According to Standard Chartered, Norway’s sovereign wealth fund increased bitcoin holdings by 83% in Q2, signaling growing institutional interest.

According to Geoffrey Kendrick, the global head of digital assets research at Standard Chartered, Norges Bank Investment Management increased its bitcoin-linked holdings by 83% in the second quarter.

The fund, also called Norway’s Government Pension Fund Global, is the world’s largest sovereign wealth fund with $1.7 trillion in assets.

Kendrick stated that he analyzed the most recent 13F filings with the U.S. Securities and Exchange Commission for companies that hold exchange-traded bitcoin funds.

These include Strategy (formerly MicroStrategy, ticker MSTR) and Metaplanet, which is frequently referred to as “Japan’s MicroStrategy.” He observed that Norges Bank Investment Management’s elevated exposure to Metaplanet and MicroStrategy was the most noteworthy aspect of the second quarter.

Kendrick stated that Norges increased its bitcoin-equivalent exposure by 83% in Q2 from 6,200 BTC to 11,400 BTC. Additionally, he noted that the position is primarily located in Strategy, with a minor addition of approximately 200 BTC-equivalent in Metaplanet.

Kendrick explained to The Block, “The underlying is that Norges is utilizing MSTR to gain exposure to it.” “The proactive stance necessitates an increase of 83% in one quarter.”

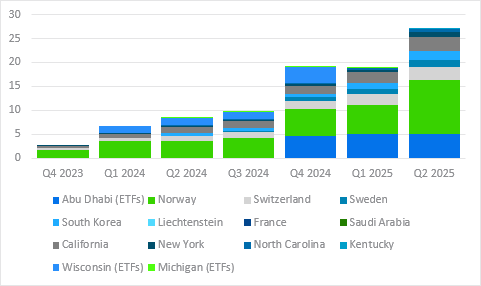

The equivalent of ‘000 BTC in government holdings

At present prices, MicroStrategy is the largest publicly traded corporate holder of bitcoin, with 628,946 BTC at nearly $74 billion. Metaplanet is presently the seventh-largest cryptocurrency, with 18,113 BTC valued at over $2 billion

Kendrick’s Q2 update on 13F filings is consistent with his earlier May analysis, which demonstrated that sovereigns and government entities were increasing their indirect exposure to bitcoin in Q1 by primarily purchasing shares of Strategy.

He anticipated that a greater number of sovereign wealth funds would acquire exposure to bitcoin in February.

Kendrick has been one of the most optimistic voices regarding cryptocurrency. He increased his prediction for bitcoin to $135,000 by September 30 and reaffirmed his $200,000 year-end objective last month. His projected income for 2028 is $500,000.

Kendrick has recently increased the price forecast for Ethereum to $7,500 by the end of the year, from $4,000, and anticipates that it will reach $25,000 by 2028, up from $7,500. This is in addition to Bitcoin.

He anticipates that BNB will reach $2,775 by 2028, Avalanche’s AVAX token will increase to $250 by 2029, and XRP will reach $12.50 by 2028. He also anticipates that the adoption of stablecoins will increase, with the total market value approaching $2 trillion by the end of 2028.