The recent on-chain fund transfers indicate that Mt. Gox is preparing to pay back creditors via the Bitstamp cryptocurrency exchange.

In anticipation of Mt. Gox continuing to make creditor repayments, another wave of Bitcoin may be hitting the market. Is it likely that 99 percent creditors will sell their Bitcoin?

The initial test transactions have been made to the Bitstamp cold wallets from the address connected to Mt. Gox.

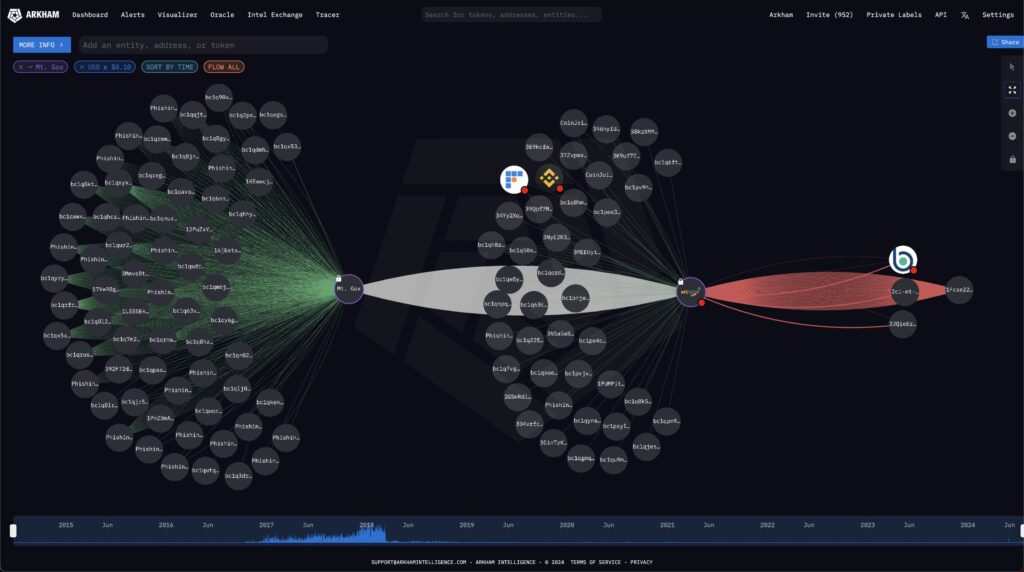

In an X post from July 22, blockchain intelligence company Arkham Intelligence identified the test transactions.

“Mt. Gox addresses deposited $1 to 4 separate Bitstamp deposit addresses. Bitstamp is 1 of 5 exchanges working with the Mt. Gox Trustee to facilitate creditor repayments… These transfers are likely to represent test transactions.”

Approximately 127,000 creditors owe more than $9.4 billion in Bitcoin and have waited more than ten years to get their money back.

The Mt. Gox repayments, however, have some cryptocurrency investors worried about possible sell pressure that might drive down the price of Bitcoin to BTC$67,713.

Could 99% of Mt. Gox creditors sell the money?

Given that Bitcoin has gained more than 8,500% in value in the ten years following the collapse of Mt Gox, most of the exchange’s creditors may be considering selling their holdings.

Finance expert Jacob King stated in a July 4 X post that up to 99% of the debtors might be looking to sell their Bitcoin from the collapsed exchange:

“99% of those on Mt. Gox are going to sell their coins the moment they get it. Imagine billions worth of Bitcoin all being dumped gradually over the next several weeks. There is no way to spin this to be bullish, or news that could offset this.”

However, according to a Reddit community poll, 56% of Mt Gox creditors said they planned to keep their Bitcoin, while only 20% said they intended to sell.

$6 billion remains in the Mt. Gox Bitcoin payout remains 36% complete.

Almost 36% of the Bitcoin owing to Mt Gox creditors had already been dispersed as of July 17, but big Bitcoin investors, or “whales,” were undeterred and kept going on their buying binge.

Insensitive to the possibility of selling pressure, a shrewd whale purchased 245 BTC on July 17 for around $16 million. In the past year, the address has only traded Bitcoin twice, yet it has made a profit of nearly $30 million each time.

Based on information from Arkham Intelligence, the wallet bearing the Mt Gox label presently has about 90,300 Bitcoin valued at $6.12 billion.

Although it’s unknown when Mt Gox will start making repayments again, today’s test transactions show that these are the last steps before paying back BitStamp’s creditors.