In Q2 of this year, MicroStrategy acquired an additional 12,222 Bitcoin for $805 million, bringing its total holdings to 226,500 BTC, valued at $14.7 billion.

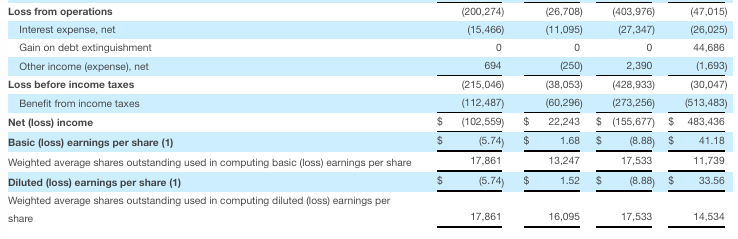

MicroStrategy had a net loss of $123 million in the second quarter, and its stock only went up 1% after the market closed.

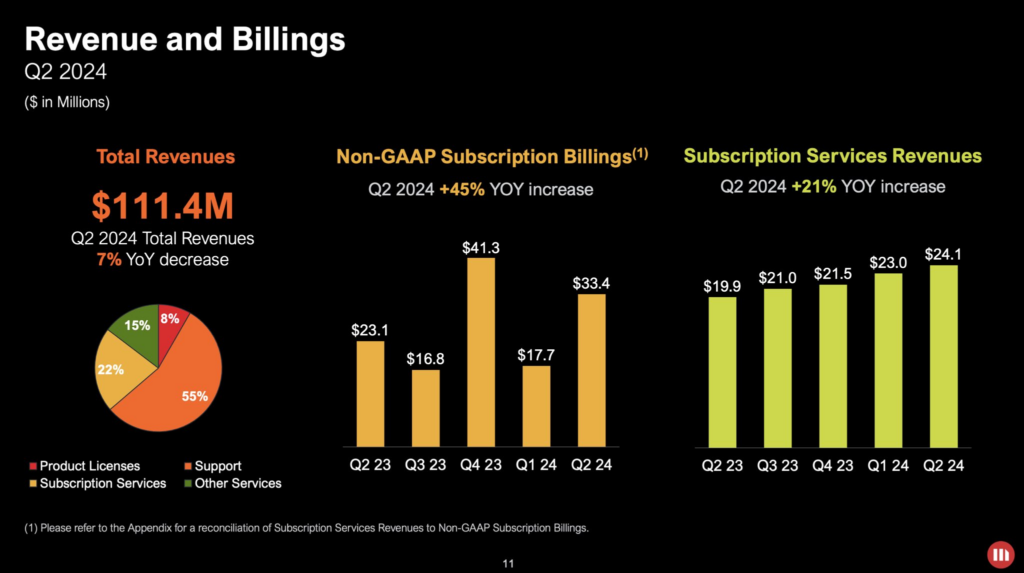

MicroStrategy reported significant losses of $5.74 per share on its Q2 earnings call. The company made $111.4 million in sales, which is 7% less than the same time last year.

Sources surveyed by Bloomberg say that analysts were expecting a loss of $0.78 per share and sales of $119.3 million for the quarter.

The company reported a net loss of $123 million for Q2, a little less than the $137 million it lost in the same quarter last year.

The company said the 226,500 Bitcoins it owned had been bought for $8.5 billion, about $36,821 each.

It also introduced a new KPI called “Bitcoin Yield.” This shows the percentage change over time in the ratio between the company’s Bitcoin ownership and its diluted outstanding shares.

The company’s common stocks and any extra shares made from convertible notes or taking stock options are counted as diluted shares outstanding.

MicroStrategy said that its Bitcoin return for the year so far was 12.2%. It said its goal for the next three years is to have a rate of between 4% and 8% per year.

As a key performance indicator (KPI), the company uses BTC Yield to measure how well its plan of buying bitcoin in a way that the company thinks is good for shareholders is working, the company said in a statement.

The company also confirmed that the 10:1 stock split first mentioned on July 11 would happen on August 7.

More buying of Bitcoin is coming up?

MicroStrategy said it would file a registration form for a $2 billion at-the-market stock offering to get more money. However, it did not say what the money would be used for.

Throughout its history, MicroStrategy has raised money intending to buy more Bitcoin.

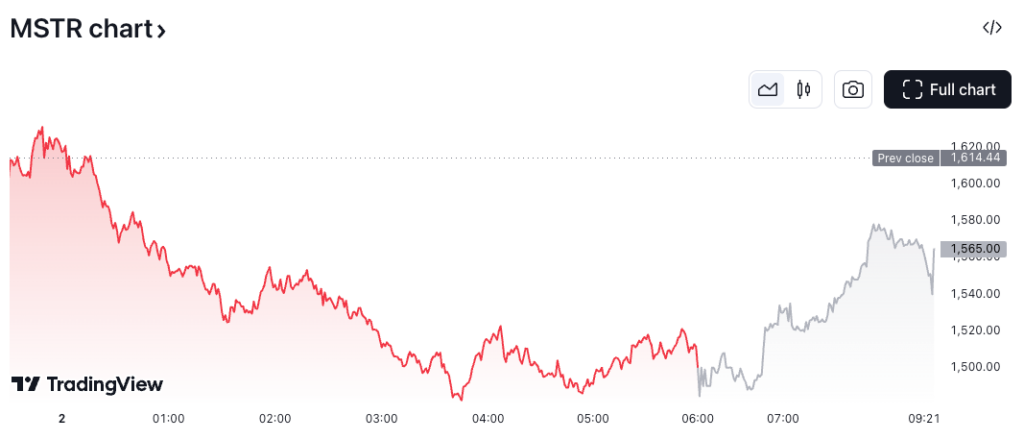

MicroStrategy stock is now worth $1,500, down 6% from yesterday. TradingView data shows that after the company reported its Q2 earnings, its share price increased 1.1% in after-hours trade.