Metaplanet boosts holdings to 6,796 BTC, surpassing El Salvador, as Bitcoin price climbs to $105,000.

Metaplanet disclosed on Monday that it had acquired 1271 Bitcoins through a $126.7 million investment at a BTC price of $102,111. The announcement is made just days after the company disclosed its $25 million bond issuance at 0% to pursue its BTC acquisition plans. Due to its most recent acquisition, the Japanese company has now surpassed El Salvador in terms of its total BTC holdings.

Metaplanet is inching closer to its 10,000 BTC objective

Metaplanet, a company as well-known in Japan as MicroStrategy, has recently acquired 1,241 BTC, which is valued at approximately $126.7 million. This acquisition has bolstered the company’s Bitcoin holdings and underscores the company’s ongoing confidence in the long-term potential of BTC.

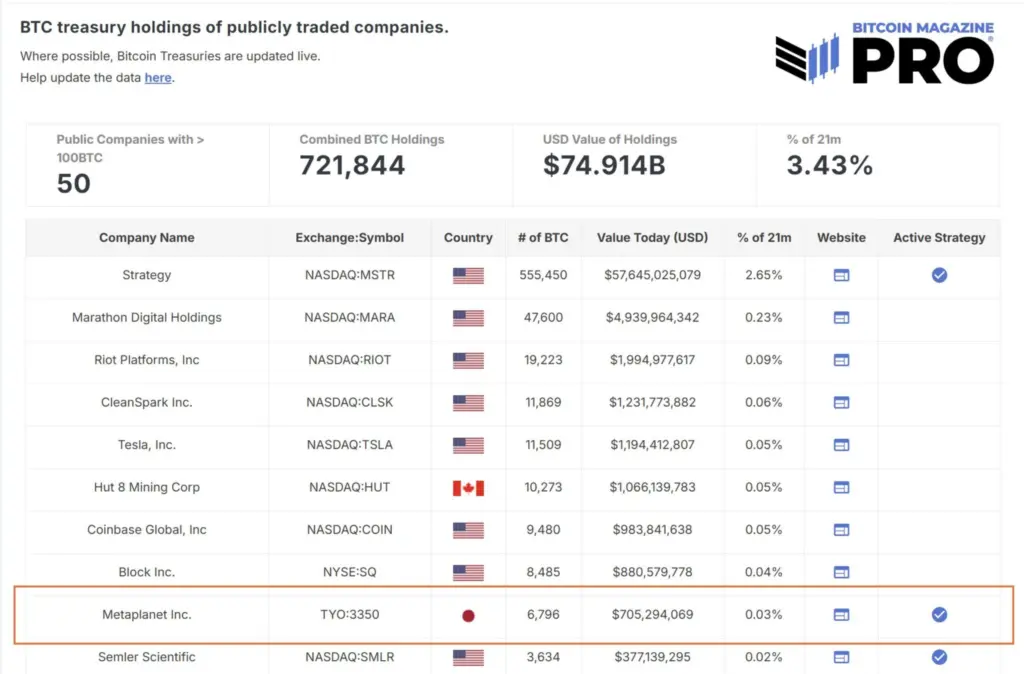

The firm’s total Bitcoin reserves, which were acquired for a cumulative investment of approximately $608.2 million at an average cost of $89,492 per Bitcoin, are currently 6,796 BTC as of May 12, 2025. Simon Gerovich, the company’s CEO, also observed that they have achieved an impressive 170% BTC yield through their Bitcoin acquisition strategy over the past year.

Adam Back, a market veteran, contended that their BTC acquisition strategy is superior to that of MicroStrategy. Additionally, the Japanese company intends to raise its BTC holdings to compete with industry titans such as Coinbase and Block Inc. after surpassing El Salvador.

A week after the Japanese company announced its intention to issue its 13th Series of Ordinary Bonds to raise $25 million for further Bitcoin acquisitions, today’s development has occurred. As part of its ongoing strategy to increase its Bitcoin holdings, the organization has consistently employed its EVO FUND to issue bonds. The Japanese company is rapidly approaching its objective of maintaining 10,000 BTC in its treasury by the conclusion of 2026.

Following today’s developments, Metaplanet’s stock price increased by 3%, surpassing 550 JPY. The stock has experienced a remarkable 1700% increase since the BTC strategy was implemented in mid-2024, and it has further increased by over 51% since the beginning of 2025.

Is a BTC rally imminent this week?

The BTC price reached $105,000 earlier today, with a weekly chart showing a robust 10.63% increase, as US-China trade negotiations continue to progress positively. This week, market analysts are increasingly optimistic about the possibility of new all-time highs.

Joe Consorti, a financial analyst, has noted a robust correlation between the Global M2 Money Supply and the price movement of Bitcoin, with a 70-day latency. The analyst acknowledged that M2 is a “poor measure of money supply,” but it continues to be an intriguing trend.

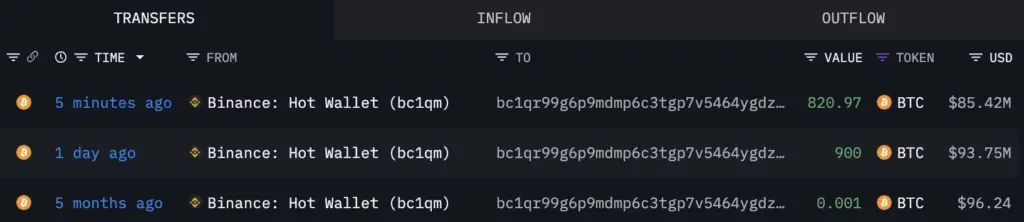

In addition to acquiring Metaplanet, purchasing Bitcoin whales has persisted at an unprecedented rate. LookonChain, a blockchain analytics platform, has reported substantial activity from a prominent Bitcoin behemoth.

The investor recently acquired an additional 821 BTC, which is valued at $85.42 million, following a similar acquisition the previous day. Over the past two days, the whale has amassed a total of 1,721 BTC, which is equivalent to approximately $179 million.