MicroStrategy’s premium to Bitcoin reflects investor confidence in its management, debt-leveraging for Bitcoin, and potential for future expansion.

Over the past year, MicroStrategy (MSTR), a software intelligence company traded on the Nasdaq, has significantly outperformed Bitcoin BTC$70,204.

As of May 21, MSTR stock was trading at about $1,279 per share, having increased by nearly 500% in the last year and 150% year to date (YTD). By contrast, the price of Bitcoin increased by 166% in a year and by roughly 60% year over year.

Why does MicroStrategy perform better than Bitcoin?

Investor confidence in MicroStrategy’s management, its debt-hedging plan to buy more Bitcoin and its potential for future growth beyond the value of its Bitcoin holdings alone are reflected in the company’s premium to Bitcoin.

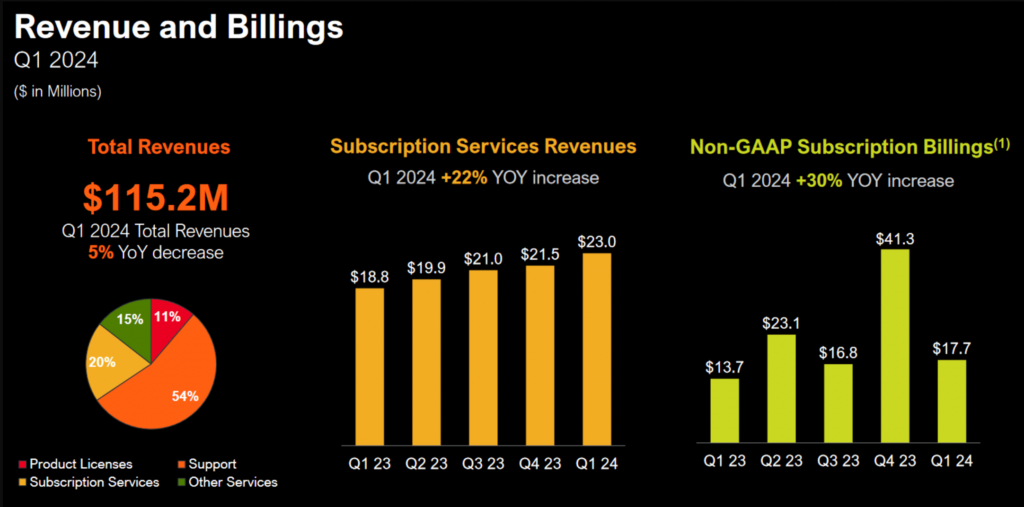

MicroStrategy reported first-quarter 2024 revenues of $115,2 million, 5.5% less than the $121.73 million analysts had predicted and less than the company’s actual revenue. The company reported a net loss of $53.1 million, or $3.09 per share, which contrasts sharply with the net gain of $461.2 million, or $31.79 per share, recorded during the same period in the previous year.

In the meantime, MicroStrategy disclosed $3.55 billion in net long-term debt, which is repayable with cash flows from its primary line of business. The company is now developing a decentralized ID solution based on Bitcoin in an apparent attempt to increase revenue in the upcoming quarters.

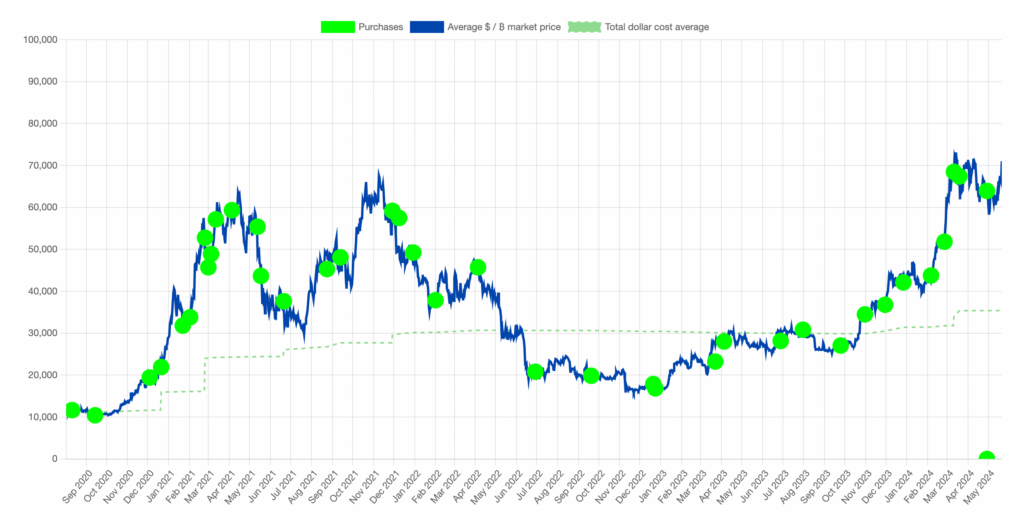

Because MSTR’s BTC per share has climbed by 50% during Q1/2021, the company is overvalued by Bitcoin.

