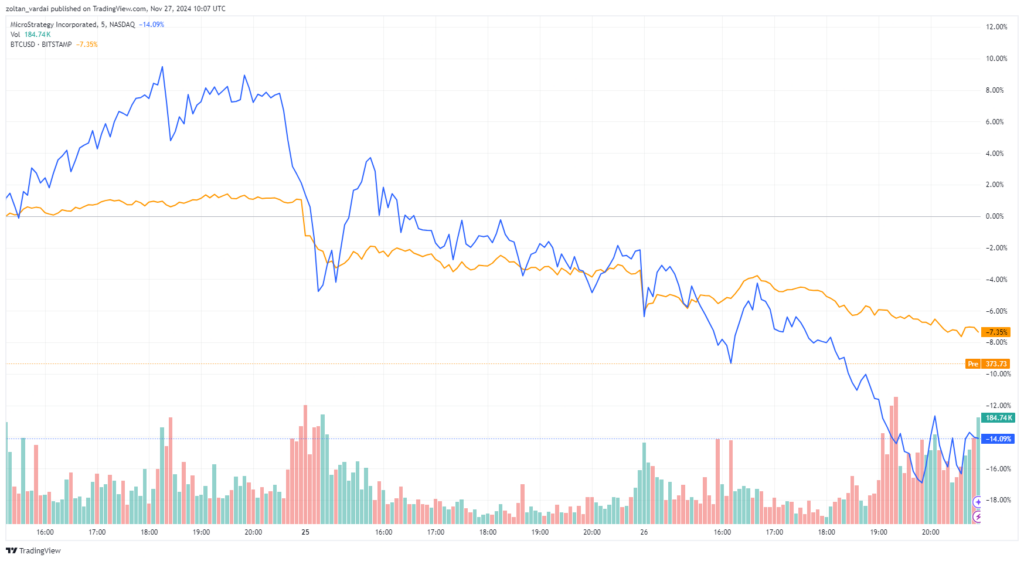

Over the past year, Bitcoin climbed 146% while MicroStrategy surged 599%, with retail investment amplifying MicroStrategy’s volatility compared to BTC.

The market capitalization of MicroStrategy had the biggest four-day decline in its history, raising concerns about its suitability as a leveraged Bitcoin investment vehicle.

Over $30 billion was erased as the company’s market value dropped more than 35% from its peak on November 21.

The Kobeissi Letter, which emphasized the drop in a Nov. 26 X post, said that this was the largest four-day decline in the history of the business intelligence firm:

“MicroStrategy stock, MSTR, just fell a MASSIVE -35% from its peak seen on November 21st. That’s ~$30 BILLION of market cap erased in 4 trading days.”

The price of MicroStrategy’s shares fell along with this week’s Bitcoin correction, but it has since marginally increased.

According to TradingView data, MicroStrategy’s price dropped 7.5% in 24 hours, reaching $354.10 at 9:52 a.m. UTC on November 27.

Is MicroStrategy Still Trading Bitcoin With Leverage?

The stock fell in tandem with the correction of Bitcoin, which had peaked on November 22 at about $99,800.

However, over a longer period, MicroStrategy and Bitcoin have shown strong growth.

Over the previous month, MicroStrategy has increased by more than 32%, while Bitcoin has increased by 44%.

On the annual chart, MicroStrategy has increased by almost 599%, while Bitcoin has increased by 146%.

Many investors are considering MicroStrategy as a leveraged wager on the price of Bitcoin, which is predicted to beat the returns of the original cryptocurrency.

However, MicroStrategy’s recent 35% decline, which is more than four times Bitcoin’s correction, raises questions regarding the stock’s volatility as a stand-in for Bitcoin.

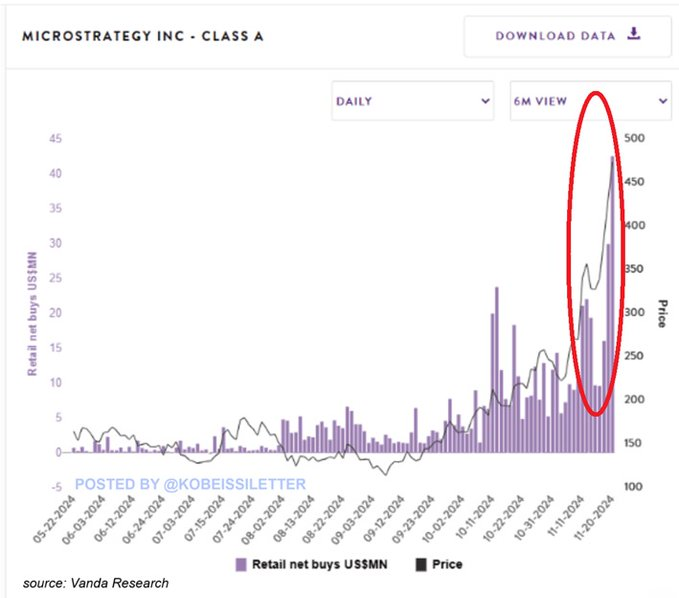

Volatility Of Microstrategies Brought On By Individual Investors

The Kobeissi letter stated that the increasing number of retail traders is the cause of this rising volatility.

“On Wednesday alone last week, retail investors bought ~$42 million worth of MicroStrategy stock, $MSTR. This marked the largest daily retail buy on record and was 8 TIMES higher than the daily average seen in October.”

Over the course of the last week, retail investors purchased almost $100 million worth of MicroStrategy stock, with the company’s $2.6 billion note issuance contributing to the increase in demand.

Several of the biggest traditional institutions in the world are investing in Michael Saylor’s business.

In March, Allianz, the second-biggest insurance company in Europe, purchased more than 24 percent of MicroStrategy’s $600 million note offering.