With its $800 million Bitcoin treasury funding proposal, Mercurity would surpass Galaxy Digital as the eleventh-largest corporate Bitcoin holding.

As more businesses embrace Bitcoin for strategic reasons, Mercurity Fintech Holding, a digital fintech company listed on the Nasdaq developing blockchain-based payment infrastructure, intends to raise $800 million to create a Bitcoin treasury reserve.

In a statement released on Wednesday, Mercurity stated that it intends to raise $800 million to create a “long-term” Bitcoin (BTC $107,114) treasury reserve. This reserve will be incorporated into its digital reserve framework through tokenized treasury management services, blockchain-native custody, and staking integrations.

A portion of Mercurity’s treasury will be converted into a “yield-generating, blockchain-aligned reserve structure that reinforces long-duration asset exposure and balance sheet resilience,” according to the company.

According to Shi Qiu, CEO of Mercurity Fintech, the company wants to position itself as a “key player in the evolving digital financial ecosystem” by establishing its corporate Bitcoin treasury.

“We’re building this Bitcoin treasury reserve based on our belief that Bitcoin will become an essential component of the future financial infrastructure.”

The company could buy roughly 7,433 Bitcoin at current pricing thanks to the $800 million capital increase.

According to Bitcoin data, Mercurity would exceed GameStop’s 4,710 BTC and rank globally as the eleventh largest corporate Bitcoin holder behind Galaxy Digital Holdings.

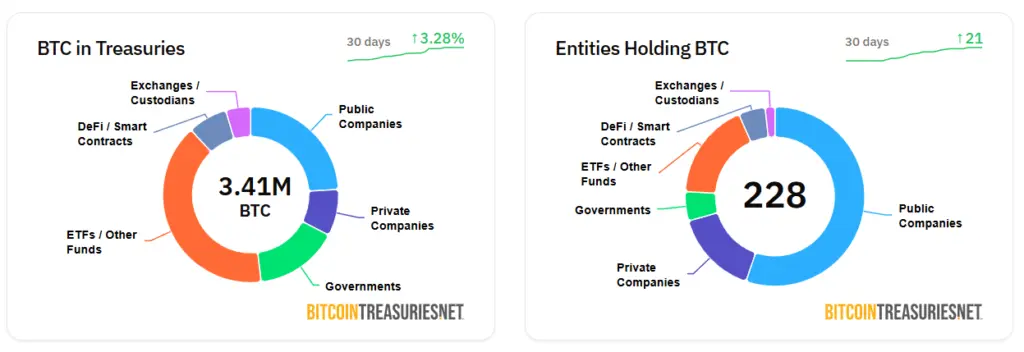

Corporations’ use of Bitcoin is growing; 223 businesses currently own BTC.

At least 223 public corporations already have Bitcoin in their corporate treasuries, up from just 124 organizations on June 5, indicating significant institutional interest, according to Cointelegraph.

According to data from BitcoinTreasuries.NET, public firm treasuries own about 819,000 BTC, or 3.9% of the total supply.

A representative for Binance Research said that a long-term investment mindset is driving the tide of corporate Bitcoin acceptance, adding:

“Corporate BTC adoption is driven by long-term balance sheet strategy, treasury diversification and capital-raising activity.”

Growing institutional interest is also helping altcoins. Interactive Strength, a fitness equipment maker listed on the Nasdaq, announced plans to raise $500 million to create a treasury of Fetch.ai FET$0.7635 tokens.