Norwegian crypto firm K33 is raising funds to purchase up to 1,000 Bitcoin as part of its growing treasury strategy and long-term bet on digital assets.

To finance its aim to buy up to 1,000 Bitcoin for its treasury, Norwegian cryptocurrency broker K33 is issuing shares to raise at least 85 million Swedish krona ($8.9 million).

To buy up to 1,000 Bitcoin for its business reserves, Norwegian cryptocurrency company K33 announced on Wednesday that it intends to raise at least 85 million Swedish krona ($8.9 million) through a share offering.

Per its release, K33 has designated Pareto Securities as its manager and book-runner for the share issue. The cost of a subscription is $0.011 per share. K33 anticipates issuing a minimum of 820 million shares.

According to the corporation, “Bitcoin will be purchased with the net proceeds from the Directed Share Issue and held on the balance sheet.” The action comes after K33 declared that it had obtained funding in late May to purchase up to 57 Bitcoin (BTC) at $105,101.

According to K33, the exposure to Bitcoin will “unlock real operational leverage for the company as a broker.”

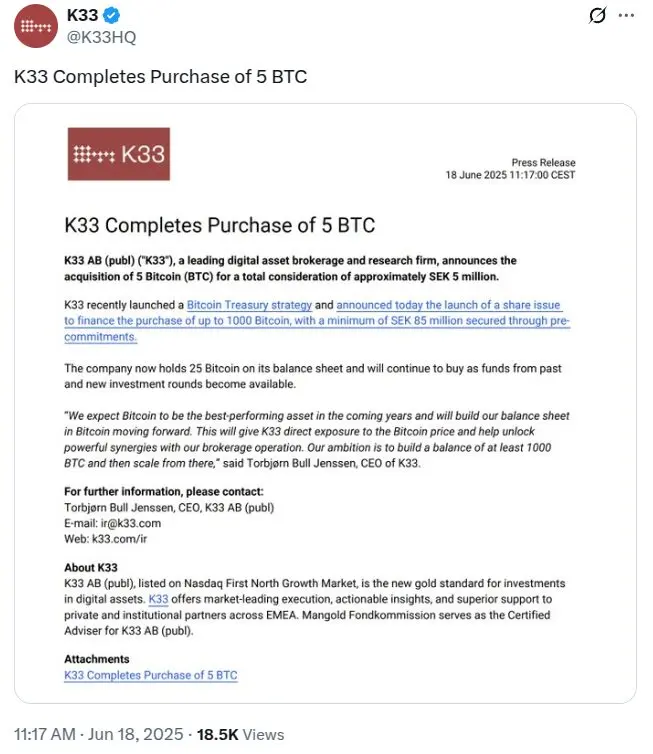

The business anticipates that the holdings will increase its profitability, open new product opportunities, and increase its attractiveness to institutional clients. K33 acknowledged on Tuesday that it had purchased 5 BTC, which was valued at about $523,000.

Money raised by issuing shares

The business also stated that the shares would not be given in any country where it would be unlawful to sell the product, including the US, Canada, Australia, Russia, South Korea, and others.

The fundraising, according to K33 CEO Torbjørn Bull Jenssen, is a step toward obtaining 1,000 BTC, with ambitions to expand the Bitcoin treasury in the future:

“A strong balance sheet built on Bitcoin enables us to significantly improve our brokerage operation while maintaining full exposure to Bitcoin’s upside potential.”

Norwegian businesses embrace Bitcoin.

K33’s action aligns with a larger pattern of Bitcoin investments by Norwegian businesses. When the Norwegian Block Exchange announced earlier this month that it would start storing Bitcoin on its balance sheet, its stock shot up more than 138% in a single day.

In 2021, the Norwegian industrial holding corporation Aker ASA established Seetek, a subsidiary solely focused on Bitcoin investment and cryptocurrency ownership. According to data from BitcoinTreasuries.NET, as of this writing, this subsidiary possesses 754 BTC, which is valued at approximately $63 million.