MicroStrategy will join the Nasdaq-100 on December 23, driven by a sixfold stock surge fueled by its Bitcoin investments. Analysts view this as a step toward potential S&P 500 inclusion by 2025.

MicroStrategy (MSTR.O) will be included in the Nasdaq-100 Index on December 23, following a sixfold increase in its stock price this year, which was primarily attributed to its aggressive Bitcoin investments. The inclusion of the stock is anticipated to increase its value, as ETFs that are linked to the index will acquire shares.

Investors anticipated the addition, which was disclosed subsequent to the market’s close on Friday, prior to the index’s rebalancing.

MicroStrategy Added to NASDAQ 100

The company, which is currently the largest corporate holder of Bitcoin, altered its strategy in 2020 in response to obstacles in its software business. This milestone is expected to facilitate future inclusion in the S&P 500 by 2025, according to analysts.

On December 23, MicroStrategy (MSTR.O) will be included in the Nasdaq-100 Index, which comprises 100 of the largest nonfinancial companies in the Nasdaq Composite. The inclusion will cause ETFs, such as the Invesco QQQ Trust, which oversees $325 billion in assets, to automatically acquire the stock.

Apple, Nvidia, Amazon, Tesa, Alphabet, T-Mobile, Adobe, Cisco, Intuit, and other prominent companies are among the companies included in the index.

MicroStrategy, which is frequently regarded as a Bitcoin proxy, has outperformed the cryptocurrency this year, with its shares increasing by over sixfold in contrast to Bitcoin’s 140% increase.

Bitcoin is on the brink of a new all-time high

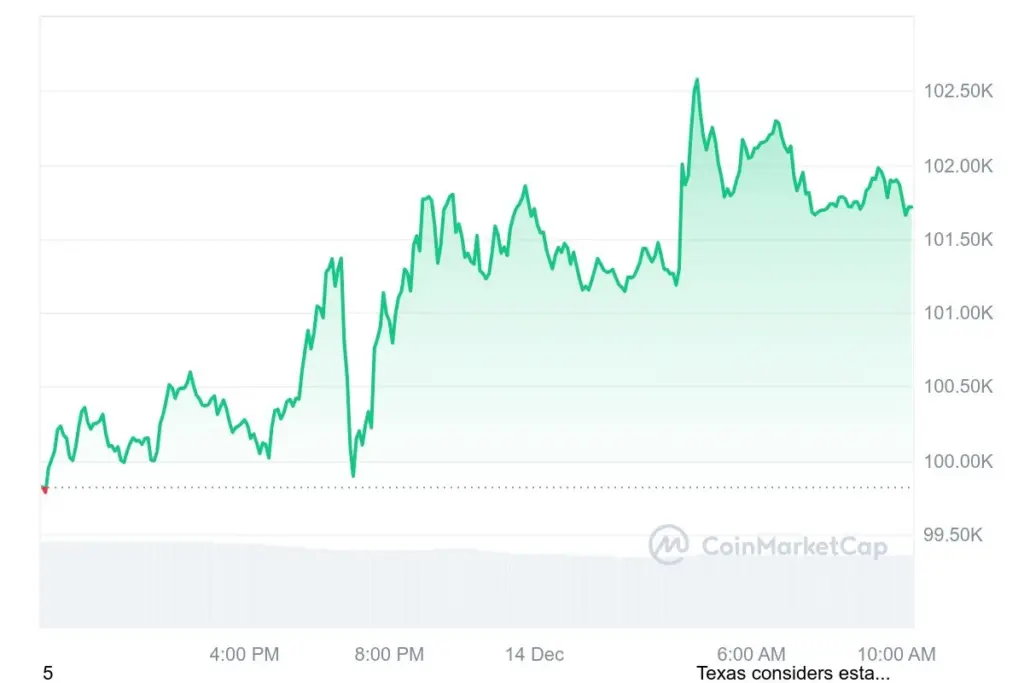

MicroStrategy’s market position has been further fortified by Bitcoin’s recent ascent beyond $100,000, which has synchronized its stock performance with the cryptocurrency’s growth. The price of Bitcoin (BTC) increased by nearly 2% on Friday, reaching $101,762.26.

The company’s total holdings have increased to 331,200 BTC, valued at $30 billion, as a result of the recent acquisition of 51,780 BTC for $4.6 billion. Although impressive, this is still less than BlackRock’s iShares Bitcoin Trust, which currently contains 471,329 BTC.

MicroStrategy’s positioning of Bitcoin as a central reserve asset and inflation hedge has served as an inspiration for other organizations, including Marathon Digital and Semler Scientific.