Meta’s refusal to adopt Bitcoin signals ongoing skepticism among Big Tech firms toward crypto, despite rising institutional interest and market momentum.

According to Butterfill of CoinShares, a strong argument exists for keeping Bitcoin on a company’s balance sheet, and “the pace of adoption is accelerating.”

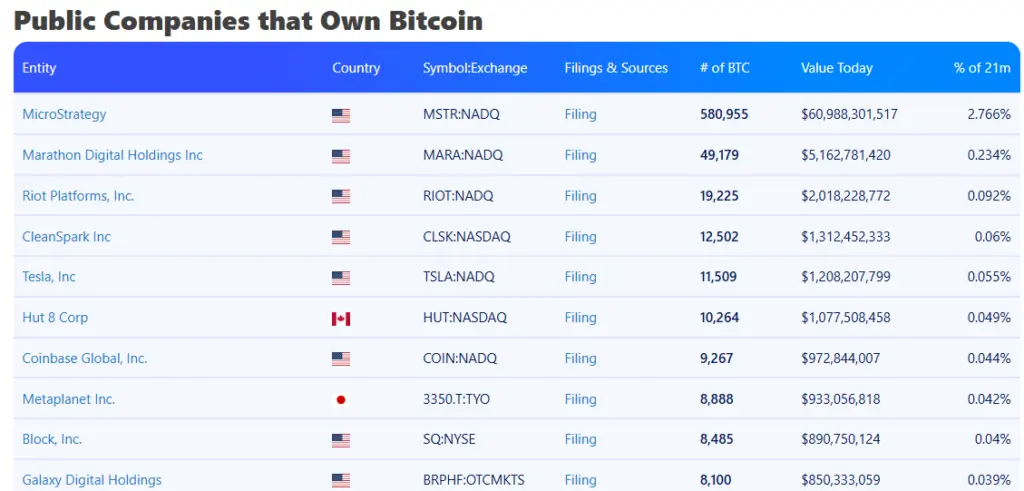

Not many significant software companies have adopted Bitcoin as their primary treasury reserve asset since Strategy, the first publicly traded business to do so in August 2020.

Corporations hold treasury reserves, sometimes cash reserves, to cover immediate or unexpected expenses. Usually, these are cash or cash equivalents, such as US Treasury bills with a maturity of three months or money market funds.

The social networking behemoth Meta has a stockpile of $72 billion in liquid assets. However, at its May 28 annual meeting, shareholders rejected a plan to determine whether BTC ($108,754) may be used as a future treasury reserve asset. There was a 1,221 to 1 vote against the proposition.

That rejection isn’t all that shocking. While corporate Bitcoin usage is increasing, Big Tech and most mainstream firms are still wary. In December 2024, Microsoft, a major US IT company, rejected similar plans.

Institutional readiness to embrace cryptocurrency is called into question by Meta’s failed BTC proposal, which was rejected by a resounding majority.

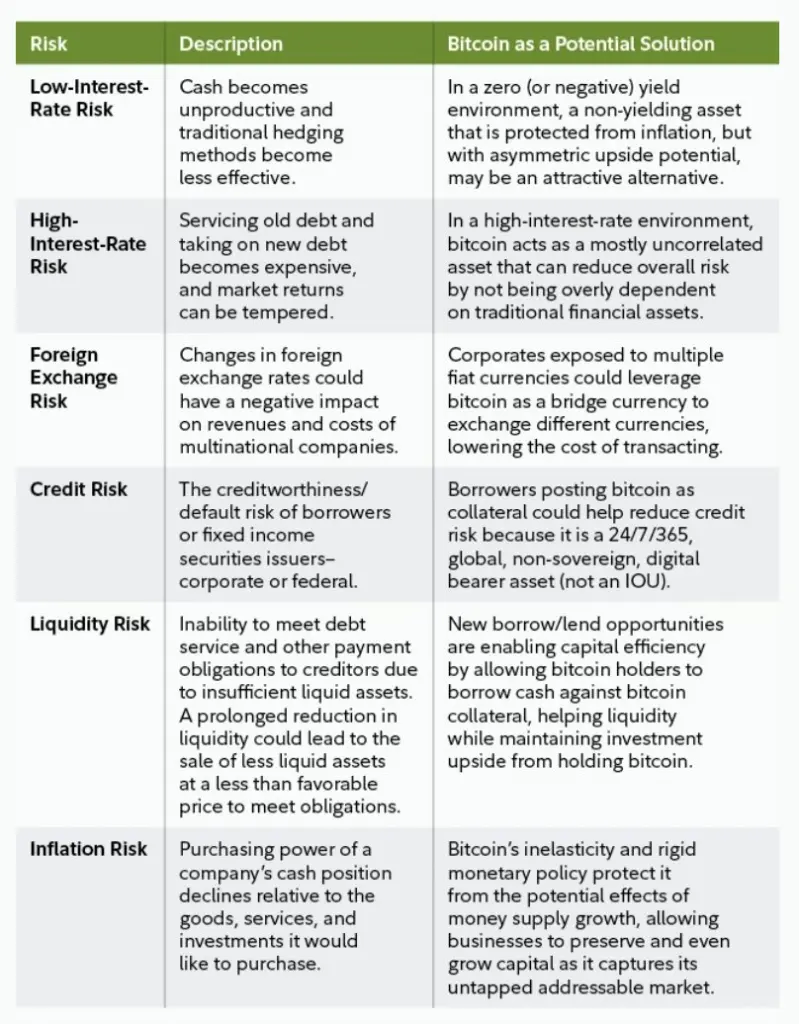

Bitcoin’s treasury asset rationale is weakened by its volatility.

