Strategy, formerly MicroStrategy, became the first public firm to hold 600K BTC as MSTR stock jumped double digits after the latest Bitcoin buy.

One week after halting its efforts to acquire Bitcoin, Strategy (formerly MicroStrategy) has announced another acquisition.

The company’s most recent acquisition makes it the first publicly traded corporation to hold more than 600,000 Bitcoins.

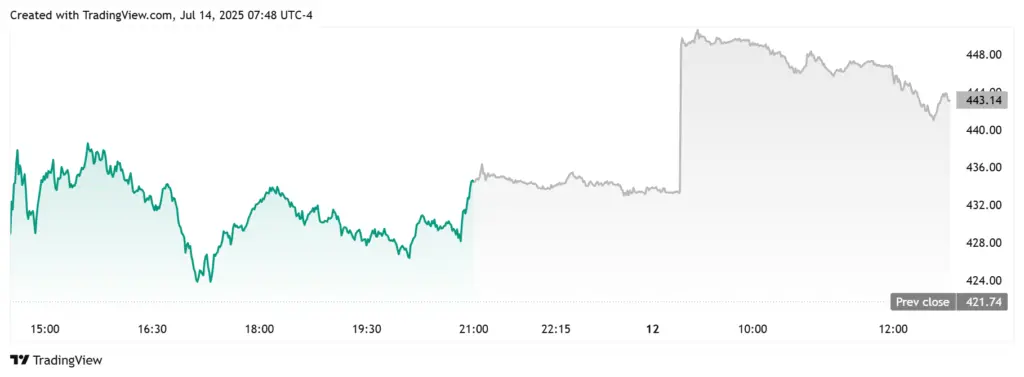

The MSTR stock, however, has increased from last week’s closing price of $434.

Strategy Reports Another Bitcoin Acquisition

According to a press release, the company paid $472.5 million for 4,225 bitcoins at an average price of $111,827 each, resulting in a 20.2% year-to-date (YTD) bitcoin yield.

At an average price of $71,268 per bitcoin, the corporation paid $42.87 billion to acquire 601,550 BTC, which it currently owns.

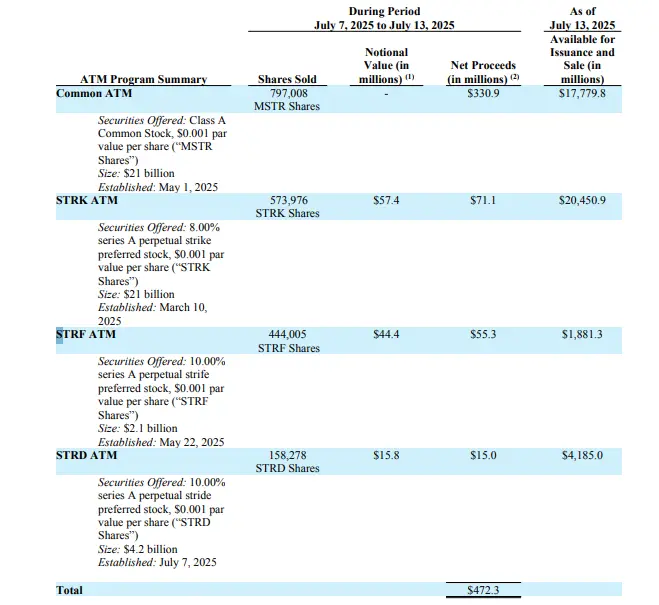

According to the SEC filing, Strategy mostly raised money for this Bitcoin purchase by selling common shares.

The sale of MSTR shares brought in $330.9 million for the corporation, while the sales of STRK, STRF, and STRD securities brought in $71.1 million, $55.3 million, and $15 million, respectively.

This comes after Michael Saylor alluded to a potential Bitcoin acquisition in his remarks yesterday.

A graph of MicroStrategy’s Bitcoin purchases was shared by Saylor, who said, “Some weeks you don’t just HODL.”

This meant that the business had bought Bitcoin once more.

Saylor had said the week before, “Some weeks you just need to HODL,” which proved to be a clue that they didn’t purchase Bitcoin that week.

After purchasing the flagship cryptocurrency for twelve weeks, MicroStrategy stopped between June 30 and July 6, as CoinGape was revealed last week.

Now that businesses are purchasing Bitcoin again, a new trend of weekly transactions can be started.

A $4.2 billion STRD offering as part of the company’s at-the-market (ATM) program has previously been announced. It intends to purchase further Bitcoin with the net proceeds from the stock offering.

Amid the news of this most recent Bitcoin acquisition, MSTR stock is rising.

According to TradingView data, the price of MSTR’s shares is up more than 2% in premarket trading and is presently trading at about $443.

As the price of Bitcoin soared to new all-time highs (ATH) and broke above $123,000 for the first time, the MSTR stock also increased in value.

Because of the company’s exposure to Bitcoin, both assets are connected.