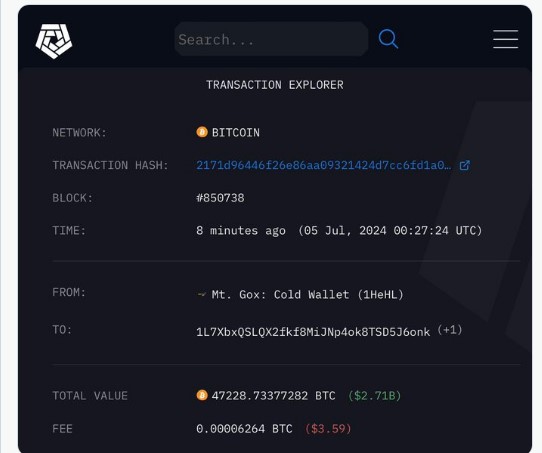

On Thursday, defunct Japanese crypto exchange Mt. Gox transferred Bitcoin worth $2.7b to a new wallet address. It marks the exchange’s first significant transaction since May, following several smaller test transactions on Wednesday.

In a Thursday X post, Arkham Intelligence reported that a cold storage wallet Mt. Gox owns moved 47,228 BTC to a wallet address ending with “6onk.”

This transfer coincides with the exchange’s creditor repayments scheduled early this month, as it aims to distribute $9b in Bitcoin to creditors.

In June, the exchange’s trustee, Nobuaki Kobayashi, assured creditors that repayment preparations were finalized and would begin in early July, per the plan.

Mt. Gox Creditors Edge Closer to Recovery After Long Delay

Creditors have finally seen a light at the end of the tunnel over a decade since the exchange collapsed after a 2014 hack. A verification process in January that the trustee spearheaded has cleared the path for the funds’ delayed return.

The exact dates for payouts to designated exchanges are still under wraps. But the process appears to be moving forward.

The total disbursement will include 142,000 Bitcoin, 143,000 Bitcoin Cash, and 69 billion yen by Oct. 2024.

Bitcoin Market Braces for Potential Price Pressure as Mt. Gox Repayment Nears

Several Mt. Gox creditors have recently updated their claims, signaling advancements in receiving repayments in both crypto and fiat.

Initial reports emerged on the Mt. Gox insolvency Subreddit around mid-April. That’s when users highlighted details about expected payments in their account’s repayment data table. Additionally, some creditors reported successful receipt of fiat currencies in their bank accounts.

However, a dark cloud hangs over this positive news. Analysts at K33 Research warn that re-entering such a large Bitcoin amount into the market could trigger price instability and put downward pressure on Bitcoin’s value.