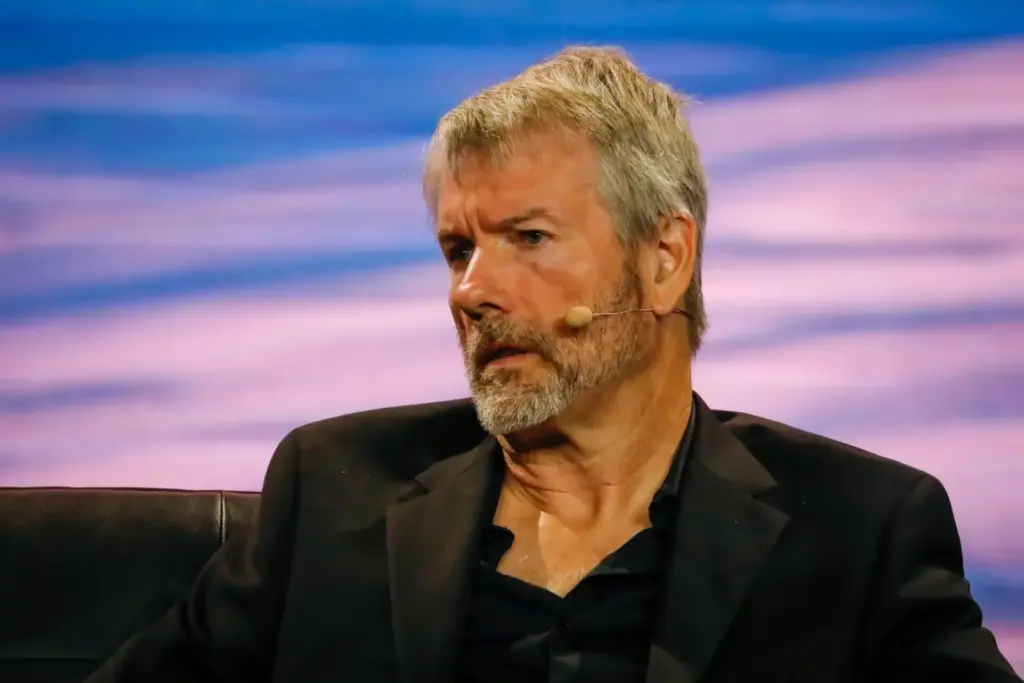

MicroStrategy co-founder Michael Saylor defended the firm’s latest Bitcoin acquisitions, emphasizing that avoiding top-price buys misses opportunities.

Michael Saylor, the co-founder of MicroStrategy, has defended the company’s recent Bitcoin purchases, contending that those who do not purchase the largest cryptocurrency at the top are squandering money.

Michael Saylor Reacts to Bitcoin Purchases

On Monday, the Virginia-based business intelligence firm disclosed its seventh consecutive weekly Bitcoin acquisition, as reported by U.Today.

It increased the value of Bitcoin by over $500 million, with an average price of nearly $107,000 per coin. Saylor has consistently been forthright about his intention to acquire Bitcoin at the peak, eschewing the notion of attempting to time the market.

During his appearance on the PBD Podcast, Saylor reiterated his prediction that the Bitcoin price would eventually go up to $13 million. “Every BTC you don’t buy is going to cost you $13 million, my friend,” he said.

Nevertheless, despite Saylor’s history of demonstrating his skepticism, some continue to be astounded by the fact that MicroStrategy’s most recent average purchase price is so close to Bitcoin’s local high

On December 17, the largest cryptocurrency reached its highest point of $108,135 before plummeting to $92,000. It experienced an intraday low of $92,441 earlier today.

Peter Schiff, a vocal Bitcoin critic, has suggested that Saylor is already running out of firepower to keep propping up Bitcoin, noting that MicroStrategy recently announced its smallest buy-in months. “Plus, not only is this your smallest buy, but the first time your average purchase price has been above the market price on the Monday you disclosed the buy,” he said.

Saylor is unlikely to be discouraged by this criticism, and MicroStrategy is currently on course to conduct a shareholder referendum to increase the number of authorized Class A shares to 10.33 billion.