All of this could be miscommunication. According to Aswath Damodaran, a professor at New York University, cryptocurrency partisans might not have understood that corporate treasuries are more like emergency funds, meant to be used in the event of pandemics or natural disasters or to support regular business operations rather than as a platform for speculative investing.

He said, “I think it is lunacy” about the latest Meta proposal made by Bitcoin supporter Ethan Peck. “I couldn’t think of a semblance of a reason for why this is a good idea,” Damodaran remarked.

Damodaran is known for being skeptical about crypto. But even a professor of finance at Duke University.

Campbell Harvey, who is generally optimistic about the future of blockchain technology and has written a book on decentralized finance, dismissed the BTC treasury proposal, stating:

“If Meta investors want to own Bitcoin, they can buy it themselves. It is not clear what role cryptos play in any treasury function unless the company is doing business in a crypto like Bitcoin.”

Harvey compared BTC to a volatile instrument that isn’t appropriate for corporate reserves, saying that stablecoins qualify as treasury reserves because they are usually liquid and correlated with an underlying asset, like the US dollar.

Harvey said other businesses have been motivated to follow Strategy’s successful Bitcoin model. Since the IT company designated BTC its principal reserve asset, Strategy’s MSTR stock has increased by 2,466%, outpacing firms like Microsoft, Nvidia, Tesla, and Google.

Harvey added, “But Strategy has bet the company on transforming itself into an active BTC fund.”

“If a company wants to make a strategic investment in Bitcoin just like they might make a strategic investment in a startup, I have no problem with that. It is a risky venture investment, and companies do this all the time. Just don’t call this a treasury asset.”

Even still, the Metas of the world frequently have billions of dollars in cash reserves, often left with minimal interest. That’s practically a sin for seasoned investors.

David Tawil, president and co-founder of ProChain Capital, said, “Meta is sitting with billions of dollars in cash all the time.” “They always have money on hand.” They would be better off investing a portion of their money in Bitcoin to protect themselves from an inflated dollar and diversify their holdings.

A 3% Bitcoin allocation can quadruple a fund’s Sharpe ratio, a metric used to evaluate risk-adjusted performance, according to James Butterfill, head of research at digital asset investing firm CoinShares, who spoke to Cointelegraph.

According to CoinShares’ survey, which monitors $1 trillion in assets under management (AUM), the average allocation to digital assets increased from 1% in October 2024 to 1.8% in April 2025. “The adoption rate is increasing more quickly than we expected,” Butterfill continued.

An indication of a more circumspect approach to Bitcoin

Regarding Bitcoin, mainstream corporate and institutional investors may be more cautious, which could be reflected in Meta’s shareholder vote. However, Meta’s voting power is dominated by CEO Mark Zuckerberg, so this isn’t necessarily a representative sample of business America.

“It’s not surprising that we’re seeing firms—including tech firms—take differing positions on the ‘none-some-lots’ spectrum when it comes to Bitcoin,” stated Stefan Padfield, executive director of the Free Enterprise Project at the National Center for Public Policy Research, who said that corporate boards and managers are probably as split on the cryptocurrency as economists and politicians.

There may be more to this than first appears. Padfield also said:

“While the proposal is merely requesting consideration of Bitcoin, it may still be rejected simply because managers and investors don’t want to be told what to do in this space.”

Meanwhile, some of the most prominent asset managers worldwide, including BlackRock and Fidelity, have become more interested in cryptocurrency. For diversity, BlackRock has advised investors to consider holding up to 2% of their portfolio in Bitcoin.

Globally, Bitcoin treasury projects have been increasing. Blockchain Group, a Paris-based company, revealed on June 3 that it had increased its corporate treasury by $68 million in Bitcoin. Then, on June 4, Korea’s K Wave Media declared that it would fund $500 million as part of a “treasury strategy” to buy Bitcoin.

Although “many of these moves appear to be driven more by a desire to flatter their stock prices rather than a genuine belief in the long-term value of holding Bitcoin on the balance sheet,” Butterfill said that at least 72 new businesses had accepted Bitcoin this year. He noted that a long-term perspective is necessary for a purposeful allocation.

However, what about big businesses whose primary operations are unrelated to blockchain or cryptocurrency? According to Butterfill, Tesla is the only company in this group currently.

“Given current trends, it’s likely that we’ll eventually see a major large-cap company add Bitcoin to its balance sheet.”

But returning to Meta, the rejection ratio of 1,221:1 was relatively straightforward.

Butterfill said Meta shareholders might have overreacted to Bitcoin’s alleged volatility. “For more than two months now, Bitcoin has continuously shown lower volatility than Meta, and this trend holds across the FAANG stocks more broadly,” he stated.

“I’m always worried that people read too much into low [proxy] vote counts,” Padfield continued. In this instance, it might not be a rejection of Bitcoin per se but rather a reflection of a wish to avoid being “forced” to think about it.