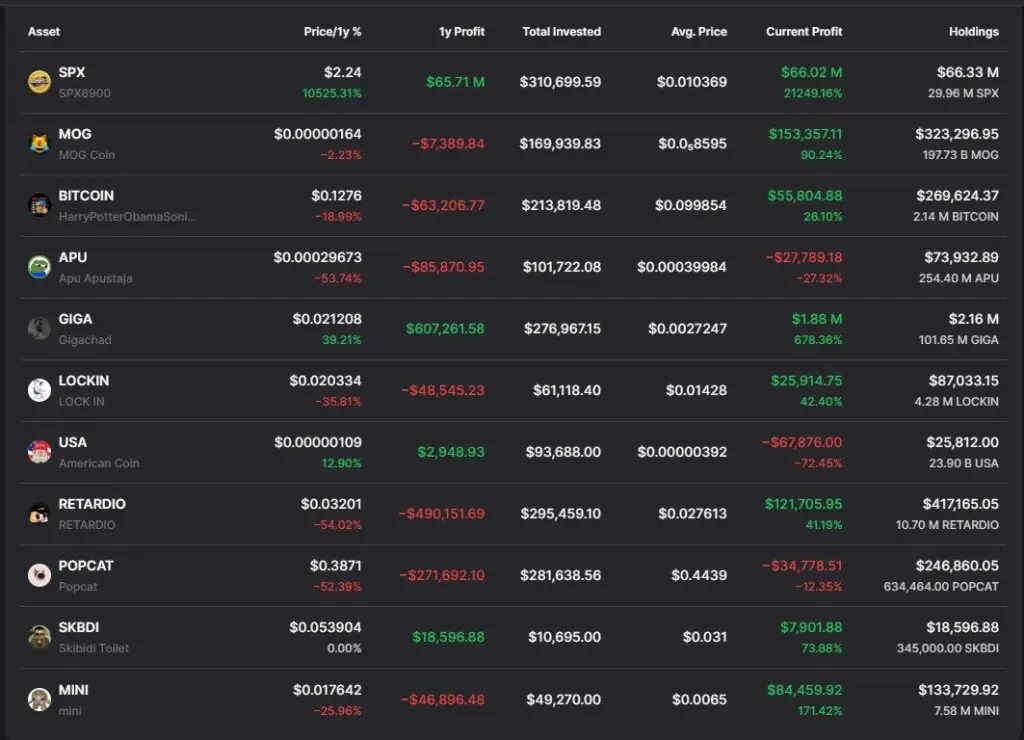

Mahmudov owns more than $70 million in memecoins, according to data from the on-chain data aggregator DropsTab, despite having only $1.86 million in invested capital.

That amounts to about $68.3 million in unrealized profit for him overall.

According to the data, the memecoin SPX6900 is its largest winner, having increased by nearly 10,500% in the last 12 months.

The coin currently trades at $2.24, although its entry price on SPX was $0.01036. According to the figures, his profit from SPX alone reaches $66 million.

The memecoin with the worst performance in Mahmudov’s holdings is Apu Apustaja.

His investment has lost more than $86,000 when the memecoin fell 53 percent.

Mahmudov owns tens of millions of SPX; therefore, the price may change if he sells the tokens.

As an outspoken advocate of the token, Mahmudov’s sale could indicate to investors that the “supercycle” may have peaked, leading to a sell-off.

Memecoin Supercycle Thesis

The memecoin supercycle theory is the brainchild of cryptocurrency investor Mahmudov.

In his presentation at Token2049 Singapore 2024, he claimed that the cryptocurrency industry is about to enter a new era in which meme-driven tokens perform significantly better than conventional digital assets like Bitcoin and Ether.

The memecoin supercycle, according to Mahmudov, is a new market phase fueled more by virality, culture, and community identification than by technology or fundamentals.

According to him, memecoin supercycle operate more like online cults or groups bound together by shared beliefs and humor than they do like traditional financial assets.

Blockchain researcher ZachXBT criticized the trader for promoting meme-based currencies.

ZachXBT supposedly made Mahmudov’s wallets public in 2024 so that the public could keep an eye on his trading activity.

The crypto expert accused Mahmudov of making audacious memecoin predictions “while controlling the supply.”

ZachXBT drew attention to the purported wallet’s July 16 MIN coin transaction, which was made an hour before a post claiming to have 1% of the supply.

Cointelegraph contacted Mahmudov on X, but they did not respond right away.

In July, Memecoin Market Jumped 54%

On Wednesday, the memecoin industry peaked at $85 billion, a 54% increase over its June 30 estimate of $55 billion.

The market had corrected to $78 billion at the time of writing, which was still 41% higher than its June closing valuation.

Community members’ reactions to the sudden spike in the memecoin market were mixed.

Memecoins are the “most attractive segment” of cryptocurrency, according to Neiro community leader S.

Anthony Anzalone, the CEO of Xion, stated that the asset class’s rise indicates that capital has nowhere else to go.

The Solana memecoin community has criticized Anatoly Yakovenko, a co-founder of Solana, for his comments regarding meme-based coins.

Yakovenko stirred some controversy on Sunday when he called NFTs and memecoins “digital slop.”