Michael Saylor’s Bitcoin tracker post signals Strategy’s next big BTC buy, aiming to boost its $62B holdings amid price swings.

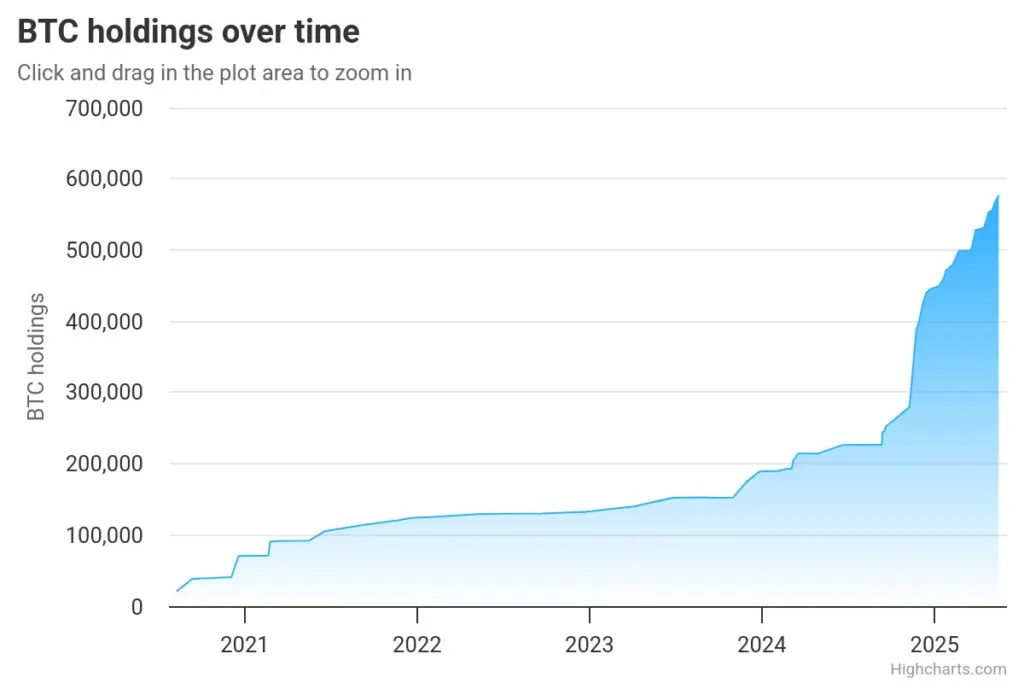

Michael Saylor has again disclosed indications of an imminent substantial Bitcoin acquisition this week. It is essential to mention that Strategy has been purchasing Bitcoin for the past six weeks and currently possesses 576,230 BTC following its most recent purchase on May 16th.

Michael Saylor Announces Another Significant Bitcoin Purchase

The strategy is preparing to maintain the consistent accumulation of Bitcoin in the upcoming week. The MicroStrategy Portfolio Tracker, the telltale indicator of an imminent Bitcoin purchase, has been displayed in an X post by the company’s outspoken founder, Michael Saylor.

Michael Saylor has previously published the portfolio tracker on the eve of each Bitcoin purchase. Investors anticipate yet another institutional acquisition as Saylor displays the tracker for the sixth time.

According to the tracker, the strategy currently possesses 576,230 BTC, which is valued at $62 billion at current prices. Strategy’s accumulation binge has not ceased, as evidenced by its acquisition of 7,390 BTC for $764 million a week ago.

There is increasing speculation that the forthcoming acquisition will be a market-moving acquisition. The post’s accompanying caption, written by Michael Saylor, suggests that a significant Bitcoin acquisition is imminent.

“I only buy bitcoin with money I can’t afford to lose,” read Saylor’s caption.

Is it possible for the upcoming strategy purchase to induce a BTC price increase?

There is increasing optimism that a new Strategy purchase will initiate a rally as Bitcoin prices remain approximately $106K. Profit-taking and macroeconomic conditions have caused prices to plummet by nearly 5% in less than a week since BTC established a new ATH.

The asset needs institutional capital inflow after a weekend propped up by retail traders, and a Michael Saylor and Strategy BTC purchase is expected to rally Bitcoin prices.

Previous Strategy purchases have triggered noticeable price movements for BTC, with retail investors keen for institutional action. Short sellers are increasing their short positions, citing dour technicals and unsavory fundamentals.

James Wynn, a high-risk crypto trader, has concluded his previous $1.2B Bitcoin long position and initiated a new short position. James Wynn had previously predicted that Bitcoin would achieve a new all-time high of $121K in the upcoming week; however, he has since reversed course.