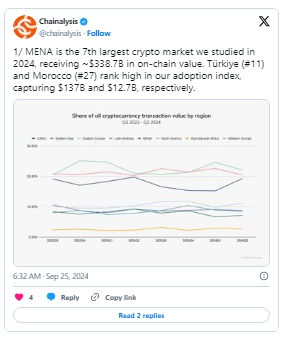

The Middle East and North Africa region has emerged as the seventh-largest cryptocurrency market as retail and institutional adoption continue to expand

MENA secured the seventh position by receiving $338.7 billion in cryptocurrencies between July 2023 and June 2024, as per a Chainalysis report. This represented 7.5% of the global on-chain value.

The region is led by Turkey, which has received $137 billion in on-chain value, followed by Morocco, which has received $12.7 billion. There are only two countries included in Chainalysis’ global crypto adoption index.

The report discovered that professional and institutional movements drove 93% of the region’s transactions, valued at over $10,000.

The United Arab Emirates experienced significant growth in retail and institutional on-chain value due to its favorable regulatory environment, as reported by Chainalysis.

Tether, the issuer of the largest stablecoin, USDT, announced last month that it would establish a dirham-pegged stablecoin in the UAE. The country’s liquid reserves will support this stablecoin.

The stablecoin issuer collaborated with Fuze, a crypto infrastructure company, to increase the awareness of cryptocurrencies and educate individuals and large institutions in Turkey and the Middle East.

Saudi Arabia’s crypto market experienced a 154% year-over-year increase during the specified timeframe, establishing itself as the region’s fastest-growing digital asset economy, as per Chainalysis’s data.

Decentralized exchanges were the site of most on-chain activity in the MENA region. According to the report, DEXs accounted for 32.4% and 30.9% of the on-chain movements in the UAE and Saudi Arabia, respectively.

It is crucial to acknowledge that Saudi Arabia and Qatar lack an operational regulatory framework for crypto companies, which may be the primary factor contributing to their utilization of DEXs.

In February, the Saudi Arabian Ministry of Investment allocated $250 million to the Hedera blockchain to stimulate the development of web3.