Ribbit Capital, which invests in Revolut, NuBank, Coinbase, Robinhood, Mercado Libre, Figure, and Uniswap, has contributed $50 million to Morpho Labs.

Morpho Labs, a decentralized finance protocol, has recently raised $50 million in funding due to a business overhaul.

Ribbit Capital spearheaded the round, which a16z Crypto, Coinbase Ventures, Variant, Pantera Capital, Kraken Ventures, and other investors attended. Morpho Labs had previously secured $23.6 million in funding through various rounds, including a $18 million Series B funding round with Variant and a16z in 2022.

The funds will be utilized to provide support for Morpho Blue, a recently introduced permissionless lending protocol. This protocol enables entities to establish and operate their markets without needing prior sanction from any central authority.

The solution also provides vaults that can be customized to meet specific risk management parameters.

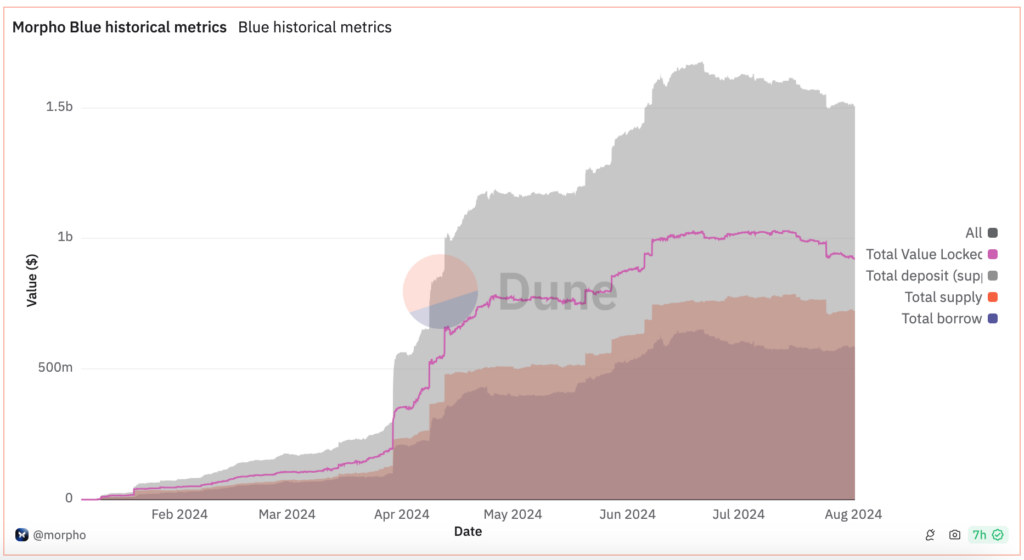

Dune Analytics data indicates that Morpho Blue has received deposits exceeding $1.5 billion since its launch nearly six months ago.

In 2022, the Morpho Optimizer, an optimization layer that sits on top of Aave and Compound, was introduced to the protocol with the intention of maximizing interest rates for users.

Since then, Morpho has evolved from a single application to a collection of protocols designed to operate on a shared base layer and resolve the fragmentation within the Ethereum ecosystem.

As of August 1, the protocol has borrowed over $1.07 billion, resulting in fees of over $27.3 million, as per data from DefiLlama. It can currently support nearly 160 pools, with an average yield of 4.77%.

Paul Frambot, CEO and co-founder of Morpho, stated, “Our objective is to establish and sustain the infrastructure that serves as the foundation for a financial system that is truly global, internet-native, and free of opinion.”

The restoration of liquidity to crypto markets following the introduction of Bitcoin exchange-traded funds in the United States has resulted in a surge in activity for DeFi protocols in 2024. At the time of this writing, the total value of the on-chain across protocols is $96.1 billion.