To turn the $1.3 billion trust into a regulated ETP, NYSE Arca has applied to the SEC to list the Bitwise 10 Crypto Index Fund.

The US Securities and Exchange Commission (SEC) has received a request from NYSE Arca to list an exchange-traded product (ETP) run by Bitwise Asset Management. It contains a basket of ten different cryptocurrencies.

Bitwise revealed on November 15 that NYSE Arca had submitted a 19b-4 form to list the Bitwise 10 Crypto Index Fund (BITW) as an exchange-traded fund (ETP). Bitcoin BTC $89,919, Ether ETH $3,097.72, Solana Solana SOL $213.57, XRP XRP $0.8896, Cardano ADA $0.6594, Avalanche AVAX $32.46, Bitcoin Cash BCH $432.27, Chainlink LINK $13.54, Uniswap UNI $8.23, and Polkadot DOT $5.00 are among the ten distinct allocations across the significant cryptocurrency assets in the portfolio.

As of October 31, 2024, the fund’s portfolio comprises 1.6% XRP, 4.3% Solana, 16.5% Ether, and 75.1% Bitcoin. Less than 1% of the fund’s holdings are made up of the remaining assets.

ETPs are the “most efficient” way to expose people to cryptocurrency.

ETPs are the “most efficient, convenient, and useful vehicles for providing crypto exposure,” according to Bitwise CEO Hunter Horsley’s announcement. He says the business is dedicated to turning the fund into an ETP.

According to the corporation, ETPs provide benefits like enhanced shareholder efficiency and regulatory protections. The ETF issuer clarified that an ETP would continuously accept redemptions and subscriptions.

According to Bitwise, this allows the fund to trade on the secondary market, which is more directly related to its net asset value (NAV), by establishing an arbitrage mechanism.

Bitwise’s attempt to transform its $1.3 billion trust into an ETP structure continues with this submission.

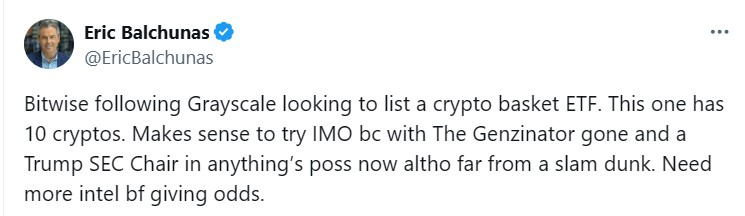

A Bloomberg analyst, Eric Balchunas, stated that the action “makes sense” because “anything” would be conceivable if Donald Trump were elected to the SEC chair. Nevertheless, Balchunas noted that the space requires more intelligence and is not a “slam dunk.”

Grayscale crypto index ETF listing is another goal of NYSE Arca.

Following NYSE Arca‘s application to list a Grayscale fund that holds a variety of spot cryptocurrencies, the action was taken. The Grayscale Digital Large Cap Fund was listed as an ETF by NYSE Arca on October 29. The fund’s cryptocurrency index portfolio includes BTC, ETH, SOL, XRP, and AVAX.