Metaplanet, Japan’s MicroStrategy, bought 775 BTC in the dip, boosting holdings to 18,888 BTC with a rating of 18.67x.

Known as Japan’s MicroStrategy, Metaplanet has taken advantage of the recent decline in the price of Bitcoin by purchasing an extra 775 units earlier today.

The company’s steady Bitcoin purchases have allowed it to reach a BTC rating of 18.67x, placing it in a powerful position to withstand BTC volatility.

The price of Bitcoin has dropped more than 7% after reaching all-time highs last week, and it is currently finding support near $115,000.

Metaplanet Increases Bitcoin Purchases, Reaching 18.67x BTC Rating

Japan’s MicroStrategy reported on August 18 that it has acquired an additional 775 BTC, increasing its total Bitcoin holdings to 18,888 BTC.

According to data from Bitcoin Treasuries, the seventh-largest Bitcoin holding is Metaplanet, which is about to surpass Bitcoin miner Riot platforms.

Bullish, a cryptocurrency exchange sponsored by Peter Thiel, made it into the top five list following a successful initial public offering (IPO) last week.

After its recent BTC purchase, the Japanese company has announced a year-to-date Bitcoin yield of 480.2% for 2025.

The company’s average Bitcoin buying price is $102,653 per coin.

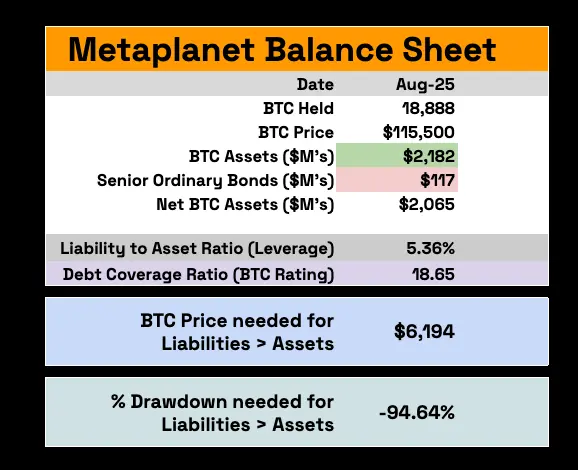

According to Dylan LeClair, the company’s Bitcoin strategist, Metaplanet now has over $2.18 billion in Bitcoin holdings, more than its $120 million in outstanding 0% ordinary bonds.

The company’s Bitcoin holdings provide 18.67 times the collateral for its 19th Series Ordinary Bonds.

As a result, the company’s Bitcoin rating has risen to an astounding 18.67x, meaning that its Bitcoin Treasury exceeds its outstanding debt by more than 18 times.

Furthermore, Dylan LeClair said:

“As it currently stands, the price of Bitcoin would have to decline 94.6% to ~$6,200 for our $BTC NAV to match our outstanding senior bond obligations.”

Demand For Metaplanet Stock Following Successful Q2

Following the release of the most impressive quarterly results in the second quarter of 2025, Metaplanet stock has been in high demand.

The company’s stock was the most bought on NISA accounts throughout the past week.

As a result, investors view it as a reliable stand-in for exposure to Bitcoin.

The stock price, however, has been under pressure and corrected by 17% last week. It is currently settling around 850 JPY.

Produced its best quarterly performance last week, driven by stronger financial measures and aggressive Bitcoin accumulation.

In an X post, CEO Simon Gerovich highlighted the accomplishment, writing, “This is the strongest quarter in Metaplanet’s history.”

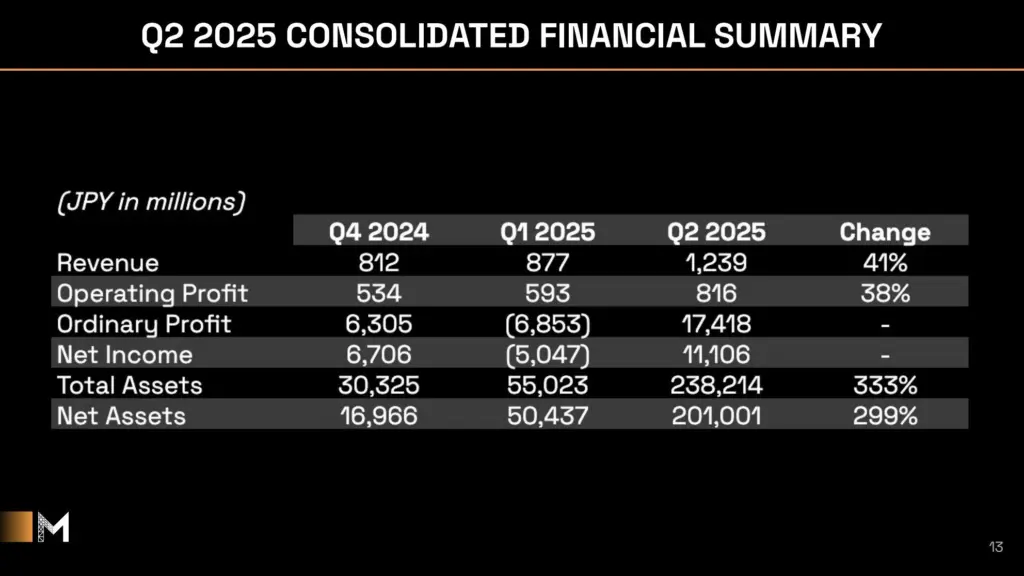

Following a ¥6.9 billion loss in the previous quarter, the corporation recorded an ordinary profit of ¥17.4 billion for the second quarter.

After losing ¥5.0 billion last year, net income increased to ¥11.1 billion.

Quarter-over-quarter, revenue climbed 41% to ¥1.239 billion, and gross profit surged 38% to ¥816 million.

With net assets rising 299% to ¥201.0 billion ($1.36 billion) and total assets rising 333% to ¥238.2 billion ($1.61 billion), the equity ratio was 84.2%.

Price Of Bitcoin Is Strongly Declining

Amid hopes of a Fed rate decrease, the price of Bitcoin hit an all-time high of $124,500 last week.

Since then, it has had a significant 7% decline and is currently finding support at $115,000.

Today’s selling pressure on Bitcoin coincides with a 22% increase in daily trading volume to $57 billion.

According to market observers, Bitcoin may continue to decline and find support near $110,000 before rising again.