MicroStrategy plans to raise $1.75B via 0% senior convertible notes, avoiding interest payments, to boost its Bitcoin holdings.

The biggest corporate Bitcoin owner, MicroStrategy, plans to raise $1.75 billion to purchase additional Bitcoin via senior convertible notes at zero percent interest.

In a statement released on November 18, MicroStrategy stated that the company “intends to use the net proceeds from this offering to acquire additional bitcoin and for general corporate purposes.”

Bondholders will not receive monthly interest payments from the business intelligence provider because of its 0% senior convertible note.

These convertibles are offered at a discount, and if they are not converted before the maturity date, which in MicroStrategy’s case is 2029, they will mature to face value.

Additionally, they are “senior” to common stock in that holders are given priority in the case of liquidation or bankruptcy.

If MicroStrategy were to invest the full $1.75 billion in Bitcoin, it could purchase an additional 19,065 Bitcoin at the present price.

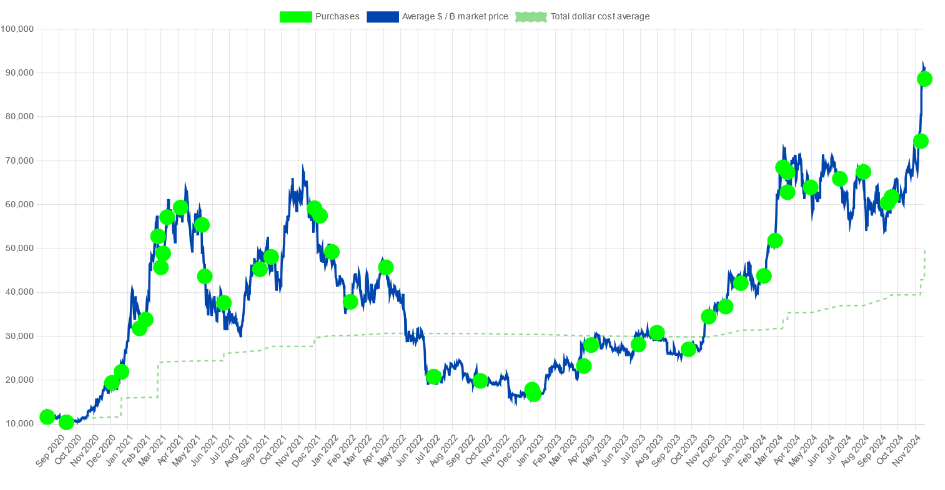

After purchasing an additional $4.6 billion worth of Bitcoin on November 18, Bitcoin Treasuries data indicates that it presently possesses 331,200 Bitcoin, valued at approximately $30.3 billion.

With an average purchase price of $39,292, Michael Saylor’s company has already made 133% on its Bitcoin investment plan.

According to Google Finance statistics, shares of MSTR rose by almost 13% to reach a new closing high of $374.8 on November 18, but they have since dropped by 0.7% after hours.

To stack more Bitcoin under its “21/21” plan, MicroStrategy said last month that it will raise $42 billion over the next three years, which would be divided between $21 billion in equities and $21 billion in fixed-income securities.

According to CoinGecko data, the price of Bitcoin is currently $91,653, which is less than 2% below its peak of $93,477 on November 13.