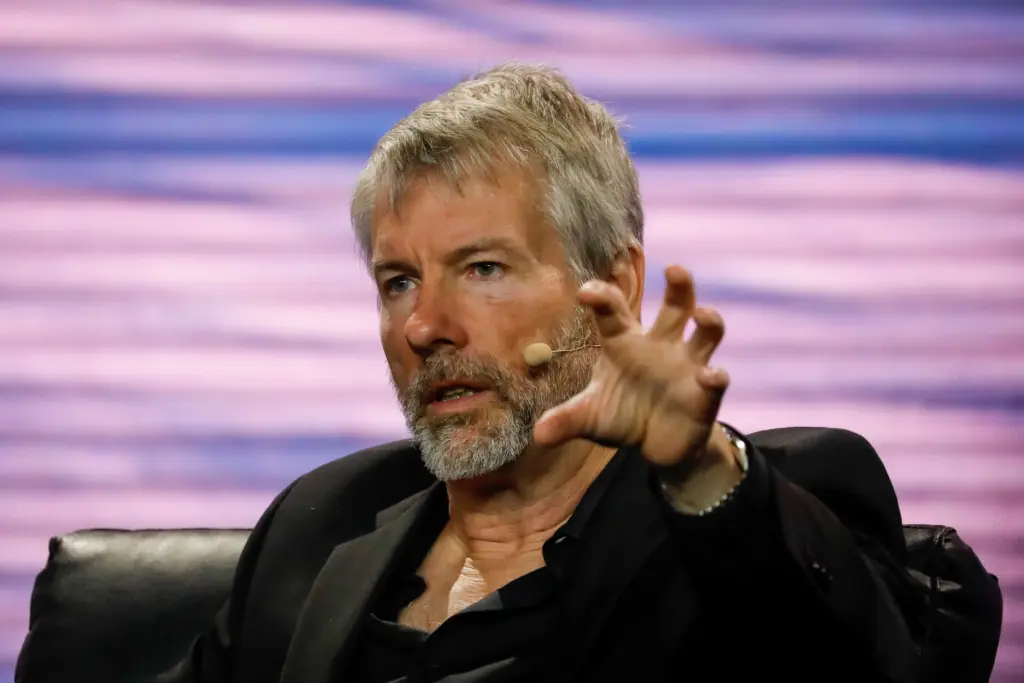

Michael Saylor disclosed a mechanism demonstrating the precise method by which the US could generate $81 trillion by establishing a Strategic Bitcoin Reserve.

For the first time, Michael Saylor disclosed an unprecedented mechanism demonstrating how the United States government could generate $81 trillion by establishing a Strategic Bitcoin Reserve.

The proponent’s proposal emphasizes a strategic digital asset policy that is designed to fortify the US dollar to neutralize national debt, establish America as a leader in the 21st-century digital economy, empower the majority of businesses, drive unparalleled economic growth, and, as a result, generate immense value.

Michael Saylor: The United States Strategic Bitcoin Reserve Has the Potential to Hold $81 Trillion

A revolutionary strategy has been unveiled by Michael Saylor, which illustrates how the United States government could generate $81 trillion by establishing a Strategic Bitcoin Reserve.

The taxonomy is a critical element of Saylor’s approach, as it defines the classes of digital assets. This classification is expected to clarify the characteristics distinguishing each asset class.

Digital commodities, such as Bitcoin, are not issued by any individual or organization and are supported by digital power, distinguishing them from digital securities backed by equity, debt, or derivative contracts.

The framework encompasses digital currencies backed by fiat, utility digital tokens, non-fungible tokens representing unique assets, and asset-backed tokens linked to physical resources such as gold or oil. These definitions will be essential for the advancement of the policy discussion and the promotion of innovation.

Saylor underscores the necessity of establishing a framework of legitimacy, which has been vigorously advocated for by Senator Cynthia Lummis. Michael Saylor posits that the framework should develop the rights and obligations of all stakeholders in the digital asset ecosystem. Issuers are accountable for the creation of assets, as well as the maintenance of ethical conduct and the provision of fair disclosure.

Exchanges shall be permitted to custody, trade, and transfer assets in a manner that guarantees transparency, safeguards client interests and prevents conflicts of interest. Owners can trade their assets and maintain self-custody, but they will still be subject to local laws. This principle is predicated on the notion that no individual should be permitted to deceive, steal, or cheat and that all players should be held accountable for their actions.

Facilitating a Capital Markets Renaissance by Simplifying Crypto Regulations

The structure should ensure that standardized disclosures are made for each asset class to promote transparency and build confidence while implementing effective, reasonable compliance measures that facilitate innovation rather than obstruct it.

Exchanges could significantly reduce issuance and maintenance costs by taking the lead in collecting and publishing data and allowing industry-led compliance. Michael Saylor advocates for removing regulators from the critical path to digital asset issuance to enable exchanges to streamline processes and minimize friction for both issuers and investors. The cost, speed, quality, and accessibility of digital assets could be significantly enhanced by implementing these measures.

Michael Saylor foresees a 21st-century capital markets renaissance propelled by digital assets. This would speed up the issuance of digital assets, allowing them to be created in days rather than months.

This could make the capital markets accessible to millions of businesses, artists, and entrepreneurs, as the issuance-related costs could decrease from tens of millions of dollars to as low as $10,000. Investors would have unparalleled access to tokenized commodities, real estate, and intellectual property, among other things, promoting more extensive involvement in the digital economy.

America’s Trillion-Dollar Opportunity: Digital Assets

Positioning the US dollar as the global reserve digital currency would be achieved through a strategic digital asset policy. The demand for US Treasuries would be immense as digital currency markets would expand from $25 billion to $10 trillion. Some individuals even believe that the currency would easily reach $500K in the event of the establishment of a Strategic Bitcoin Reserve.

The global digital capital markets have the potential to expand from $2 trillion to $280 trillion. The US investor base would capture a significant portion of this. Michael Saylor is confident that the United States market value could reach $590 trillion due to its leadership in digital assets like Bitcoin.

The proposed Strategic Bitcoin Reserve has the potential to generate $16 trillion to $81 trillion for the United States Treasury, which would serve to mitigate the national debt. This policy could strengthen the US dollar as a cornerstone of the global digital financial system and unlock trillions for American companies.

Michael Saylor’s vision is to leverage the digital asset revolution.