MSTR stock fell 7% to $336 on Tuesday after Michael Saylor eased the mNAV policy, allowing stock issuance below 2.5x to fund Bitcoin purchases.

Strategy stock plummeted by 7% on August 19, following Michael Saylor’s announcement of plans for additional MSTR equity dilution, representing a reversal of the company’s mNAV policy. The MSTR stock price closed at $336 on Tuesday, marking a four-month low. Saylor’s abrupt policy modifications have prompted numerous company supporters to liquidate their stock positions.

Michael Saylor Experiences Opposition Regarding MSTR Stock Dilution Plan

The mNAV for MSTR stock has plummeted from 3.63x in November 2024 to 1.6x in response to the recent underperformance of Strategy shares on Wall Street. Michael Saylor, the company’s executive chairman, has been subjected to significant criticism for his decision to reverse course on the prohibition of stock dilution below the 2.5x mNAV. Saylor defended the decision, saying that Strategy is experiencing difficulty obtaining additional capital to fund additional Bitcoin acquisitions.

Josh Mandell, a prominent figure on the X and Reddit platforms and an investor in MSTR stock, sold his shares after Saylor failed to fulfill his equity dilution commitment. Mandell branded Michael Saylor a “liar” and accused him of violating his previous agreement not to dilute MicroStrategy’s stock by 1 to 2.5 times, except for funding interest and dividend payments. Mandell issued a forceful missive on the X platform:

“Please stop asking me if or why I sold $MSTR at 1.5 mNAV. You just don’t seem to get it. I actually bought above here and then Saylor sold. He said they wouldn’t … and then he did. I am announcing that I will not speak in support of anything that man does again”.

David Joel Katz Schwartz, the Chief Technology Officer of Ripple, has also joined the chorus of critics and has cautioned investors holding MSTR stock if Bitcoin experiences an additional decline. He also criticized the company’s purported efforts to intimidate individuals who express negative opinions regarding Michael Saylor’s intentions to acquire additional Bitcoin.

Additional Strategy supporters have joined Mandell in response to the most recent departure. Additionally, they have criticized Saylor for his dishonesty regarding the stock dilution plans. Conversely, Strategy employees are also expressing dissatisfaction with the Glassdoor platform. The position was described as “extremely disappointing” by a Strategy employee on Glassdoor, and the experience was “demoralizing” by an account executive. Amid the recent stock underperformance, asset manager Vanguard reduced its stake in Strategy by 10% during the second quarter.

According to an analyst, the next objective for Strategy Stock is to reach $300

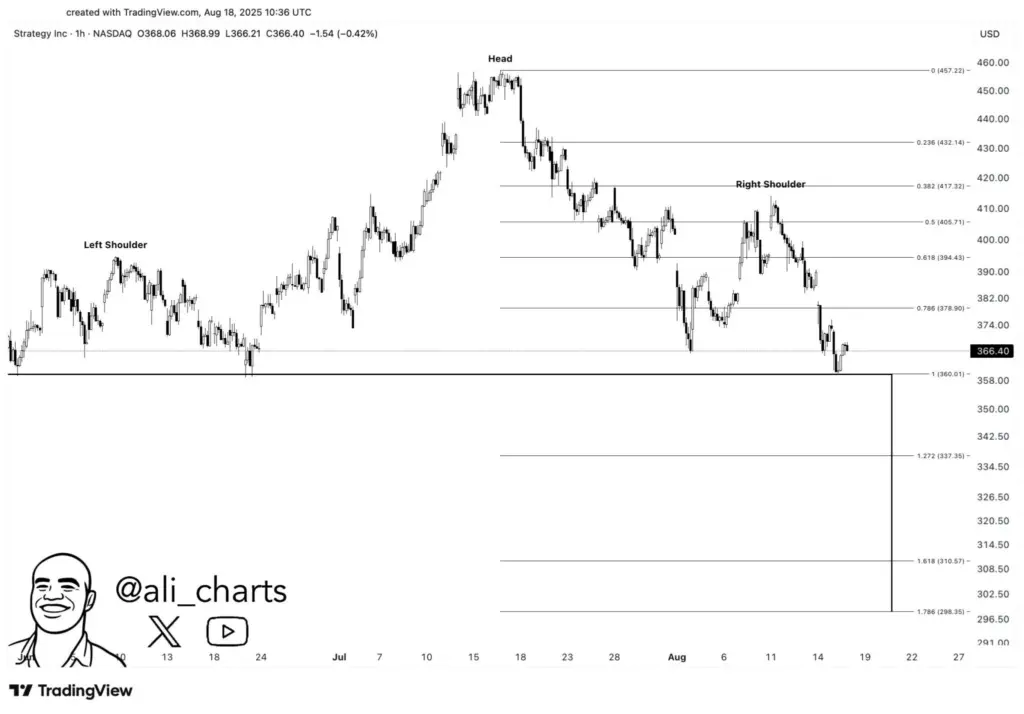

Recent analysis indicates that MSTR stock forfeited critical support at $360, as indicated by its 7% decline on Tuesday, following its head-and-shoulders technical chart pattern. The stock’s subsequent technical support is priced at $300. Intriguingly, this would further reduce the Strategy premium over Bitcoin, thereby complicating Saylor’s ability to maintain stock dilution.