MoonPay Balance will enable deposits and withdrawals in euros and British pounds, with plans to expand to the US in the future.

By launching a new payment system that enables users to keep and spend fiat balances, cryptocurrency infrastructure company MoonPay is taking steps to enhance self-custodial spending.

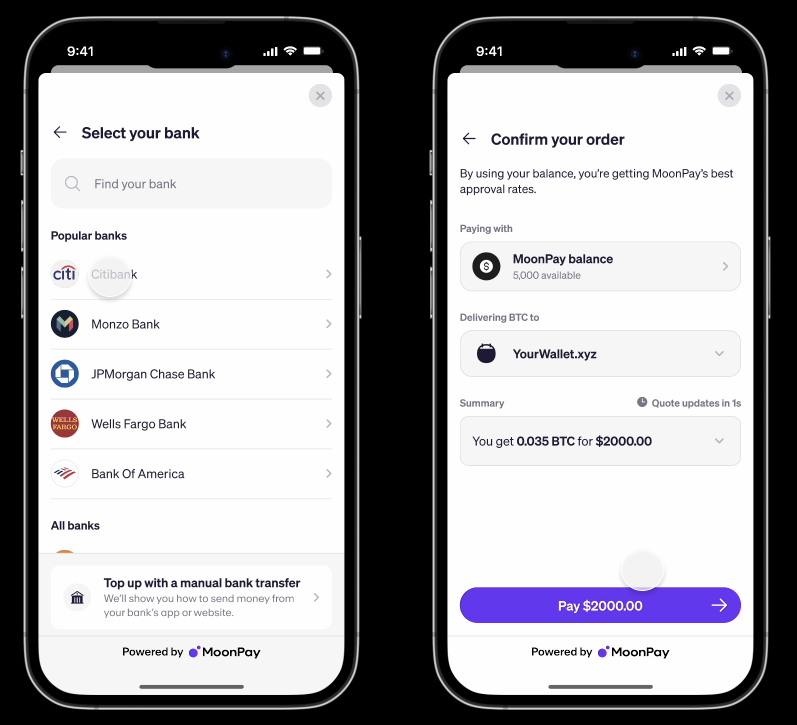

MoonPay Balance, a new payment solution that allows users to hold and spend fiat balances on MoonPay and use it as a gateway to engage with decentralized finance (DeFi), was formally unveiled on November 13 by MoonPay.

According to a statement provided to Cointelegraph, MoonPay’s direct integration with non-custodial or self-custodial wallets such as MetaMask, Phantom, and Bitcoin.com enables users to spend balances.

At launch, SEPA, Faster Payments, Open Banking Are Supported

Except for Germany, MoonPay Balance will first be accessible throughout the UK and the majority of European nations.

The UK, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, and Sweden are among the 27 nations that are included in the full list of supported jurisdictions.

Upon launch, the new payment system supports a variety of payment mechanisms, including Open Banking, Faster Payments, and Single Euro Payments Area (SEPA) payments.

According to a MoonPay representative who talked to Cointelegraph, “MoonPay is actively working to expand payment options, with ACH coming soon for US users.”

According to the spokesman, customers can still convert their cryptocurrency into euros or British pounds and utilize the money they receive to top up their MoonPay balances even though they are unable to do it with cryptocurrency.

While its partners “may charge ecosystem fees depending on the specific transaction or service,” MoonPay stated that it will not charge any costs for deposits, withdrawals, purchases, or sales.

Crypto Wallets That Are Not Primary Bank Accounts Custodial

By introducing MoonPay Balance, MoonPay made a substantial contribution to the acceptance of self-custody—a technique for keeping cryptocurrencies like Bitcoin separate from all other parties to save the owner.

Ivan Soto-Wright, co-founder and CEO of MoonPay, stated that consumers should anticipate their non-custodial cryptocurrency wallets to function as their main bank accounts in the future.

He added that MoonPay Balance allows users to manage their cryptocurrency in non-custodial wallets, filling a significant vacuum in the decentralized ecosystem.

“At MoonPay, we believe users should have complete control over their digital assets, while enjoying an experience that matches or exceeds the standards set by traditional fintech applications.”

The most recent spending solution from MoonPay comes after a number of connections with significant traditional financial companies, such as PayPal.

MoonPay integrated fiat PayPal on-ramps for users in the UK and the EU in July 2024. A comparable PayPal service was already made available in the US by MoonPay in May 2024.