As the Crypto dip continues, NFT falls by 44% in sales against the current trend of memecoins soaring and selling fast.

According to Apollo Crypto’s investment chief, the sale of non-fungible tokens (NFTs) in Q2 may have experienced a 44% decline due to a recent surge in celebrity, political, and animal-themed memecoins and a crypto market downturn.

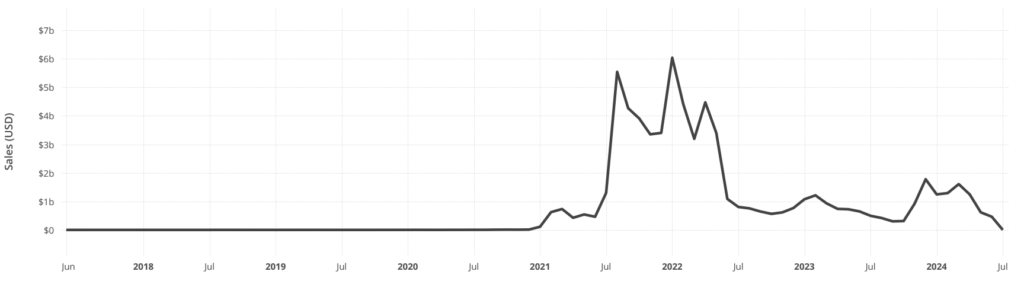

According to CryptoSlam’s data, the sale of NFTs decreased from $4.14 billion in Q1 to $2.32 billion in Q2 due to a broad market decline.

“Q2 was a challenging market, with Bitcoin experiencing a 15% decline and numerous altcoins performing significantly worse,” stated Henrik Andersson, Apollo Crypto’s chief investment officer, in an interview with Cointelegraph.

“However, meme coins are also likely to steal a portion of the mind share from NFTs,” Andersson continued.

A marketing term that denotes the degree of consumer awareness or popularity associated with a specific product or concept is “mind share.”

Despite the slowdown in the sales of NFTs, Memecoins continue to experience substantial trading volumes, with $3.4 billion in the last 24 hours alone, according to CoinGecko data.

A significant portion of this has been precipitated by the emergence of PolitiFi memecoins associated with the United States presidential election. Additionally, several new celebrity tokens have been introduced on Ethereum and Solana.

MAGA (TRUMP) and Pepe

PEPE was one of the memecoins that experienced a price increase in the second quarter.

In the months ahead, Andersson also observed that developments in Bitcoin-based Ordinals may divert attention from traditional NFTs.

“Longer term we believe Bitcoin ordinals will continue to take market share in the NFT space, in particular given the many Bitcoin L2s coming to the market.”

Nevertheless, there has been a decline in network activity on Ordinals and Runes in recent weeks.

Ordinal inscriptions and Runes have contributed less than 2 Bitcoin (BTC) per day in miner fees over the last week, while Runes transactions have fallen 88% from their highest point in June.

NFTs have previously rebounded, with a modest increase in sales exceeding $3 billion in the final quarter of 2023. This could indicate that there is potential for an NFT resurgence in the latter half of 2024.

It encompassed a $1.77 billion sales month in December 2023, the most significant since the NFT summer began diminishing in June 2022.

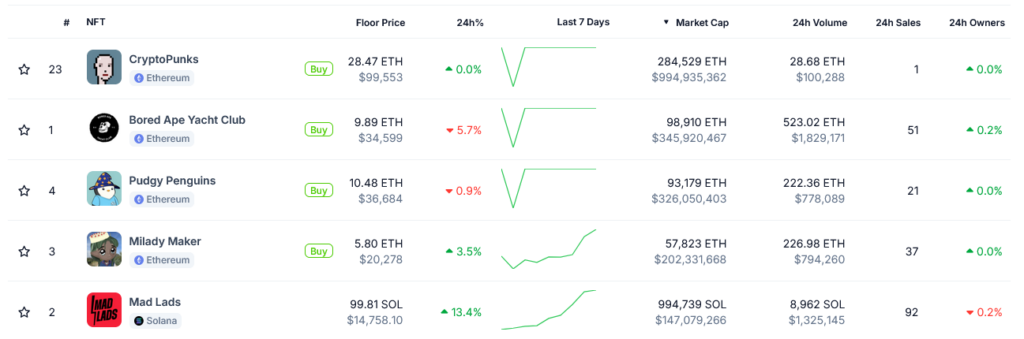

CoinGecko data indicates that the market capitalization of top NFT collectibles, such as Bored Ape Yacht Clubs and CryptoPunks, remain substantial at $994.9 million and $345.9 million, respectively.

In contrast, the market caps of the two most significant Ordinals initiatives, NodeMonkes and Bitcoin Puppets, are $121.1 million and $94.2 million, respectively.