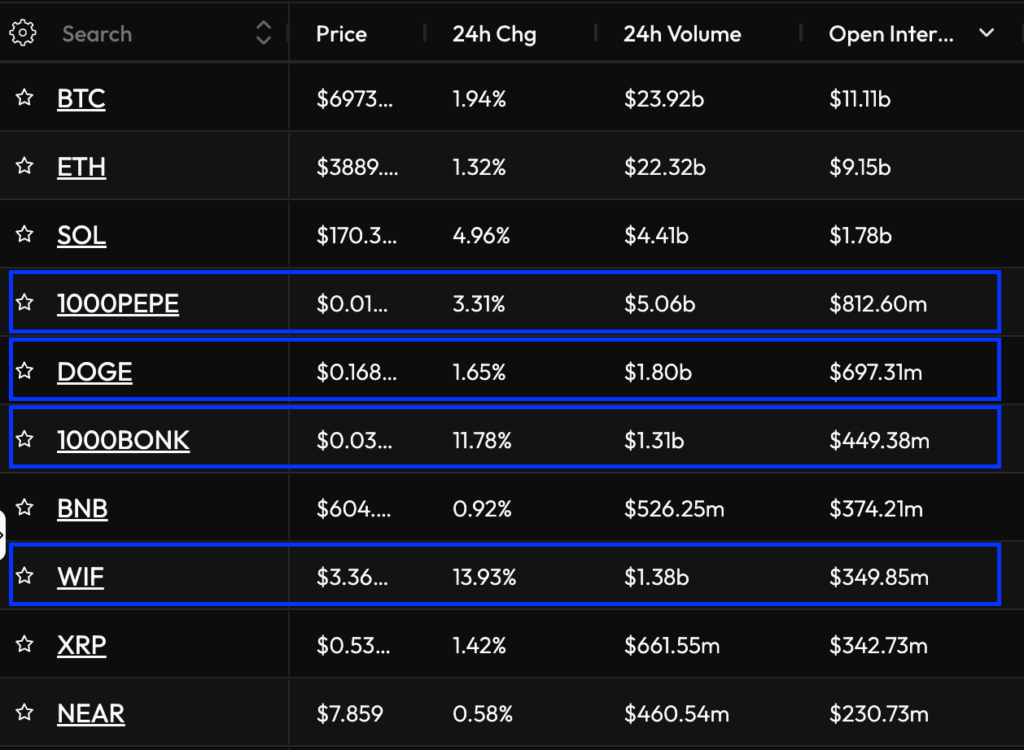

Memecoins dominate crypto open interest charts, taking 4 out of the top 10 cryptocurrencies memecoins, with Pepe leading the charge with $812.6 million in OI.

During this bull season, the cryptocurrency community’s enthusiasm for memecoin has been the talk. A year after going public, Pepe and WIF have risen into the top 20 cryptocurrencies by market capitalization.

A substantial amount of attention has been drawn to these memecoins within the crypto leverage market, where participants sell or purchase them at a loss.

Regarding Open Interest (OI), four memecoins are among the top ten. Among these, Pepe PEPE tickers, currently down $0.000016, are the most actively traded with $812.6 million in OI. Nearly half of Solana’s SOL tickers are also down $167, or $1.7 billion in OI.

In addition, among the top ten were Dogecoin DOGE, Bonk (BONK), Dogwifhat (WIF), and Dogecoin DOGE, all of which were down $0.17. With $11.1 billion in OI, Bitcoin BTC tickers down $68,080 leads the chart, followed by Ethereum ETH tickers down $3,875 with $9.15 billion.

Additionally, it is noteworthy that the OI varies substantially from top to bottom. Bitcoin has an OI of $11 billion, whereas the tenth-placed Near Protocol NEAR, depreciating $7.95, has an OI of only $230 million. This discrepancy highlights the substantial divergence in Interest among speculators.

Recent increases in OI for memecoins result from their bullish momentum over the past two weeks, during which Pepe and WIF surpassed $3.30 for the first time and established new all-time highs, respectively.

Open Interest denotes the aggregate value of unresolved derivative contracts that are presently pending. Futures contracts necessitate a buyer’s presence to satisfy each seller’s obligations.

A contract is considered “open” from when the buyer or seller initiates the opening process until the counterparty completes the closing. OI increases with the addition of new contracts and decreases with the settlement of existing ones. Continuous data, as opposed to transaction volume, constitutes OI.

An increasing OI signifies a favorable trend in the market as leverage traders enter into a more significant number of contracts in anticipation of price momentum.

Notwithstanding the escalation in memecoin prices and the surge in OI, the funding rates for memecoins on all cryptocurrency exchanges remained negative.

The cost of maintaining a position in a perpetual swap or futures contract to the underlying asset’s current price is denoted by funding rates. A positive funding rate signifies an optimistic outlook for the market, whereas a negative funding rate signifies a pessimistic sentiment.