Metaplanet has disclosed that it has issued 30 billion JPY (approximately $208 million) in 0% ordinary bonds to acquire additional Bitcoin (BTC).

This is the 19th series of ordinary bonds that the company has issued. The organization recently acquired an additional 1,005 BTC, which is estimated to be worth approximately $108 million. The organization maintains 13,350 Bitcoin (BTC), valued at roughly $1.44 billion.

Metaplanet Makes a Full Investment in Bitcoin

Institutions worldwide are accumulating BTC. Inflows of $2.22 billion were observed in BTC-based ETFs from June 23 to June 27. The consistent purchases made by institutions evidence the increasing demand for BTC products.

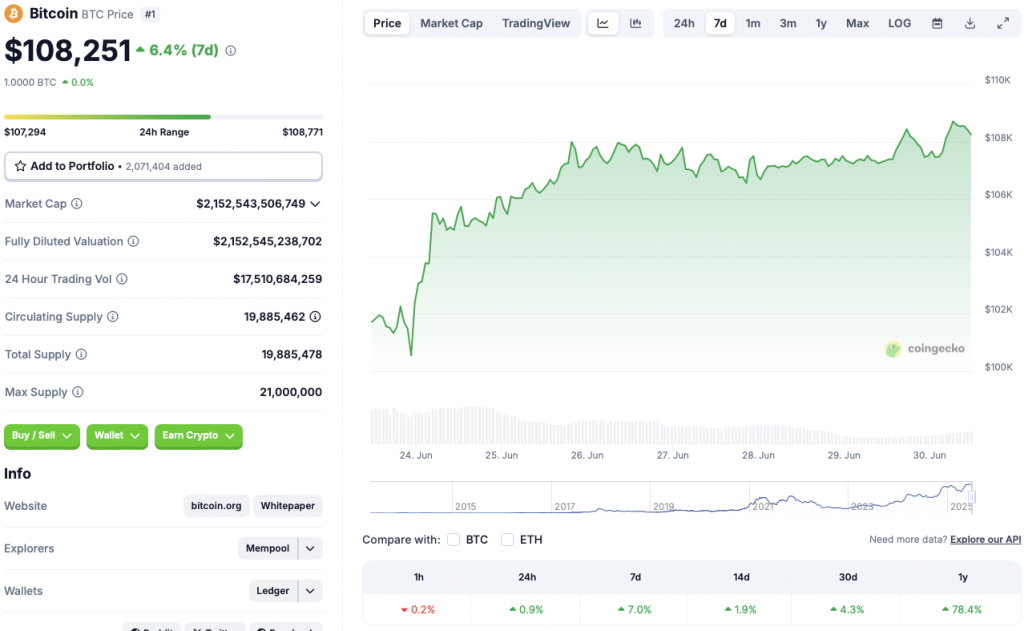

The asset’s recent resurgence is consistent with the increasing acquisitions of Bitcoin (BTC). The recent collapse has resulted in BTC regaining the $108,000 price level. BTC is currently trading in the green zone on all time frames.

The asset has experienced a 0.9% increase in the daily charts, a 7% increase in the weekly charts, a 1.9% increase in the 14-day charts, a 4.3% increase over the previous month, and a 78.4% increase since late June 2024.

Is a new all-time high on the horizon?

The original crypto is currently down by a mere 3.2% from its all-time high of $111,814. BTC could reach a new peak shortly if it maintains its growth trajectory.

In June, the crypto market experienced significant volatility due to global geopolitical tensions and trade conflicts. The two factors are subsiding.

The European Union is willing to negotiate a new trade agreement with the United States. The Iran-Israel conflict has also experienced a rapid de-escalation. The developments have the potential to propel BTC to new heights.

The Federal Reserve’s decision to maintain interest rates at their current levels is an adverse factor. President Trump has advocated for a reduction in the Federal Reserve’s interest rate. Nevertheless, interest rates may not decrease shortly.