The iconic Bitcoin exchange Mt. Gox, which crashed in 2014, has finally begun paying back its creditors in a long-overdue move.

Due to the deluge of Mt. Gox repayments into the market, Bitcoin is highly volatile.

In addition to ending one of Bitcoin’s worst moments, this resolution to one of the most well-known controversies in the cryptocurrency space also actively influences the asset’s real-time market dynamics.

The rehabilitation trustee for Mt. Gox, Nobuaki Kobayashi, declared on July 5 that debt repayments to creditors would begin in Bitcoin BTC$57,730 and Bitcoin Cash.

BCH $337. Repayments are made possible via a convoluted web of trades, each essential to distributing monies.

The repayments’ magnitude is astounding. Data that is currently accessible indicates that about 47,288 BTC, or about $2.7 billion, have already been transferred from wallets connected to Mt. Gox to new addresses.

This is just the start; in the upcoming weeks, the victims will get about 140,000 BTC, worth an astounding $9 billion at today’s exchange rates. The entire cryptocurrency market is on edge due to the sheer size of the transfers, with traders and investors intently observing every move.

Furthermore, transferring the funds across five exchanges—Bitbank, SBI VC Trade, Bitstamp, Kraken, and BitGo—seems to be a pretty logistical challenge during the return process. Payout processing timelines vary throughout exchanges, with some offering instant payouts and others having a 90-day gap.

After receiving the funds, Bitbank and SBI VC Trade, two Japanese exchanges, processed the payments in hours, concluding their distributions. While this speedy action relieved creditors, several beneficiaries soon sold their freshly obtained Bitcoin, adding to the ongoing market instability.

In addition, Bitstamp promised to accelerate payments, with exchange representatives saying they would pay out to investors before the allotted 60 days.

A cascading effect in action

The effect on the price of Bitcoin was instantaneous. In just a few hours, Bitcoin fell 10% from around $62,000 to as low as $53,600 on July 4 as word of the reimbursements spread.

A wave of liquidations swept across the cryptocurrency market due to this steep collapse, wiping away leveraged positions worth roughly $425 million. Not just Bitcoin saw volatility; the whole cryptocurrency market shook, with numerous altcoins seeing double-digit percentage declines.

Nevertheless, Mt. Gox wasn’t the only factor in the market’s response. News of the German authorities selling off millions of dollars worth of Bitcoin seized from illegal activity coincided with these repayments.

The largest-ever single-day Bitcoin liquidation occurred on July 8 when a German government-affiliated crypto wallet sold around $900 million worth of Bitcoin, moving about 16,309 BTC to multiple external addresses in many transactions.

Some transfers were sent to market makers like Flow Traders and Cumberland DRW and cryptocurrency exchanges like Bitstamp, Coinbase, and Kraken.

With the German government almost halfway through its selling binge, having cut its holdings from 50,000 BTC to 23,788 BTC, traders anticipate that after the immediate selling pressure eases, Bitcoin prices will stabilize and possibly rise again.

The collapse of Mount Gox

It’s crucial to consult historical accounts to comprehend the scope of the present repayment plan.

Mt. Gox, founded in 2010 by Jed McCaleb and then sold to Mark Karpelès in 2011, rose to prominence as the most significant Bitcoin exchange in the world, processing an astounding 70% of all BTC transactions at one point.

Its prominence made it the preferred platform for early adopters of Bitcoin and was essential in establishing the credibility of the cryptocurrency during its early stages. However, because of technical difficulties, Mt. Gox halted all Bitcoin withdrawals in February 2014. The exchange had suffered a long-standing security failure that resulted in the loss of almost 850,000 Bitcoin, as was shortly discovered.

In today’s dollars, this loss, estimated to be worth $450 million at the time, would be worth almost $48 billion. The incident badly harmed Bitcoin’s reputation and sent shockwaves across the cryptocurrency industry, delaying attempts towards mainstream adoption for years.

The consequences were harsh and swift. With its bankruptcy filing, Mt. Gox left thousands of clients needing a way out. With the case moving to civil rehabilitation in 2018, creditors had some hope. Karpeles was found guilty 2019 of fabricating financial documents, which added even more complexity to the already intricate legal tale.

However, Kobayashi’s announcement of a draft rehabilitation plan in 2020 presented a reasonable course of action. Over the following few years, the proposal saw multiple delays and adjustments, mainly due to logistical and legal issues. The payback date was again extended in 2023, this time to some point in the third or fourth quarter of 2024.

The cryptocurrency scene was still changing at this time, with new exchanges becoming well-known and regulatory frameworks starting to take shape.

Bitcoin’s difficult future

An already volatile cryptocurrency market has seen an increase in volatility with the start of the Mt. Gox reimbursements. But as the dust settles, a more complex picture takes shape. For example, since July 5, Bitcoin has exhibited remarkable resiliency, rising to about $59,000 from its initial drop to $53,600.

The fact that the market could take in such a massive supply shows how much more liquid and developed the Bitcoin ecosystem has become since Mt. Gox collapsed. Some analysts even go so far as to say that most of this selling pressure was “priced in” before the occurrence, which would account for the comparatively swift price rebound.

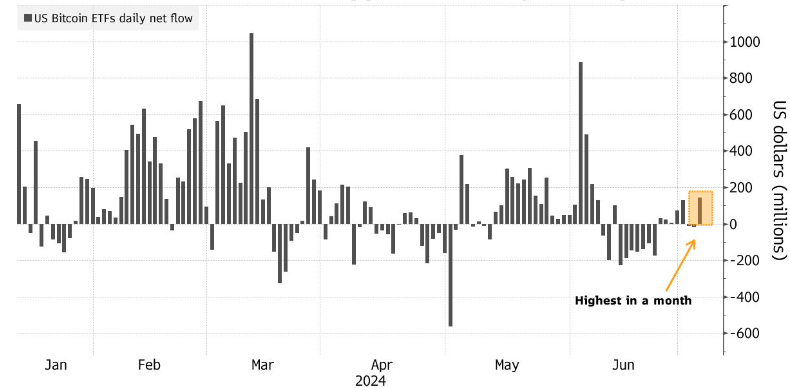

Additionally, as seen by the rise in inflows into US-based spot Bitcoin exchange-traded funds (ETFs), several significant investors saw the price decline as a buying opportunity. This institutional backing has shown that Bitcoin is accepted by the financial mainstream while offsetting the selling pressure.

Returning to the macroeconomic front, much attention is being paid to the Federal Reserve Chair Jerome Powell’s speech before the US Congress and the impending US Consumer Price Index (CPI) report, both of which might have a significant impact on the trajectory of Bitcoin prices in the months to come.

In addition, given the former president’s recent outreach to the cryptocurrency community, there is speculation that the US presidential election on November 5 could be another wild card. This could lead to a potential “Trump Trade” rise.

The broader cryptocurrency market is also beginning to react independently of Bitcoin’s fluctuations. For example, Ether ETH$3,104 has maintained its value over $3,000 despite fluctuations in the BTC market.