Michael Saylor proposed a US crypto framework, arguing that a strategic digital asset policy could boost the dollar and address national debt.

Michael Saylor, the founder of MicroStrategy, has suggested a Digital Assets Framework for the United States.

This framework involves establishing a Bitcoin reserve, which is estimated to generate up to $81 trillion for the country’s Treasury.

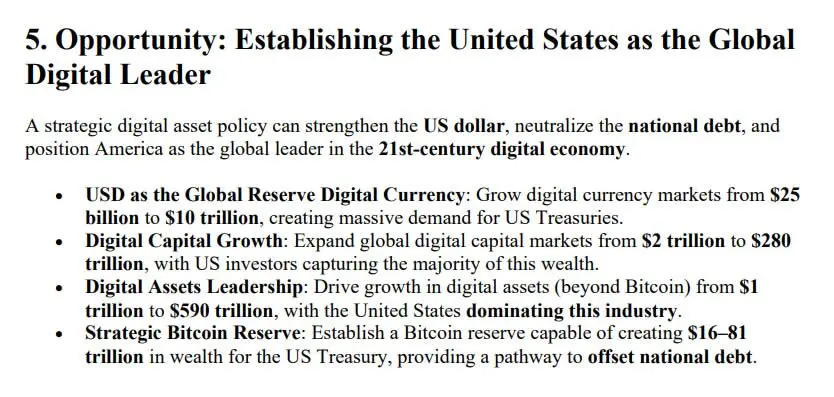

Michael Saylor stated in a Dec. 21 X post that a strategic digital asset policy has the potential to fortify the US currency, neutralize the national debt, and establish America as the global leader in the 21st-century digital economy.

Saylor’s crypto framework suggests the creation of a strategic Bitcoin reserve that has the potential to generate $16 to $81 trillion in wealth for the US Treasury, potentially offsetting national debt.

MicroStrategy’s stock price has risen this year in tandem with the cryptocurrency, which has amassed over 439,000 BTC, a sum that is presently valued at over $41 billion, under Saylor.

Additionally, he attempted to convince Microsoft to acquire Bitcoin, a proposal that was ultimately rejected by its shareholders.

Michael Saylor, the founder of MicroStrategy proposal establishes six distinct categories: digital commodities, including Bitcoin, digital securities, digital currencies, digital tokens, non-fungible tokens (NFTs), and asset-backed tokens.

The framework’s objective is to delineate the roles of issuers, exchanges, and proprietors, while also emphasizing that no participant is permitted to “lie, cheat, or steal.”

It also outlines the specific rights and responsibilities of each participant type.

It also proposes a compliance cost limit of 0.1% annually for maintenance and a maximum of 1% of assets under management for token issuance, providing a streamlined compliance approach.

“The proposal argues that digital asset regulation should prioritize efficiency and innovation over bureaucracy and friction,” it stated, while also advocating for industry-led compliance rather than direct regulatory oversight.

It also asserted that the United States has the potential to “unleash trillions of dollars in value creation by catalyzing a 21st-century capital markets renaissance.”

The objective is to significantly reduce the cost of issuance from millions to thousands and to increase market access from 4,000 public companies to 40 million businesses, with a focus on the swift issuance of assets.

Ultimately, the crypto framework is designed to assist in the establishment of the US dollar as the global reserve digital currency.

It also intends to increase the size of global digital capital markets from $2 trillion to $280 trillion, with the majority of this wealth being captured by US investors.

The proposal concluded that the United States can lead the global digital economy by establishing a clear taxonomy, a legitimate rights-based framework, and practical compliance obligations.

Nevertheless, Peter Schiff, a seasoned Bitcoin detractor, characterized the proposal as “complete bullshit” and subsequently stated that it would have the opposite effect.

It would exacerbate the national debt, weaken the currency, and render America a laughing stock.

According to SaylorTracker, MicroStrategy is the largest corporate holder of Bitcoin and has an aggregate portfolio profit of 54%.