Nigerian Interpol fosters cybersecurity through virtual assets training to enable officers to tackle cybercrimes.

An assembly of cybersecurity experts, the Nigerian Interpol, and other constituents of the domestic intelligence community convened to deliberate on strategies to combat the escalating tides of cybercrime within the nation.

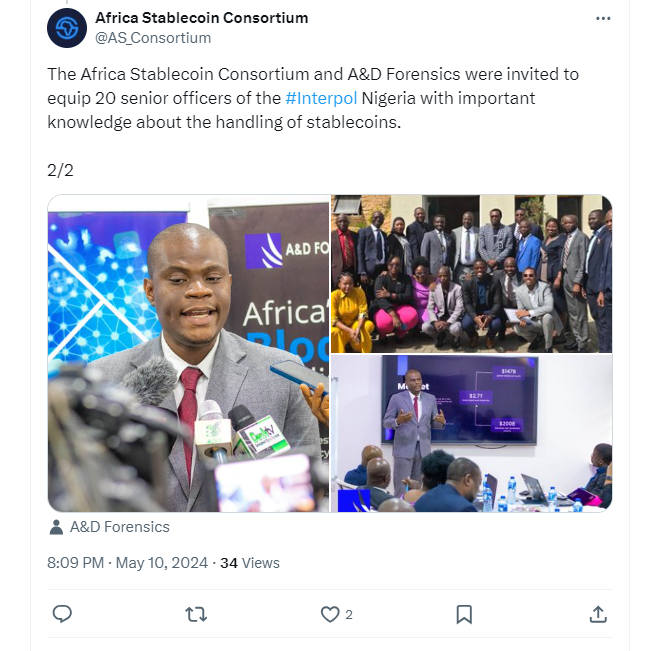

The collaborative ideation session, conducted in Abuja, the country’s capital, was reportedly organized by A&D Forensics in collaboration with the Africa Stablecoin Consortium as part of a training platform. It aimed to advise Nigerian Interpol on preventing criminal activities associated with stablecoins and virtual assets.

The purpose of the training session, according to blockchain expert Chioma Onyekelu, was to equip Interpol agents with the knowledge and abilities necessary to trace and prosecute cybercriminals engaged in cryptocurrency transactions, particularly those utilizing Bitcoin and stablecoins, by leveraging blockchain intelligence and analysis.

The purpose of the training session, according to blockchain expert Chioma Onyekelu, was to equip Interpol agents with the knowledge and abilities necessary to trace and prosecute cybercriminals engaged in cryptocurrency transactions, particularly those utilizing Bitcoin and stablecoins, by leveraging blockchain intelligence and analysis.

Onyekelu elucidated that in light of Nigeria’s increasing engagement with virtual asset exchanges, the training program will empower law enforcement personnel to tackle cybercrimes that specifically target stablecoins and virtual assets proficiently.

Senior Partner at A&D Forensics, Adedeji Owonibi, informed the media that the training was crucial in light of the escalating cybercrime patterns observed within the nation. It was noted by him that:

“A significant gap exists between the evolving cybercrimes and the capabilities of law enforcement agencies in Nigeria. As responsible corporate citizens, we recognized the need to bridge this gap and support our law enforcement agencies in staying updated and effectively combating cybercrimes.”

In light of the recent controversies surrounding the implementation of the cybersecurity levy, Owonibi posits that although cybersecurity may engender discord, the government possesses the prerogative to determine affairs about national security, underscoring the criticality of placing the nation’s security interests first.

The mandate for banks and other payment service providers to commence deducting 0.5% of the total value of electronic transactions and remit to the National Cybersecurity Fund, which will be administered by the Office of the National Security Adviser (ONSA), was issued by the Central Bank of Nigeria (CBN) on Monday.

Proposing a substantial regulatory shift, Nigeria’s Securities and Exchange Commission (SEC) prohibits naira-based peer-to-peer exchanges to tighten down on cryptocurrencies.

The International Monetary Fund (IMF) recently advised Nigeria to implement cryptocurrencies by authorizing international cryptocurrency exchanges as part of its economic reformation efforts.