During the past week, the Bitcoin network had a resurgence in the volume of non-fungible tokens, which coincided with the industry’s stabilization

Sales of Bitcoin non-fungible tokens increased

As reported by CryptoSlam, the price of Bitcoin (BTC) non-fungible tokens (NFTs) has increased by 56% in the past seven days, reaching more over $20 million. To reach 29,403, the total number of purchasers in the network increased by 48 percent.

Over $3.4 million in sales and 302 transactions were completed by the NodeMonkes collection, which is a relatively new collection. This collection was the best-performing NFT in the ecosystem.

Over the course of the week, the Guild of Guardian Heroes collection from Immutable X was the only one to have greater sales.

The volume of sales for Bitcoin Puppets was in the amount of $3.03 million. Compared to the prior week, this is a 239% increase.

It was then followed by Ordinal Maxi Biz, whose revenues increased to more than $1.89 million. The Taproot Witches, on the other hand, brought in $1.3 million.

Solana, Ethereum

Despite the fact that it handled deals worth $28 million, Ethereum continued to be the most active network for NFT. In terms of revenue, Solana brought in $13 million, while BNB Chain brought in $3.7 million.

NFTs had yet another loss in sales during the month of September, with overall sales falling by 48% to a total of $318 million. The sales of Ethereum, Bitcoin, and Solana were, respectively, $108 million, $63 million, and $61 million compared to one another.

Rebound for bitcoin

While the prices of the majority of cryptocurrencies began to recover, the weekly sales of NFTs increased. On the other hand, the overall market capitalization of all coins increased to $2.3 trillion, while the price of bitcoin reached $66,000 for the first time since July.

For the first time in two months, the cryptocurrency fear and greed index, which is regularly monitored, reached the greed zone of sixty. This is the most crucial development.

Historically, when there is a sense of greed in the market, traders tend to move their money into riskier assets such as stocks and cryptocurrencies.

This has been the case recently as a result of the Federal Reserve’s decision to reduce interest rates, China’s stimulus, and the continued decline in stablecoin holdings among investors with smart money.

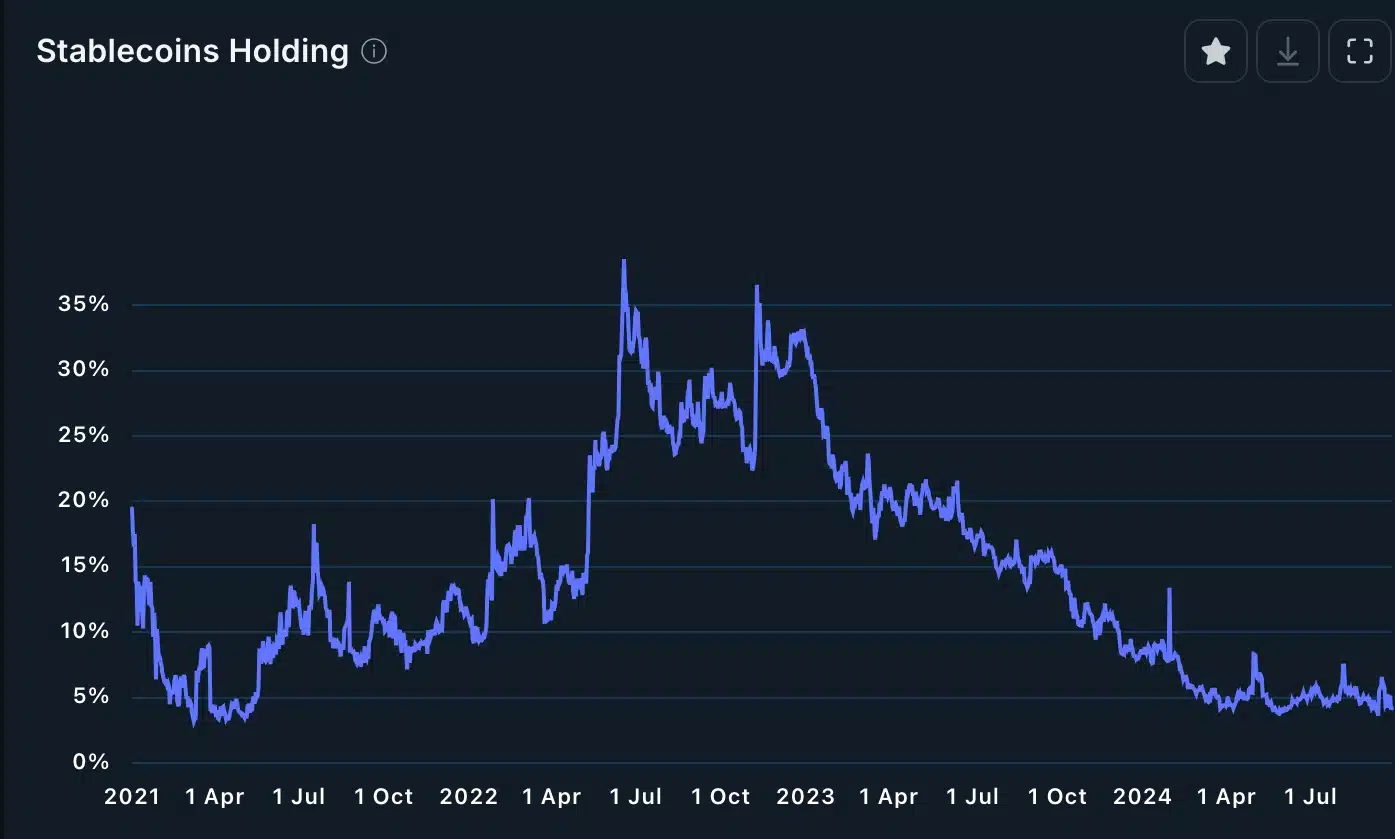

As can be seen in the following illustration, the amount of stablecoins that these investors have in their possession has reached its lowest point in the past two years.

In addition, the Nansen chart demonstrates that these holdings have been continuing their downward trajectory since 2022 when they experienced a surge due to the collapse of the FTX and Terra ecosystems.

Savvy money investors most likely decreased their holdings of stablecoins and turned their focus to cryptocurrencies and non-fiat currencies.

The fact that the market for NFTs has grown extremely crowded, with thousands of new collections, is the primary risk investors confront when dealing with these assets.

There are over 5,000 existing NFT collections, and a recent analysis finds that 96% are considered “dead.”

That is to say, they have no trading volume, have not made any sales for more than seven days, and have not been active on any social networks.