Microsoft lost to Nvidia as the world’s most valuable corporation on Tuesday due to its high-end processors’ significance in the AI race

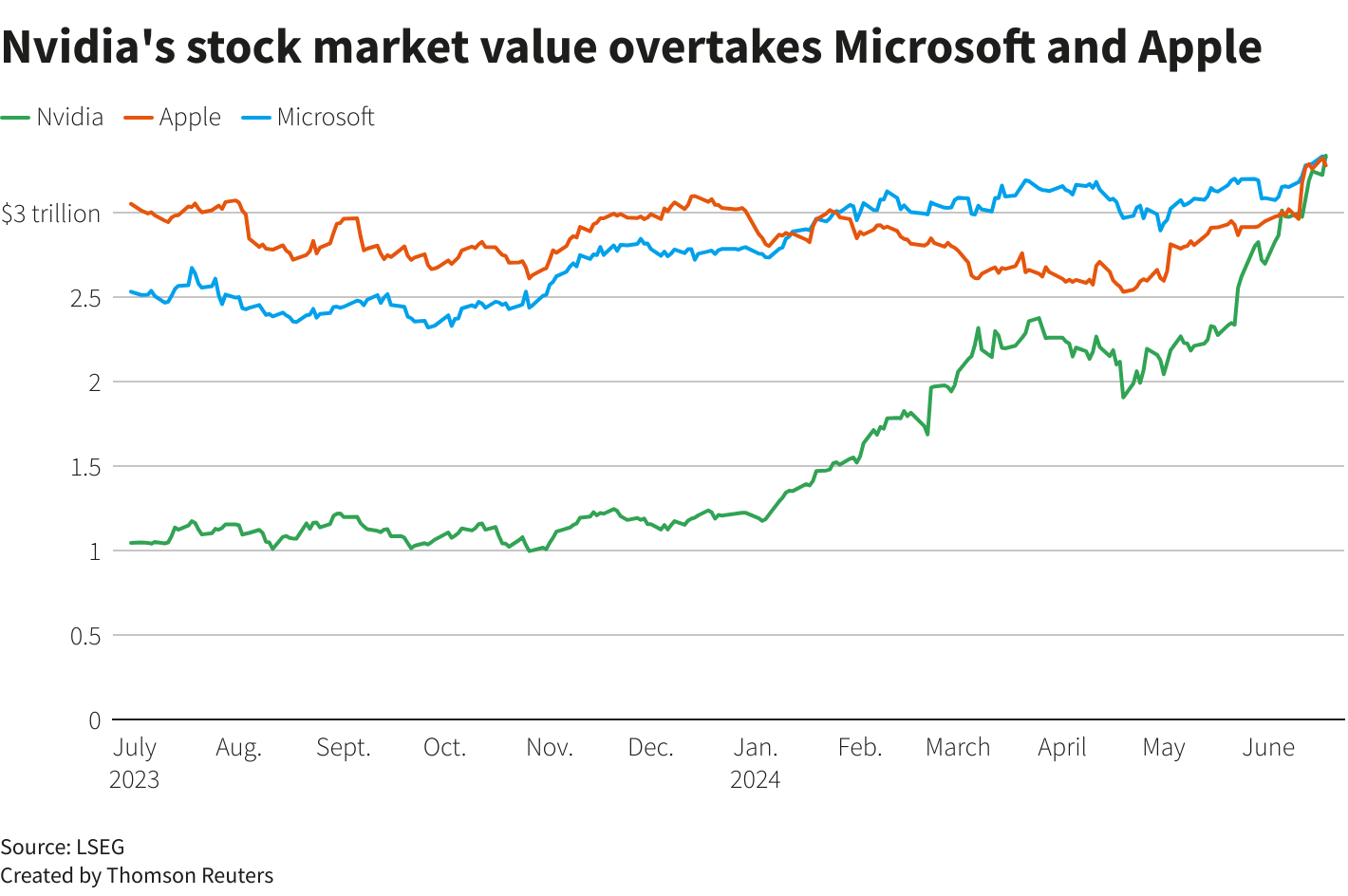

The chipmaker’s market capitalization increased to $3.335 trillion, as its shares rose 3.5% to $135.58, just days after surpassing Apple, the second most valuable company.

Microsoft’s stock market value was $3.317 trillion amid a 0.45% decline in its shares.

Apple’s stock experienced a decline of more than 1%, resulting in a value of $3.286 trillion.

