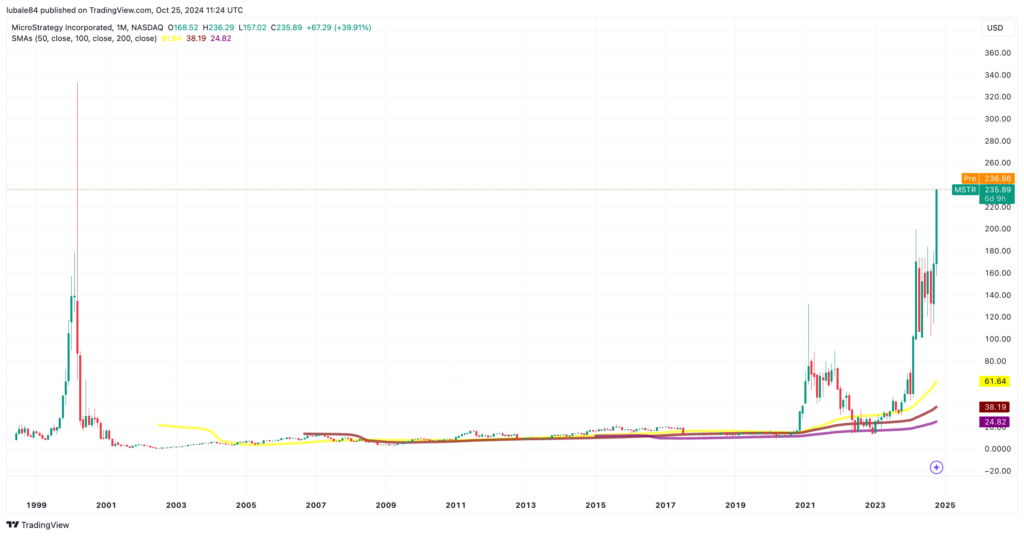

MicroStrategy’s investment in Bitcoin is yielding significant returns, as the company’s shares surged over 7% on October 25 to reach a new 25-year high of $236.

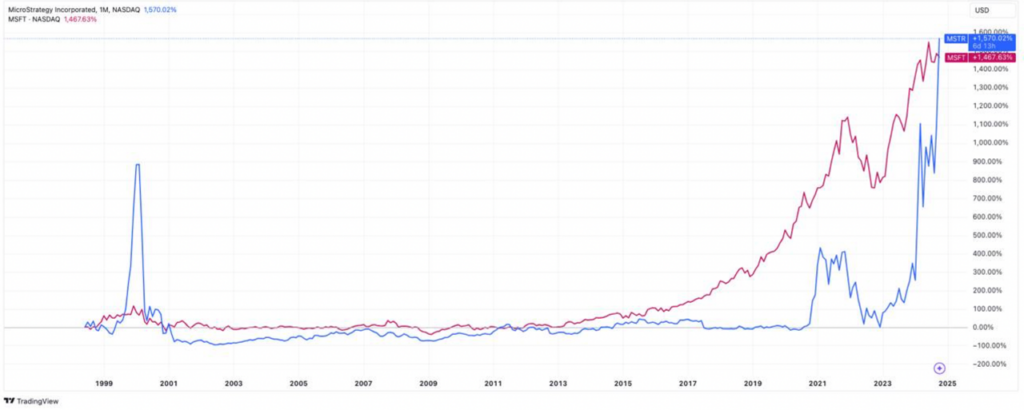

Microsoft has gained 1,460% over the same 25-year period, whereas MicroStrategy has increased by more than 1,500% since 1999.

As the tech giant prepares to vote on a proposal to review adding Bitcoin BTC$68,239 to its balance sheet publicly, the world’s largest corporate Bitcoin holder has seen its stake overtake Microsoft’s, continuing a six-week surge.

Crypto Coin Coach wrote on X, “MicroStrategy is soaring to a new all-time high!” in reaction to the software company’s share price movement on October 24.

“Crushing every company without Bitcoin on their balance sheet.”

Microsoft is surpassed in gains by MicroStrategy’s stock.

Because of its Bitcoin holdings, MicroStrategy’s stock has outperformed all of the companies in the S&P 500 index over the last five years, boosting market expectations for further strong momentum.

The figure below illustrates how the software company’s stock has surpassed Microsoft’s all-time performance in the most recent rise.

Since 1999, MicroStrategy has outperformed Microsoft, with its share rising by almost 1,570% since going public on the Nasdaq, while MSFT has increased by 1,467% in their respective US dollar pairs.

MicroStrategy’s recent success is its Bitcoin purchasing strategy, which has made it the world’s largest corporate Bitcoin holder. In 2020, when earnings from its software business dwindled, the company run by Michael Saylor started purchasing and keeping Bitcoin.

