Michael Saylor hints at Strategy’s next Bitcoin buy, nearing 600,000 BTC milestone, funded by $2.1B stock raise to expand its $40.6B holdings.

After seven consecutive weeks of consistent Bitcoin purchases, Strategy founder Michael Saylor has hinted at another acquisition. Saylor shared the MicroStrategy portfolio tracker, a clear signal of Strategy’s impending Bitcoin purchase announcement. The company’s Bitcoin accumulation strategy has driven a 44% rise in MSTR stock over the past three months, outperforming Gold, Tesla, and Nvidia.

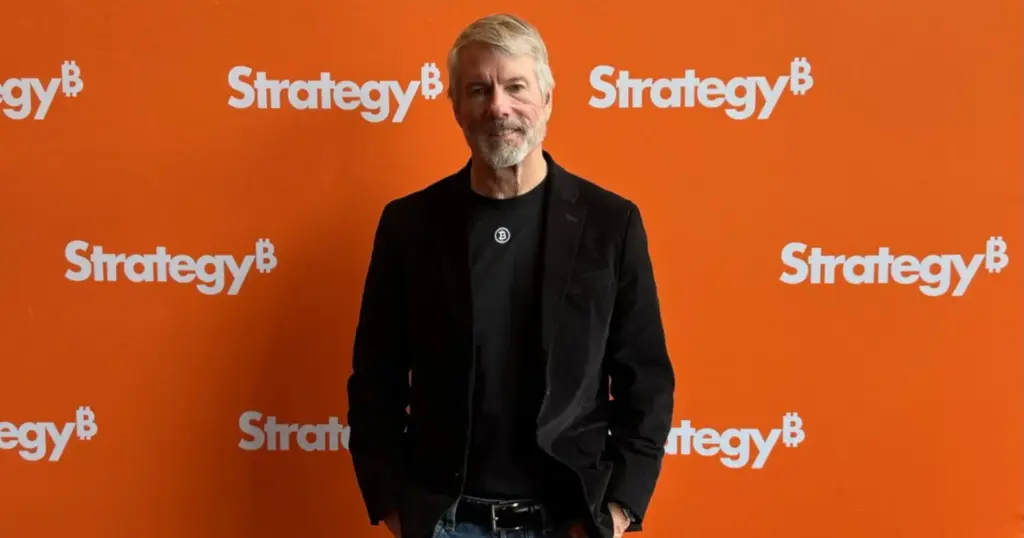

Michael Saylor Signals Strategy Bitcoin Purchase

Michael Saylor has indicated a potential Bitcoin buy by Strategy through a post on X featuring the company’s portfolio tracker. The tracker shows Strategy holding 580,250 BTC, valued at $60.69 billion at current prices.

Saylor’s habit of posting the portfolio tracker has consistently preceded Strategy’s Bitcoin acquisition announcements. Market observers see this as a strong hint of another purchase, given the pattern over the past seven weeks. Last week, Strategy acquired 4,020 BTC for $427 million, reinforcing its position as the largest corporate Bitcoin holder.

“Orange is my preferred color,” Saylor wrote in the caption accompanying the tracker post.

Saylor also highlighted MSTR’s 44% three-month return, noting that it has outpaced Tesla, Microsoft, and Nvidia shares during this period.

Strategy shows no signs of slowing its Bitcoin buying spree, recently raising $2 billion to bolster its holdings. Amid concerns over proof of reserves, Arkham uncovered Bitcoin linked to Strategy that had not been publicly disclosed.

Can a New Purchase Stem Bitcoin’s Price Drop?

With declining transaction volume, Bitcoin’s price has been sluggish over the weekend. As Strategy’s potential purchase looms, Bitcoin is trading at $104,000, down 6.79% from its all-time high of $111,970.

Despite strong institutional buying during the week from companies like Strategy, GameStop, Metaplanet, and The Blockchain Group, corporate interest waned over the weekend.

On the one-week chart, Bitcoin’s price fell 8%, and investors are hopeful that renewed institutional purchases, led by Strategy, could prevent the price from dropping below $100,000. In mid-May, a significant Strategy Bitcoin purchase helped propel BTC to a new all-time high.