Metaplanet adds Bitcoin as a reserve currency amidst the decline of the Japanese Yen with up to 117.7 BTC, which is equivalent to $7.2 million.

Metaplanet, a publicly traded investment firm, has incorporated Bitcoin as a reserve asset in light of the Japanese yen’s ongoing depreciation.

The Tokyo-based firm officially declared on May 13 that it is implementing a “strategic shift” in its treasury management approach, placing Bitcoin-first and Bitcoin-only as the primary focus.

The company stated, “This action is a direct reaction to persistent economic pressures in Japan, specifically elevated levels of government debt, extended periods of negative real interest rates, and the resulting depreciation of the yen.”

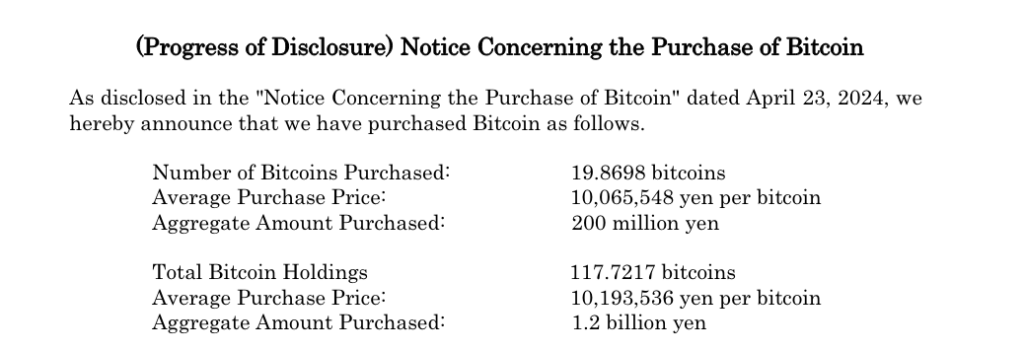

The announcement provides no information regarding the current or anticipated Bitcoin holdings in Metaplanet’s treasury. Metaplanet disclosed on May 10 that it had acquired 117.7 BTC ($7.19 million) for an approximate average of $65,000, or 10.2 million yen. Metaplanet’s current market value is approximately $20 million, or 3.5 billion yen.

A few weeks after the company announced its Bitcoin-centric strategy in early April when it declared the successful acquisition of its initial Bitcoin worth $6.5 million, Metaplanet implemented Bitcoin.

The action generated substantial buzz on social media platforms and precipitated a considerable surge in the value of Metaplanet shares listed on the Tokyo Stock Exchange. Metaplanet’s stock, denoted by the symbol 3350, increased in value from 20 JPY ($0.13) to 35 JPY ($0.22) in the hours following the company’s April announcement of its Bitcoin acquisition.

Before its strategic transition to Bitcoin, Metaplanet was predominantly engaged in conventional investment activities. When it was established in 1999, its primary operations were hotel management, investment services, and investor relations consulting.

A few days before the announcement, Metaplanet named eminent market researcher Dylan LeClair, director of Bitcoin strategy.

On May 9, Metaplanet CEO Simon Gerovich wrote in an X post regarding the company’s purchase of additional Bitcoin, “This is only the beginning.”

Reportedly, among major currencies, the Japanese yen has performed the worst against the U.S. dollar in 2024, falling to levels not seen since the 1990s in April. Local sources indicate that the yen’s depreciation over the last three years was primarily attributable to the widening trade deficit and the disparity between domestic and foreign interest rates.