Mayor Steven Fulop stated that he had been a “long-time believer” in crypto, but it is apparent that he did not mention Bitcoin or other tokens prior to July 25.

Steven Fulop, the mayor of Jersey City since 2013, has indicated that he intends to designate a portion of the city’s pension fund to crypto exchange-traded funds (ETFs).

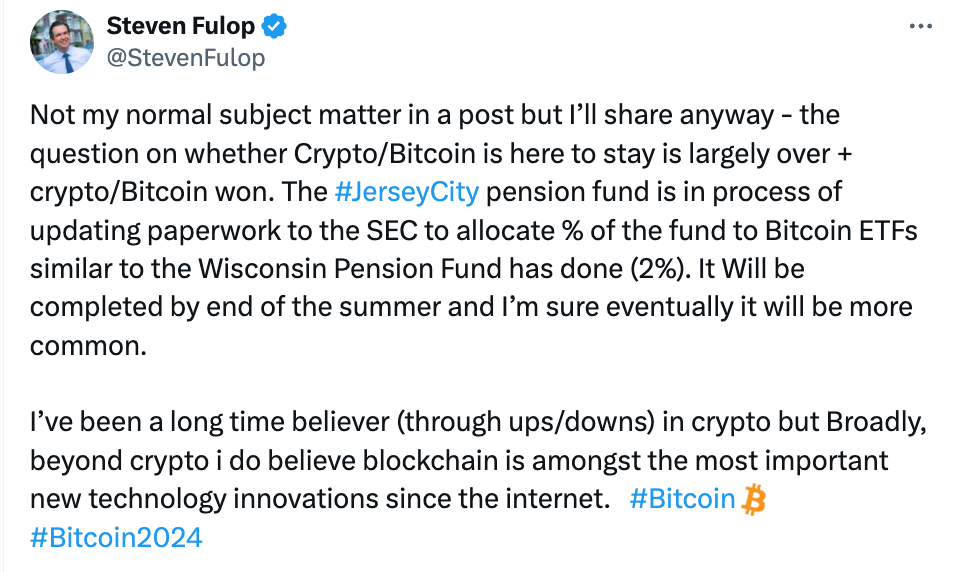

Mayor Fulop announced in a July 25 X Post that the Jersey City pension fund was revising its documentation with the United States Securities and Exchange Commission (SEC) to indicate an investment in Bitcoin ETFs.

The mayor did not specify the percentage of the fund allocated to cryptocurrency; however, he stated that it would be comparable to the 2% the Wisconsin Pension Fund assigned.

Fulop stated, “Despite its ups and downs, I have long supported cryptocurrency. However, blockchain is one of the most significant technological advancements since the internet, in general.”

The State of Wisconsin Investment Board reported exposure to spot Bitcoin ETFs issued by Grayscale and BlackRock in May. At that time, the board’s assets amounted to approximately $156 billion, with the two crypto investments comprising $164 million.

In January, the SEC authorized the registration and trading of spot Bitcoin ETFs on US exchanges. However, cryptocurrency ETFs are currently being considered by publicly-run pension funds only in Wisconsin and Jersey City.

Mayor Fulop did not expressly mention the possibility of investing in spot Ether ETFs, which commenced trading in the United States on July 23.

Major financial institutions Wells Fargo and JPMorgan Chase reported a combined investment of less than $1 million in spot Bitcoin ETFs, a negligible portion of the firms’ trillions of dollars in assets. Cointelegraph contacted Mayor Fulop for comment; however, a response was not received at the time of publication.