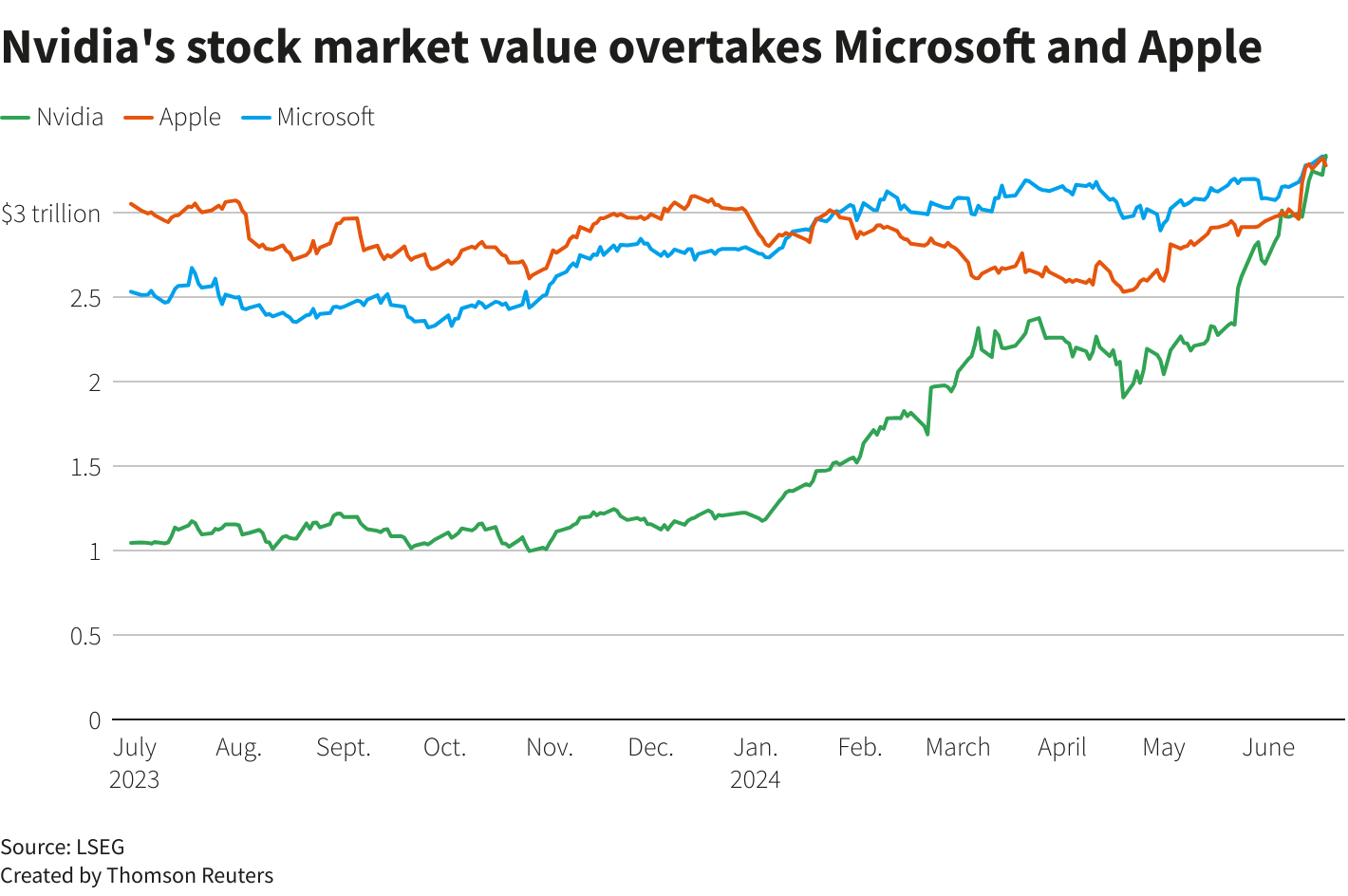

The Wall Street enthusiasm, fueled by optimism regarding emerging AI technology, has been epitomized by the remarkable increase in Nvidia’s market value over the past year.

Although the S&P 500 and Nasdaq have reached record highs due to Nvidia’s rally, some investors are concerned that the unbridled optimism regarding AI may be shattered if indications of a decrease in technology expenditure are detected.

Steve Sosnick, the chief market strategist at Interactive Brokers, stated,

“It is Nvidia’s market; we are all merely trading in it.”

Additionally, Nvidia has emerged as the most traded company on Wall Street, with an average daily turnover of $50 billion, significantly higher than the average turnover of $10 billion for Apple, Microsoft, and Tesla, as indicated by LSEG data.

The chipmaker is responsible for approximately 16% of all trading in S&P 500 companies.

Nvidia’s stock has nearly quadrupled in value thus far this year, while Microsoft’s shares have increased by approximately 19%. This is because the demand for its top-of-the-line processors has exceeded the supply.

Microsoft, Meta Platforms, and Alphabet, which Google owns, are all vying to enhance their AI computing capabilities and incorporate the technology into their products and services.

Many investors regard Nvidia as the most significant beneficiary of the current surge in AI development, as their AI processors are perceived as significantly superior to their competitors. Consequently, they are in short supply.

Oliver Pursche, senior vice president at Wealthspire Advisors in New York, stated, “Nvidia has been receiving a significant amount of positive attention and has been conducting itself in a manner consistent with industry standards.

However, a minor error could result in a significant decline in the stock price, and investors should exercise caution.”

Nvidia’s stock reached a record high on Tuesday, and its market capitalization increased by over $110 billion, equivalent to the entire value of Lockheed Martin.

In February, the company’s market value increased from $1 trillion to $2 trillion in a mere nine months, while it took just over three months to reach $3 trillion in June.

The company has consistently exceeded Wall Street’s high expectations for revenue and profit since its blowout forecast approximately one year ago.

The demand for its graphics processors has significantly exceeded supply as companies race to integrate AI applications.

In May, executives from Nvidia stated that the demand for its Blackwell AI processors could surpass the supply “well into the next year.”

The stock’s earnings valuation has declined due to the significant increase in analysts’ expectations for Nvidia’s future earnings, which has exceeded the outstanding stock gains.

LSEG data indicated that Nvidia’s recent trading price was 44 times the anticipated earnings, a decrease from the 84 times the expected earnings it commanded approximately one year ago.

Last week, Nvidia implemented a 10-for-1 stock split to enhance the allure of its highly valued stock to individual investors.