Nigerian crypto adoption backed by IMF licensing, cites remittances and investment boosts despite SEC concerns.

Nigeria is advised by the International Monetary Fund (IMF) to grant licenses to international cryptocurrency exchanges as an integral component of its economic reformation initiatives.

A recent IMF report indicates Nigeria’s endeavour to incorporate cryptocurrencies into its financial system is motivated by its desire to maintain its standing in the African cryptocurrency market. It is suggested that “international cryptocurrency trading platforms obtain registration or licensure in Nigeria and are held accountable to the identical regulatory obligations that govern financial intermediaries.”

It states, “Authorities should ensure that crypto trading platforms and other virtual asset service providers adhere to AML/CFT [Anti-Money Laundering and Countering the Financing of Terrorism] controls through effective AML/CFT risk-based supervision.”

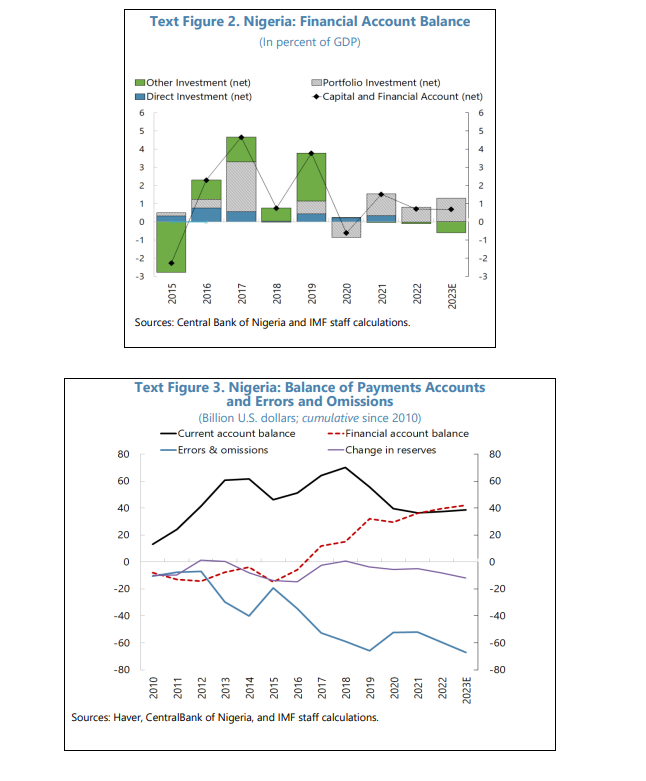

In particular, the report highlights inaccuracies and omissions in Nigeria’s balance of payments, which correspond to undocumented financial transactions. Several factors contribute to these inconsistencies, one of which is the “shift toward using crypto assets for cross-border transactions,” which is frequently not reflected in conventional banking records.

The report presents initial 2023 data that indicates “NEOs remain extremely negative” by close to $7.5 billion, or 2% of Nigeria’s gross domestic product, whereas 2020 figures were predominantly positive.

The IMF posits that Nigeria could enhance remittance mechanisms, aid in stabilizing financial markets, and attract international investment by regulating and licensing cryptocurrency exchanges. This is particularly significant given the size of the Nigerian diaspora.

The IMF endorses the incorporation of cryptocurrencies when Nigeria is confronted with escalating macroeconomic issues, including currency instability and inflation. Using authorizing cryptocurrency exchanges, the IMF intends to implement cryptocurrencies to facilitate more secure and streamlined transactional procedures.

Implementing this measure could enhance Nigeria’s regulatory framework regarding the circulation of digital currencies, reduce illicit financial inflows and outflows, and alleviate the vulnerabilities of cryptocurrency transactions to money laundering and fraudulent activities.

The regulations proposed by Nigeria’s Securities and Exchange Commission, which are expected to prohibit peer-to-peer (P2P) cryptocurrency exchanges utilizing the naira, the national currency of Nigeria, are recent evidence of this regulatory shift.

According to Nigerian SEC Director General Emomotimi Agama, the prohibition is intended to safeguard the naira against manipulation following a “perceived impact on the naira exchange rate.”

However, the prohibition of peer-to-peer cryptocurrency transactions was once regarded as an almost impossible challenge by industry proponents.