With 11.3 million outstanding shares and 91,064 BTC in possession as of March 2021, MicroStrategy’s share price was roughly 0.008059 BTC. With 11.5 million shares in circulation and 132,500 BTC in holdings by December 2022, the company’s BTC per share climbed to approximately 0.011522.

With 17 million shares in circulation as of March 2024, MicroStrategy had 205,000 BTC or around 0.012059 BTC per share.

MSTR outperforms most equities with a crypto exposure as well.

Considering MicroStrategy’s operational business and growth potential, investors are prepared to pay more for the company’s shares than the equivalent value of Bitcoin per share.

Coinbase’s stock (COIN), which has outperformed Bitcoin over the past 12 months, reflects this belief. However, the U.S. Securities and Exchange Commission’s (SEC) ongoing litigation against MicroStrategy is the main reason for its underperformance.

Similar to how it has outperformed nearly everything since the epidemic, Tesla (TSLA) is trailing Bitcoin for the first time since 2019 (and MSTR) due to lower earnings over the last several quarters.

Furthermore, as evidenced by the returns of the Valkyrie Bitcoin Miners ETF (WGMI), which tracks mega-cap Bitcoin mining businesses, mining stocks have started underperforming Bitcoin and MicroStrategy in the last 12 months.

Is MSTR a more prudent short-term investment than Bitcoin?

Technically speaking, MSTR looks to have been on the rise toward $2,000 following a test of a support confluence made up of its 50-day exponential moving average (50-day EMA; the red wave), its 0.5 Fibonacci retracement level, and an ascending trendline support that converted into resistance.

If the Bitcoin market keeps rising, MicroStrategy’s stock might reach all-time highs, surpassing Bitcoin’s gains. This, combined with its recent premium increases relative to BTC, makes MSTR a compelling short-term gamble.

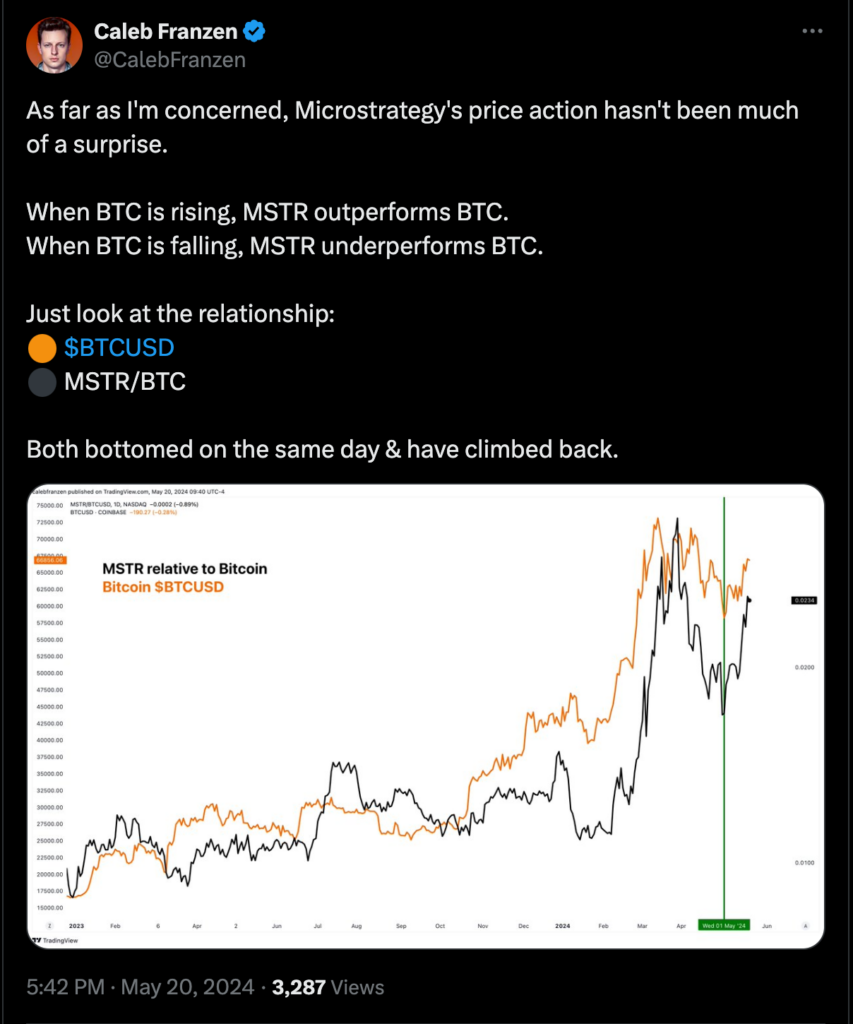

On the other hand, if the Bitcoin market declines, there may be a more extensive MSTR correction that even outpaces losses in BTC. This is due to MSTR’s recent habit of underperforming BTC during BTC/USD downturn cycles, as reported by analyst Celeb Franzen.

In the case of a decline, MSTR’s main downside objective is located around its 0.382 Fib line, currently down 25% from the stock’s current price levels, at about $1,290.