Nvidia, up more than ninefold since late 2022, has surpassed Microsoft to become the world’s most valuable public company, joining the $3 trillion market cap club in early June, driven by the boom in generative artificial intelligence

Nvidia, which has been recognized for its graphics chips in the niche gaming community for a long time, is currently the most valuable public corporation in the world.

On Tuesday, the chipmaker’s shares increased by 3.6%, resulting in a market capitalization of $3.34 trillion. This value surpasses that of Microsoft, which is currently valued at $3.32 trillion. Nvidia achieved its first $3 trillion valuation earlier this month, surpassing Apple.

Nvidia shares have increased by over 170% this year and continued to rise after the company disclosed its first-quarter earnings in May.

The stock has experienced a more than ninefold increase since the conclusion of 2022, a trend synchronized with the development of generative artificial intelligence.

On Tuesday, Apple’s market value decreased by 1.1%, resulting in a valuation of $3.29 trillion for the iPhone manufacturer.

Nvidia controls approximately 80% of the market for AI CPUs utilized in data centers.

This business has expanded due to the competition among OpenAI, Microsoft, Alphabet, Amazon, Meta, and other entities to acquire the processors required to construct AI models and execute increasingly large workloads.

The data center division of Nvidia generated $22.6 billion in revenue during the most recent quarter, representing approximately 86% of the chipmaker’s total sales. This represents a 427% increase from the previous year.

Nvidia, established in 1991, served as a hardware corporation that distributed chips to gamers to run 3D games for the first few decades. Additionally, it has experimented with cloud gaming subscriptions and cryptocurrency mining processors.

However, Nvidia’s shares have experienced a significant increase in value over the past two years as Wall Street began to acknowledge the company’s technology as the driving force behind an AI revolution, which showed no slowing symptoms.

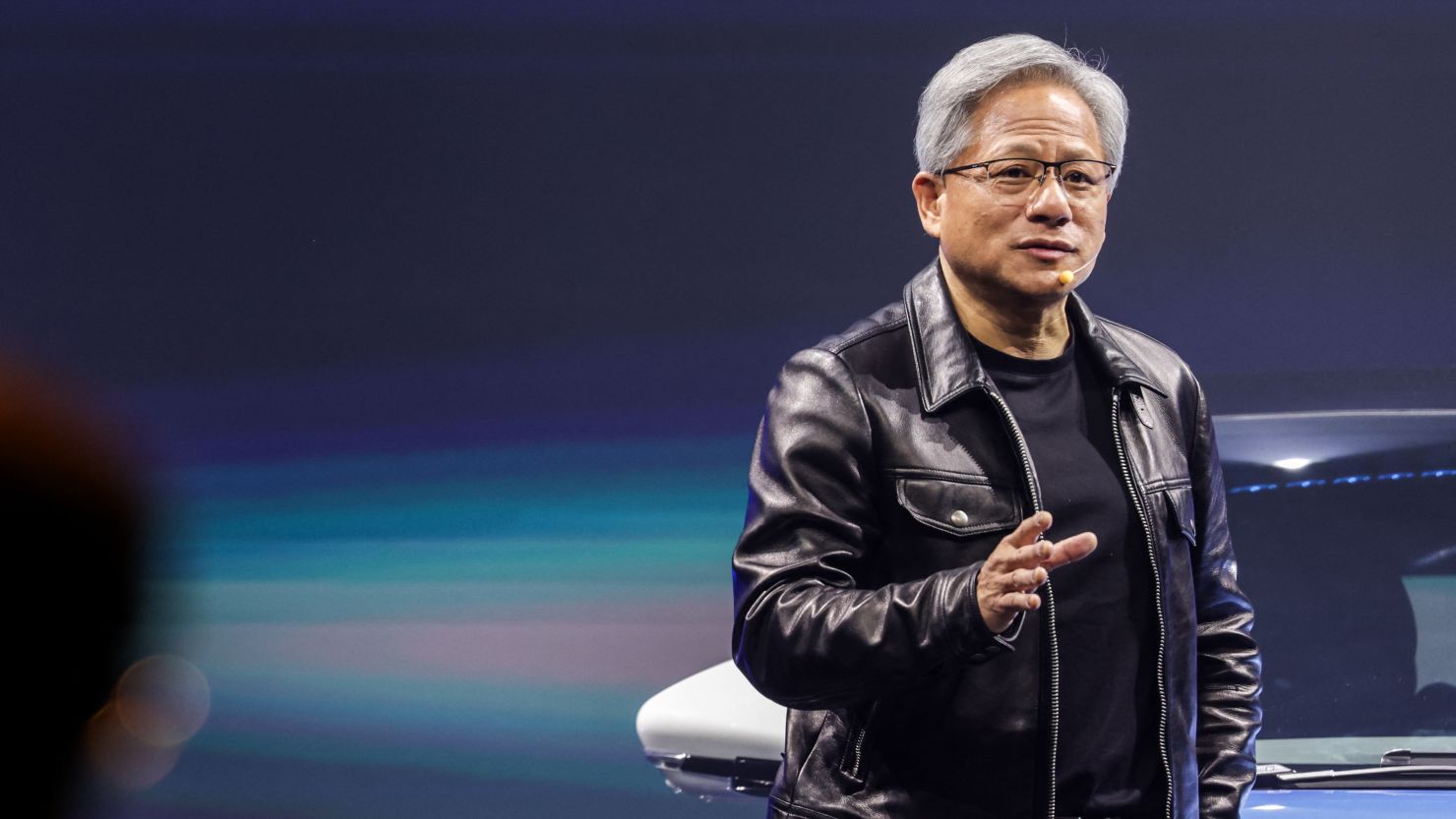

According to Forbes, the rally has increased the net worth of co-founder and CEO Jensen Huang to approximately $117 billion, thereby establishing him as the 11th wealthiest individual in the world.

Microsoft’s shares have increased by approximately 20% thus far this year. After acquiring a substantial stake in OpenAI and incorporating the startup’s AI models into its most critical products, such as Office and Windows, the software behemoth has also benefited significantly from the AI boom.

Microsoft’s Azure cloud service is one of the largest purchasers of Nvidia’s graphics processing units (GPUs). The company recently introduced a new line of laptops, known as Copilot+, specifically engineered to operate its AI models.

The title of the most valuable U.S. company is a new one for Nvidia. Apple and Microsoft have been exchanging the title for the past few years.

Nvidia’s meteoric rise has been so rapid that the company still needs to be included in the Dow Jones Industrial Average, the stock benchmark that comprises 30 of the most valuable U.S. companies.

Nvidia announced a 10-for-1 stock split in conjunction with its earnings release last month, which was implemented on June 7.

The Dow is a price-weighted index, which means that companies with higher stock prices have an outsized influence on the benchmark rather than market caps. The split gives Nvidia a greater chance of being added to the index.