Metaplanet seeks $50M via zero-interest bonds to grow Bitcoin holdings, with Evo Fund backing the private raise as the sole subscriber.

Metaplanet, a Japanese investment company, is conducting a private placement of zero-interest bonds to raise $50 million to increase its strategy exposure.

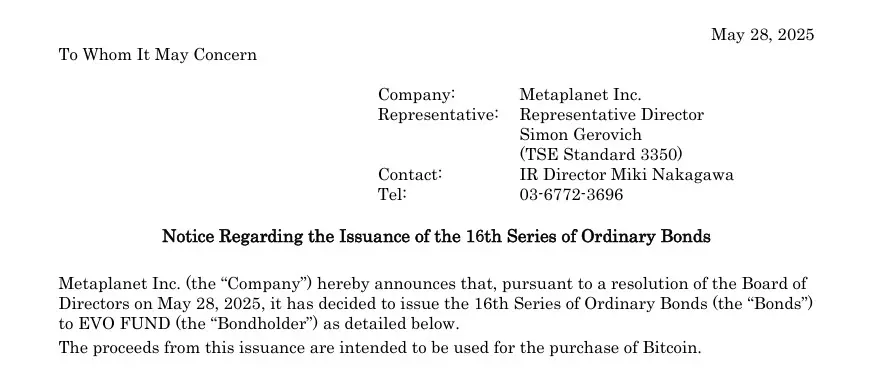

The corporation announced on May 28 that it was issuing $50 million in bonds.

The bonds are issued in denominations of $1.25 million and do not bear interest.

Investors are anticipated to derive any potential profits from the redemption value of the bonds, as they will not receive regular payments.

The solitary bondholder will be Evo Fund, an investment firm headquartered in the Cayman Islands.

The Japanese investment company’s primary supporter for its Bitcoin acquisition strategy has been the investment company, which has subscribed to multiple rounds of Metaplanet’s zero-interest bonds, thereby providing capital for its Bitcoin purchases.

The bonds are not guaranteed and are unsecured, as they lack collateral and a bond administrator.

This is indicative of the substantial level of trust that exists between the two organizations.

It also demonstrates Metaplanet’s confidence in BTC’s long-term prospects as the company continues to expand its holdings.

Metaplanet Anticipates That 2025 Results Will Be Minimally Affected

The Japanese investment company anticipates that the issuance will have a negligible effect on its 2025 financial results; however, it will provide additional information if necessary.

Metaplanet’s expansion into Bitcoin underscores a burgeoning trend among organizations seeking alternatives to fiat-based treasury strategies.

The acquisition of 1,004 Bitcoin, which is valued at over $100 million, is the second-largest BTC acquisition by Metaplanet.

This increased the company’s Bitcoin holdings to 7,800 BTC, which is valued at over $800 million.

Metaplanet has experienced a nearly 20% increase in its Bitcoin investments, per BitcoinTreasuries.NET.

The Japanese investment company’s stock price has also been bolstered by its Bitcoin strategy.

On May 27, 10x Research reported that Metaplanet’s stock is traded at a price five times its actual value due to the cost of its Bitcoin.

The research company stated that investors in the company are “dramatically overpaying for their Bitcoin exposure.”

Bitcoin Treasury Strategy Has Been Subject Of Criticism

Jim Chanos, a renowned investor, has expressed his disapproval of obtaining Bitcoin exposure through corporate containers as the stock prices of Bitcoin treasury companies have increased.

Chanos disclosed his intention to dispose of Strategy stock to acquire Bitcoin at the Sohn Investment Conference in New York.

Chanos’ action is predicated on assuming investors overpay for BTC exposure through Strategy and other entities.

Strategy adheres to the blueprint.

The investor’s decision is predicated on the assumption that purchasing Bitcoin directly would be more profitable than buying equities to gain indirect exposure to Bitcoin.