MicroStrategy, led by Michael Saylor, boosts Bitcoin holdings to 331,200 BTC worth $30B, surpassing US Bitcoin ETFs and reshaping corporate treasury norms.

A November 18 filing with the US Securities and Exchange Commission (SEC) revealed that Michael Saylor’s MicroStrategy had completed its most enormous Bitcoin buy, purchasing 51,780 BTC for $4.6 billion at an average acquisition price of $88,627 per coin.

The action was taken only a week after the company paid $2.03 billion for 27,200 Bitcoin. The deals raise the company’s November Bitcoin purchases to around 80,000 BTC, or more than $6.6 billion.

At an average price of $49,875 per coin, it paid $16.5 billion for these aggressive Bitcoin purchases, increasing its total holdings to 3331,200 BTC. These assets have a current value of almost $30 billion.

According to the company, its most recent acquisition increased its Bitcoin yield on the year-to-date metric to 41.8%. The corporation uses the Bitcoin yield as a crucial KPI to assess the effects of its BTC investment strategy on its shareholders.

Nevertheless, there was a slight fluctuation in the price of MicroStrategy’s stock despite the size of this acquisition. Google Finance’s pre-market trade data indicates a modest 0.23% rise.

Bitcoin ETFs vs. MicroStrategy

In the meantime, thanks to its most recent acquisition, MicroStrategy has acquired more of the leading cryptocurrency than all US spot Bitcoin exchange-traded funds this month.

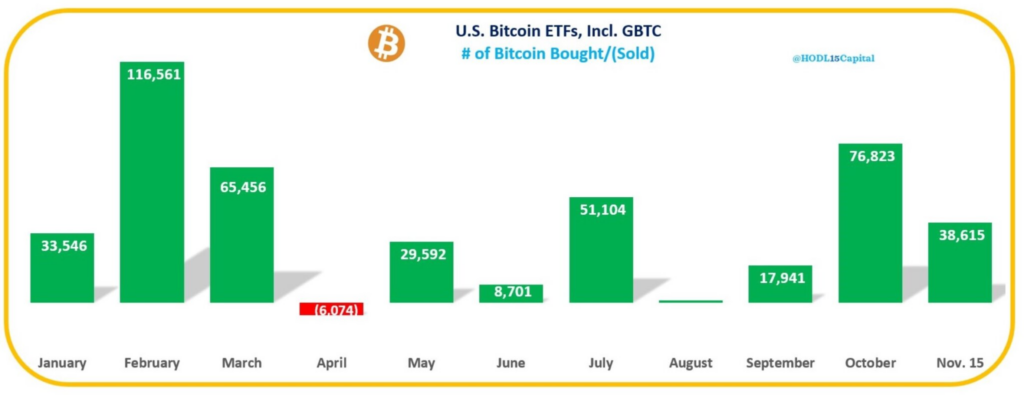

According to data gathered by HODL15Capital, as of November 15, these high-flying financial products tied to Bitcoin had gained 38,615 BTC. The most significant acquisition during this time was made by BlackRock’s IBIT, which bought over 37,000 BTC.

Unsurprisingly, MicroStrategy’s Bitcoin purchasing plan has garnered a lot of market interest as it changed the software company’s financial structure and established it as a leading proponent of adopting digital assets.

Market watchers have noted that the corporation’s corporate treasury reserve now exceeds that of all but 14 S&P 500 companies, including Alphabet, the parent company of Google, and Apple, the creator of the iPhone.