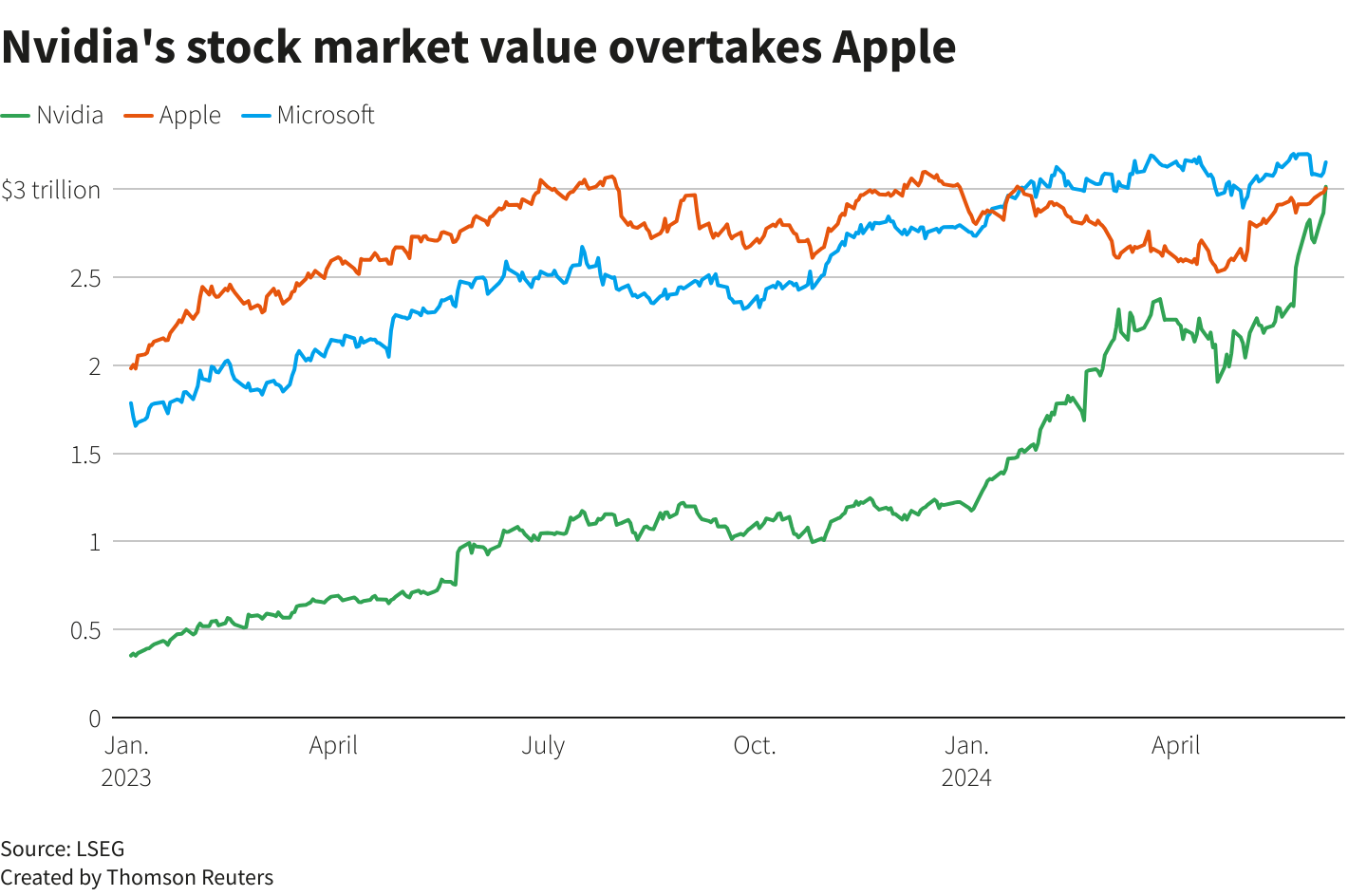

Nvidia’s worth topped $3 trillion on Wednesday, surpassing Apple to become the world’s second most valuable corporation

Nvidia is preparing to split its stock ten-for-one, effective June 7, which could increase its appeal to individual investors.

The transition in Silicon Valley, which the company co-founded by Steve Jobs has dominated since the iPhone was introduced in 2007, is reflected in the fact that Nvidia’s market value has surpassed that of Apple.

Nvidia’s stock closed the day at $1,224.40, representing a 5.2% increase and a $3.012 trillion valuation. Apple’s market capitalization was last recorded at $3.003 trillion, following a 0.8% increase in its stock price.

Microsoft, headquartered in Redmond, Washington, maintained its status as the most valuable company in the world at $3.15 trillion following a 1.9% increase in its stock price.

“At present, Nvidia is generating revenue from A.I., and companies such as Apple and Meta are investing in A.I.,” stated Jake Dollarhide, the CEO of Longbow Asset Management.

Nvidia will also surpass Microsoft. A significant amount of retail capital is being invested in what they perceive as an immediate upward trajectory.

Nvidia’s stock has increased by 147% thus far in 2024, as the demand for its top-of-the-line processors has significantly exceeded the supply.

This is due to the ongoing race between Microsoft, Meta Platforms, and Alphabet, owned by Google, to enhance their A.I. computing capabilities and dominate the emerging technology.

Since May 22, when Nvidia issued its most recent exceptional revenue forecast, it has been up nearly 30%.

On Wednesday, Nvidia’s market capitalization increased by roughly $150 million, surpassing the entire value of AT&T.

The PHLX chip index (.SOX), which opens a new tab, surged 4.5% on Wednesday, as optimism regarding A.I. lifted chip equities broadly.

The stock of Super Micro Computer has increased by 4% as it has launched a new tab that sells AI-optimized servers constructed with Nvidia processors.

The Nvidia CEO, Jensen Huang, visited the Computex tech trade show in Taipei this week and was the subject of extensive coverage on Taiwanese television.

Huang was born in Taipei before emigrating to the United States.

Apple is contending with a lackluster demand for iPhones and fierce competition in China, the world’s largest smartphone market, as Nvidia capitalizes on Wall Street’s A.I. enthusiasm.

Additionally, confident investors perceive Apple as being behind other technology giants in their haste to incorporate AI capabilities into their products and services.

The analysts’ predictions for Nvidia’s future earnings have outpaced its spectacular stock gains. LSEG data indicated that Nvidia is trading at 39 times expected earnings, a lower valuation than a year ago, when it was trading at over 70 times expected earnings.