Between September 13 and September 19, the corporation made its most recent acquisition, purchasing about 7,420 Bitcoin for about $458.2 million in cash. This brings its total holdings to 252,220 Bitcoin, valued at almost $17 billion.

This amounts to more than one percent of the total amount of Bitcoin that will ever be mined.

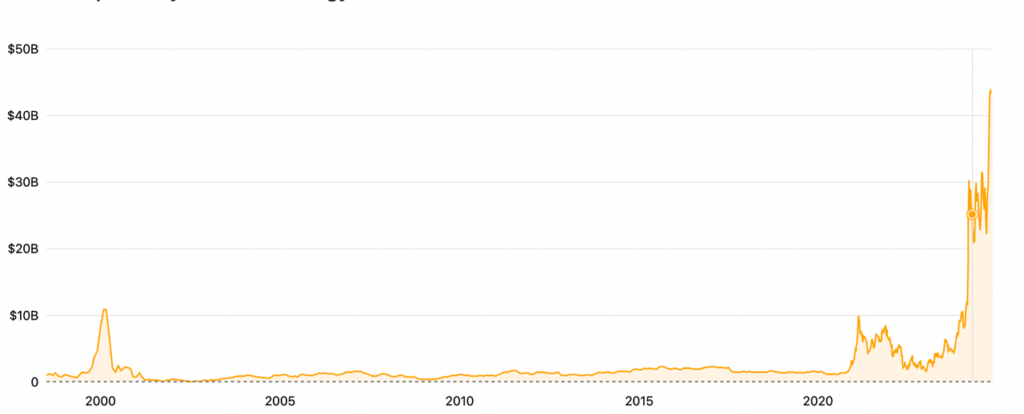

Moving near a $50 billion market cap, MSTR

The market value of MicroStrategy is increasing due to its skyrocketing stock, which indicates increased investor enthusiasm.

According to Companies Market Cap statistics, MicroStrategy is now the 477th most valuable company in the world by market value after the most recent rise saw the stock’s market capitalization hit $43.35 billion. The market capitalization of $50 billion is just 8% away from this.

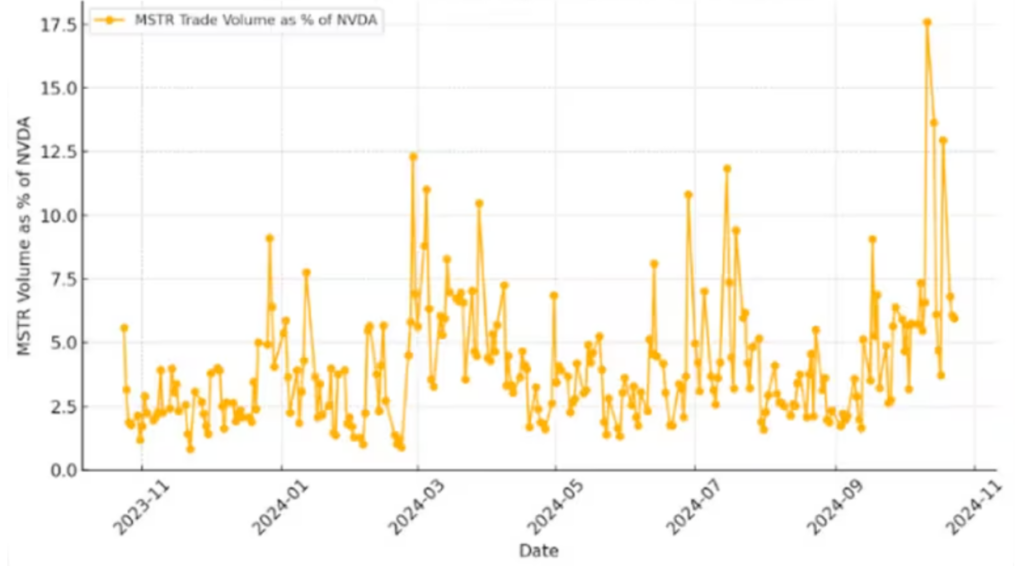

In contrast to Nvidia, MSTR’s trading volume has increased throughout 2024, peaking in October at 17.65% of NVDA’s volume. According to data from Investing.com, this was accomplished on October 11 when MicroStrategy witnessed a trading volume of 30 million compared to NVD’s 170 million.

According to data from the MSTR tracker, MicroStrategy’s net asset value (NAV) has also increased once more as the price of Bitcoin has been over $68,000. This has brought the NAV premium to nearly 3, the highest level since early 2021.

A price rise, rising market value, and trading volumes may be signs of a sustained upward trend for MicroStrategy’s stock in the months and years to come.